What States Impose Sales Tax on Groceries? Here's What We Know

Food prices have skyrocketed in the last few years. Plus some states also impose a grocery tax. What states tax groceries? Here's what we know.

April 12 2023, Published 1:34 p.m. ET

Going to the grocery store these days is exasperating. Prices have skyrocketed on almost everything. Food prices in March were 8.5 percent over what they were in March 2022.

On top of the high prices, many states also impose a grocery tax on your purchases. Which states impose sales tax on groceries? Here's what we know.

What states tax groceries?

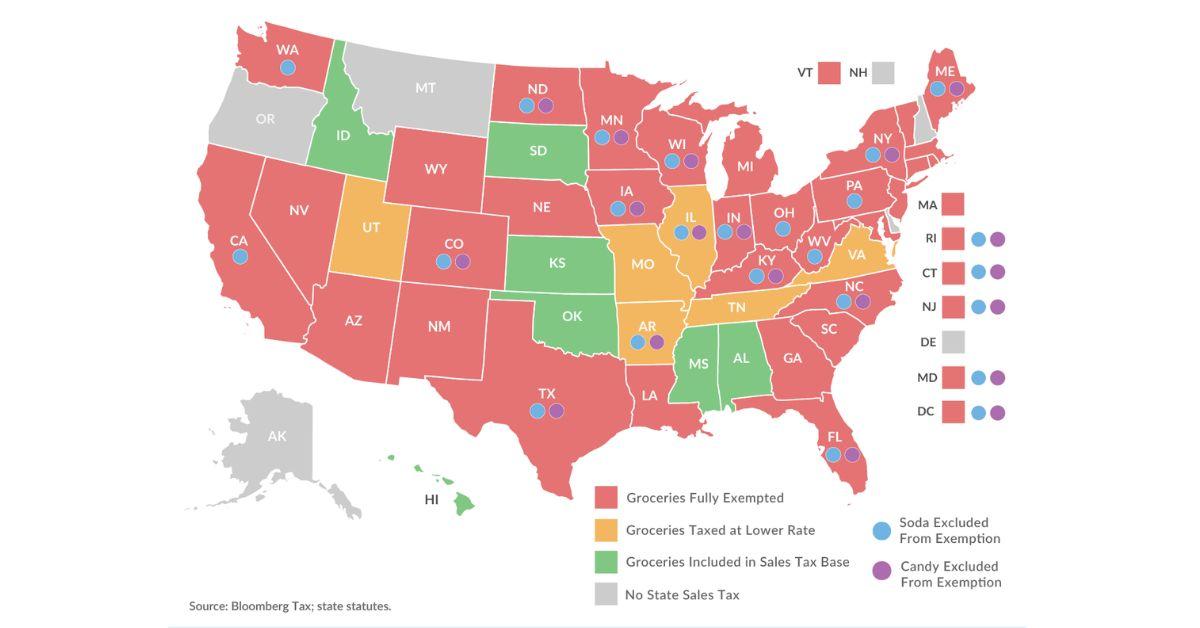

According to the Tax Foundation, 13 U.S. states impose a grocery tax. In six of those states, the grocery tax is lower than the state’s general sales tax. The average grocery tax ranges from four percent to seven percent, but some states have grocery taxes of one percent or lower.

Mississippi has the country's highest sales tax on groceries at 7 percent. Of the states that impose a grocery tax, Arkansas is the lowest at 0.125 percent. Candy and soda aren’t considered grocery items in several states.

Here are the states that have a grocery tax and their rates:

State | Grocery Tax | General Sales Tax |

Alabama | 4.00% | Same |

Arkansas | 0.125% | 6.50% |

Hawaii | 4.00% | Same |

Idaho | 6.00% | Same |

Illinois | 1.00% | 6.25% |

Kansas | 4.00% | 6.5% |

Mississippi | 7.00% | Same |

Missouri | 1.225% | 4.225% |

Oklahoma | 4.50% | Same |

South Dakota | 4.50% | Same |

Tennessee | 4.00% | 7.00% |

Utah | 1.75% | 6.1% |

Virginia | 2.50% | 5.30% |

What states are considering lowering the grocery tax?

Because of the recent spike in prices at the grocery store, some states are looking at giving a reprieve from grocery taxes by lowering them, suspending them for a specific time period, or eliminating them completely.

In 2022, lawmakers in Illinois agreed to suspend the state’s 1 percent grocery tax for one year on most groceries except soda, alcohol, and medicines. The grocery tax suspension remains in effect until June 30, 2023.

In January, Kansas dropped its sales tax on groceries from 6.5 percent to 4 percent and plans to drop it to 2 percent in 2024. The goal is to eliminate the grocery tax in Kansas by 2025. Alabama and Oklahoma are also considering suspending or eliminating their state grocery tax.

Which states offer grocery credits?

Three states that tax groceries at the same rate as their general sales tax — Hawaii, Idaho, and Oklahoma — enable residents to offset the high price of groceries with tax credits. While this may not reduce your grocery bill, it will help you get more money back when you file your taxes at the end of the year.

Are there tax exemptions for low-income families?

The concern over grocery taxes is that it disproportionately impacts low to moderate-income families, who spend much of their income on food. According to a 2020 report by the Center on Budget and Policy Priorities titled “States That Still Impose Sales Taxes on Groceries Should Consider Reducing or Eliminating Them,” families with household incomes of $20,800 or less pay almost twice as much of their income on food than those in the highest 20 percent income bracket.

For low-income families that receive SNAP benefits (food stamps), groceries purchased with those benefits are exempt from sales tax per federal laws. However, not all low-income families are eligible for SNAP benefits.