SPDR® S&P Aerospace & Defense ETF

Latest SPDR® S&P Aerospace & Defense ETF News and Updates

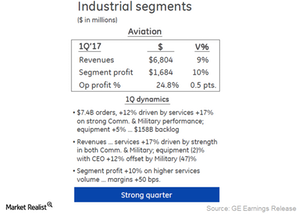

Why General Electric’s Aviation Segment Revenue Rose in 1Q17

Revenue for General Electric’s (GE) Aviation segment was $6.8 billion in 1Q17, a 9.0% rise from $6.2 billion in 1Q16.

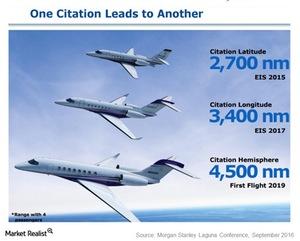

NetJets Orders Secure Textron Aviation amid Business Jet Weakness

Textron Aviation increase its sales in the last two quarters after gaining traction for its new Latitude business jets. It has secured 150 orders from NetJets.

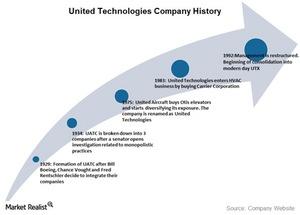

How United Technologies Has Evolved over the Years

The origins of United Technologies (UTX) lie in the creation of the United Aircraft and Transportation Company (or UATC) in 1929.

Why the Honeywell-United Technologies Merger Failed to Take Off

Both Honeywell and United Technologies recently confirmed that they had engaged in conversations related to a potential merger to create a global aerospace behemoth.