Why has natural gas gained popularity among power generators?

Natural gas has gained market share for use in power generation. Learn about the drivers of this trend and the consequences of increased natural gas use.

Nov. 1 2013, Published 2:17 p.m. ET

Energy shift

Over the past several years, the US has seen a shift away from coal-fired power generation towards natural gas–fired power generation. Increasingly, power generators have favored the fuel due to a few major reasons.

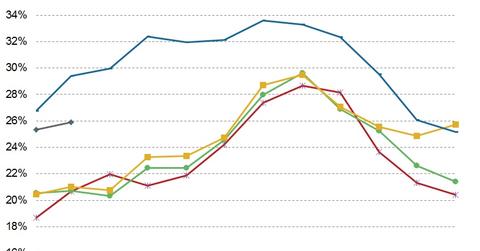

Natural gas prices have remained low for a sustained period, as production of the hydrocarbon in recent years has ramped up dramatically due to the development of abundant shale resources in the US. Natural gas prices have been low both on an absolute basis and on a relative basis to coal. This has caused more natural gas use relative to coal for power generation, as it becomes more economic to use natural gas as a fuel relative to coal. In the short term, the relative price of natural gas to coal is the primary driver of natural gas demand from the power generation sector.

Plus, as some power generation capacity is retiring and new capacity is being built to replace it as well as meet growing energy demands, power companies are more likely to build new natural gas–fired plants over new coal-fired plants. In comparison to new coal-fired plants, new natural gas–fired plants are largely more efficient, and relatively cheaper and quicker to construct. They encounter less resistance from residents near proposed plant sites, and they have lower emissions. The addition of new natural gas–fired power plants is a positive for long-term natural gas demand.

Changing regulations

Lastly, regulations around pollution and emissions have provided a strong incentive for US power companies to redirect portfolios more towards natural gas and away from coal, both through shutting down existing coal plants and favoring natural gas when proposing new plant projects. This is especially topical, as the US Environmental Protection Agency now has jurisdiction over power plant emissions and recently introduced proposed restrictions on emissions for new power plants. It’s planning to introduce a proposal for existing power plants in the near future.

All these factors combined have led natural gas to gain popularity among power companies such as Duke Energy (DUK) and the Southern Company (SO). This trend supports natural gas demand, provides a long-term floor for natural gas prices, and also reduces volatility in natural gas prices. These trends are most relevant for US producers weighted towards natural gas, such as Chesapeake Energy (CHK), Southwestern Energy (SWN), Devon Energy (DVN), and Range Resources (RRC) as well as holders of natural gas ETFs such as the United States Natural Gas Fund (UNG).

Read on to find out more about the drivers of natural gas demand for power generation and which names could be affected most.