What Is SUI Tax? An Easy Way to Understand State Unemployment Insurance

The money workers receive in unemployment benefits comes from the SUI tax and FUTA tax their employers pay. What is SUI tax? Let's get into it.

April 18 2023, Updated 3:55 p.m. ET

Most employers in the U.S. are required by law to pay unemployment insurance tax at the state and federal levels. SUI tax, or State Unemployment Insurance tax, along with federal taxes, must be paid on a quarterly basis. The SUI tax employers pay goes to the state unemployment insurance program, which is used to support workers who lose their jobs, generally through no fault of their own.

Simply put, the money workers receive in unemployment benefits comes from the SUI tax and FUTA (Federal Unemployment Tax Act) tax their employers pay throughout the year. Keep reading for more on what SUI tax, including the factors that are used to calculate it and how you can calculate it for your business.

What is SUI tax?

SUI taxes are based on SUTA (State Unemployment Tax Act) tax contribution rates and wage base. A state’s unemployment trust fund balance is the primary factor that determines what the SUI tax rates are, according to Equifax. The less money a state has in its trust fund, the higher it might raise its SUI tax rate. This helps to ensure the state has an ample amount of funds available to be paid in unemployment benefits.

It’s worth noting that some businesses are exempt from having to pay SUI tax, including some nonprofits. Also, employers are only required to pay taxes up to a certain amount per employee.

Usually, workers aren't required to pay SUI tax since it's the employer's responsibility to ensure the taxes are paid. It's unlikely that you would see SUI tax deducted from your paycheck.

In Texas, an employer’s SUI tax, which the state refers to as the Unemployment Insurance (UI) tax rate, is the sum of five components which include:

- the General Tax Rate (GTR)

- the Replenishment Tax Rate (RTR)

- the Obligation Assessment Rate (OA)

- the Deficit Tax Rate (DTR)

- the Employment and Training Investment Assessment (ETIA)

The minimum tax rate for 2023 is 0.23 percent while the maximum tax rate is 6.23 percent. Under Texas law, employers are required to pay unemployment tax on the first $9,000 that each employee earns per calendar year. Because each state has its own SUI tax contribution rate and wage base, the amount due from each employer varies.

How are SUI taxes calculated?

SUI taxes can be rather difficult to compute yourself which is why many businesses rely on professionals to help them, such as those that handle payroll. Regulations surrounding SUI taxes are also constantly changing, which makes it even more difficult for busy employers to keep up with them. But, if you’re interested in knowing how to calculate your SUI tax, here's a simple explanation.

