A Look at the Role of the Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau was established to protect consumers’ interests by implementing federal consumer financial laws.

Feb. 3 2016, Published 2:48 p.m. ET

Series overview

In The Rent Is Too Damn High: A Look at Housing Costs in the US, we discussed rising rents in national and regional US markets. In this series, we’ll discuss the initiatives taken by the government to protect mortgage consumers’ interests.

Dodd-Frank Act

The Dodd-Frank Wall Street Reform and Consumer Protection Act, widely known as the Dodd-Frank Act, came into existence in 2010. The law made some of the most significant changes to financial regulations in the United States after the housing market crash.

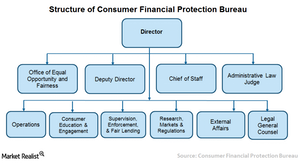

Consumer Financial Protection Bureau

The Dodd-Frank Act led to the creation of the CFPB (Consumer Financial Protection Bureau), an independent government agency. CFPB was established to protect consumers’ interests by implementing federal consumer financial laws.

CFPB is mainly responsible for consumer protection in the financial sector, which includes banks, credit unions, securities companies, payday lenders, mortgage-servicing operations, foreclosure relief services, debt collectors, and other financial companies operating in the country. CFPB works in tandem with state regulators in coordinating supervision and enforcement activities. Its main functions are as follows:

- Writing and enforcing consumer financial protection rules

- Curbing unfair practices

- Accepting consumer complaints

- Financially educating consumers

- Studying consumer behavior

- Monitoring new risks to consumers in financial markets

- Enforcing laws related to unfair treatment in consumer finance

Investor protection initiatives are beneficial to customers. They also provide an avenue for major mortgage lenders such as Bank of America (BAC), SunTrust Banks (STI), JPMorgan Chase (JPM), and Wells Fargo (WFC) to be transparent in the lending process.

The SPDR KBW Bank ETF (KBE) invests 2.7% of its portfolio in Wells Fargo. KBE also has 2.6%, 2.4%, and 2.4% holdings in JPMorgan Chase, Bank of America, and SunTrust Banks, respectively.

Continue to the next part of the series for discussion on the need for the creation of new disclosure rules.