Is Texas a “Donor State” in Terms of Federal Taxes?

Texas is one of the states that pays a higher proportion of federal taxes than most other states, which makes it less dependent on federal revenue.

June 21 2022, Published 12:24 p.m. ET

An analysis published in February by MoneyGeek calculated the “dependency” scores of U.S. states to show how much each state relies on federal monies. When breaking down the data, MoneyGeek noted that just 17.47 percent of the budgetary revenue for Texas comes from federal funds. Texas is less dependent on federal money, but does the state pay more in federal taxes than it receives?

The most recent MoneyGeek analysis looked at the return on taxes sent by each state, as well as the percentage of each state’s revenues that came from the federal government. The #1 state in terms of “federal dependency” was New Mexico, with a 100 dependency score. In comparison, Texas came in at 38 in 2022, with a 13.5 out of 100 dependency score.

The debate over federal dependency increases in times of crisis.

Whenever a bill reaches the House or Senate to provide federal relief to certain states in a time of crisis, legislators and analysts are quick to point out how dependent each state is on federal money.

In 2020 the Kentucky Senator Mitch McConnell critiqued coronavirus relief plans as “blue state bailouts,” US News reported. Then-governor of New York Andrew Cuomo threw the insult back at McConnell, saying that Kentucky “takes out $148 billion more than they put in” vs. New York putting “$116 billion more than we take out.”

Certain states do send more money overall to the federal government than they receive back. As US News noted, for over 40 years, the rankings of which states receive more or pay more in taxes have remained largely the same.

Some refer to some states as “givers” or “donors” because those states’ residents pay more in taxes than the state gets back in federal money. States on the other end might be called “getters” for taking in more from the federal government than they put in via taxation.

However, the “giver” and “getter” terminology is problematic because it ignores the progressive nature of U.S. taxation.

Mark Shepard, an assistant professor at Harvard’s Kennedy School of Government, said (via MoneyGeek), “If red states pay less in taxes than they receive in benefits, that's because they are generally poorer and program rules are progressive — not because they are 'takers' while blue states are 'donors' in any value-laden sense.”

In other words, poorer states have fewer residents paying income taxes and rely more on federal program funds.

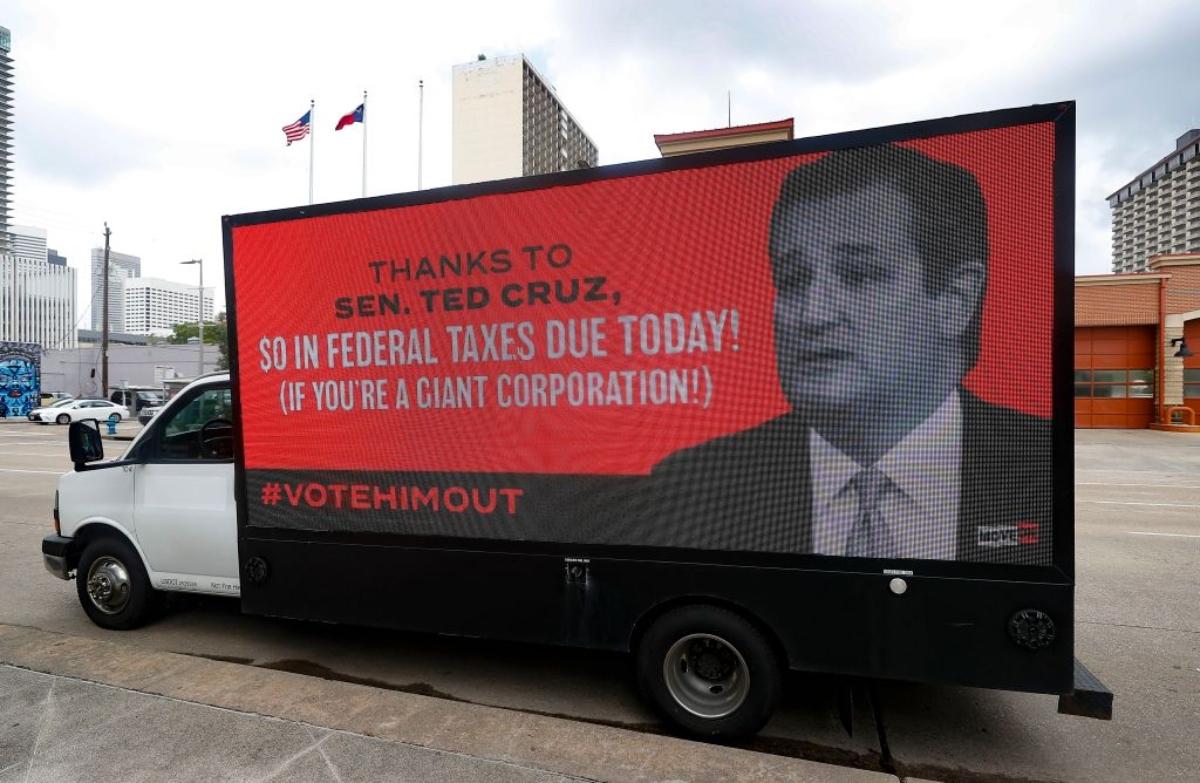

A sign protesting Ted Cruz and his policies on taxation in 2021.

Texas has considered itself a donor state.

In 2020, the Texas comptroller Glenn Hegar made a statement to The Texan noting that he was “concerned that Texas continues to be a donor state.” He praised Texas for its “independent spirit” that helps it to be less dependent on federal funds than other states. That year, Texas was only 29th on the list, and in 2022 it moved down to 38th in federal dependency.

States’ positions in terms of how much they pay the federal government compared to how much they receive back may vary. In times of crisis, such as a hurricane or the coronavirus, certain regions may be impacted more and require more federal aid.