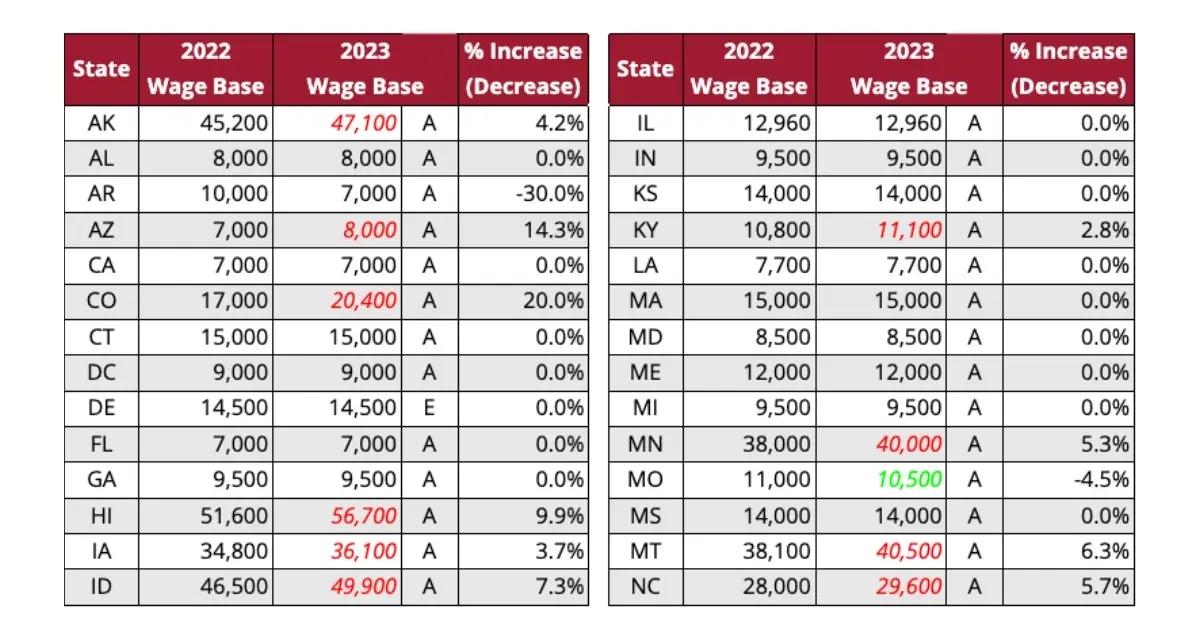

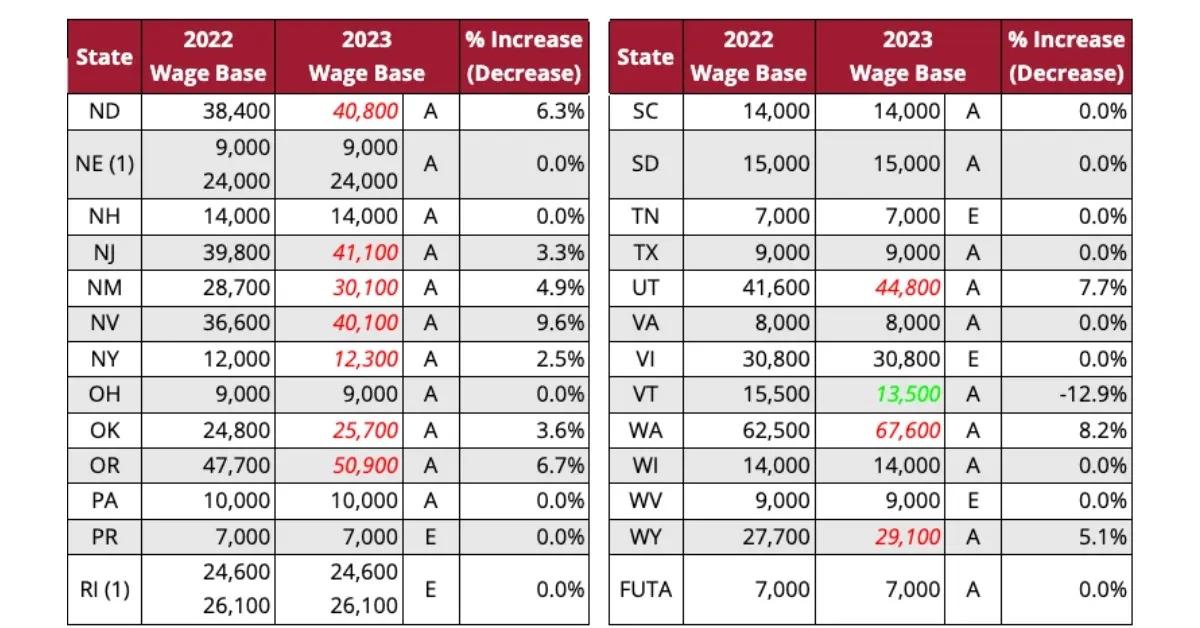

To calculate your SUI tax, you’ll need to multiply your tax rate by your state’s wage base. Below you’ll find tables made available by Equifax that outline what each state’s annual taxable wage bases are for 2023.

While it’s easy to identify your wage base, the tricky part is knowing what your tax rate is. While Equifax does offer a breakdown of the range of SUI tax an employer might pay, the exact amount varies by employer.

What is the difference between SUI, SUTA, and FUTA?

SUI taxes and SUTA are basically the same things. SUI and SUTA both refer to the state unemployment tax an employer pays. FUTA, on the other hand, refers to the Federal Unemployment Tax Act which requires employers to pay unemployment insurance tax at the federal level.

According to the IRS, the current FUTA tax rate is 6 percent and applies to the first $7,000 each employee earns during the year.