Must-know: Deciphering gold companies’ cost reporting

Gold mining companies like Goldcorp Inc. (GG), Barrick Gold Corp. (ABX), and Newmont Mining Inc. (NEM) report cash costs, total cash costs, total costs, and all-in cash costs. It can be very confusing for investors to understand exactly what’s what here.

Sept. 25 2014, Updated 1:00 p.m. ET

Gold mining companies like Goldcorp Inc. (GG), Barrick Gold Corp. (ABX), and Newmont Mining Inc. (NEM) report cash costs, total cash costs, total costs, and all-in cash costs. It can be very confusing for investors to understand exactly what’s what here.

Plus, since these numbers are non-GAAP (generally accepted accounting principles), there’s no standardization and companies can use these reports to further their interests if they wish. To confound the situation, there’s “co-product” and “by-product” accounting. It’s important that investors understand these nuances to make better investment decisions.

Cost reporting

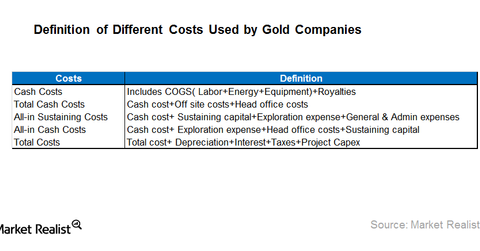

The above table provides a quick snapshot for the items generally included by gold mining companies in their cost reporting.

When can a company use by-product and co-product accounting methods?

The difference between by-product and co-product accounting depends on the contribution of each metal to overall revenues. Generally, to use by-product accounting, a single metal has to contribute at least 80% of revenues, while the other metals contribute 20% of revenues and can be considered by-products.

By-product accounting

Under by-product accounting, companies can deduct the revenue received from by-products from the costs incurred in producing all the metals from a mine. This reduces the costs per unit for a company. All the companies reporting negative costs per unit of production use by-product accounting.

For example, say a mine produces both gold (1,000 ounces @ $1,200 per ounce) and silver (15,000 ounces @ $20 per ounce) at a total cost of $1 million. Under by-product accounting, the revenues from silver ($300,000) would be deducted from costs ($1,000,000) and divided by gold ounces, so the cost per ounce is $700. If we back-calculate, the company has booked $800.000 ($1.500.000 – $700 * 1,000 ounces) in profits, which should have been $500,000 ($1,500,000 – $1,000,000).

Co-product accounting

Co-product accounting, on the other hand, assigns operating costs to each metal produced based on its relative contribution to revenues. This is a more transparent method of reporting.

For example, say a mine produces both gold (1,000 ounces @ $1,200 per ounce) and silver (40,000 ounces @ $20 per ounce) at a total cost of $1 million. Under co-product accounting, the cost per ounce for gold would be $600 and for silver it would be $10 per ounce. The back-calculations also work in this case and investors are able to see the correct margins for each commodity.

Investors can also consider investing in gold-backed ETFs like the SPDR Gold Shares (GLD) or gold producer–backed ETFs like the Gold Miners ETF (GDX) and Junior Gold Miners ETF (GDXJ).