Walter Energy

Latest Walter Energy News and Updates

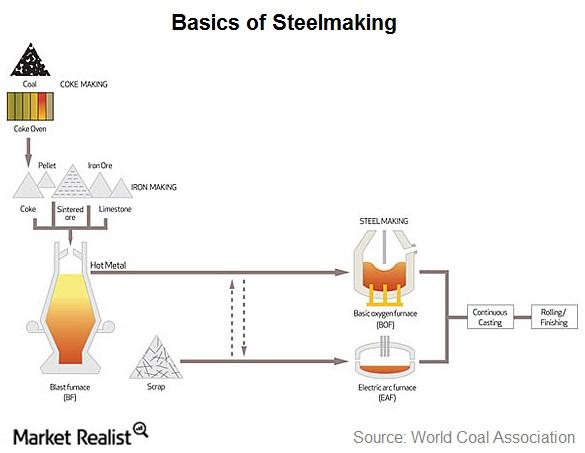

SunCoke Energy’s presence in the steelmaking process

Coke is used in the iron making process, which in turn is used in the steelmaking process. SunCoke Energy produced 4.2 million tons of coke in 2013.

How does coke fit into the steelmaking process?

Iron ore, steel scrap, and met coal are the main raw materials for steelmaking. SunCoke converts met coal to coke by driving out its impurities.

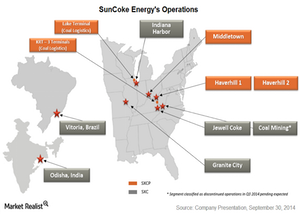

A quick look at SunCoke Energy’s US operations

SunCoke Energy (SXC) is the largest independent manufacturer of coke, which is used in steelmaking. It runs five coke making plants in the United States.

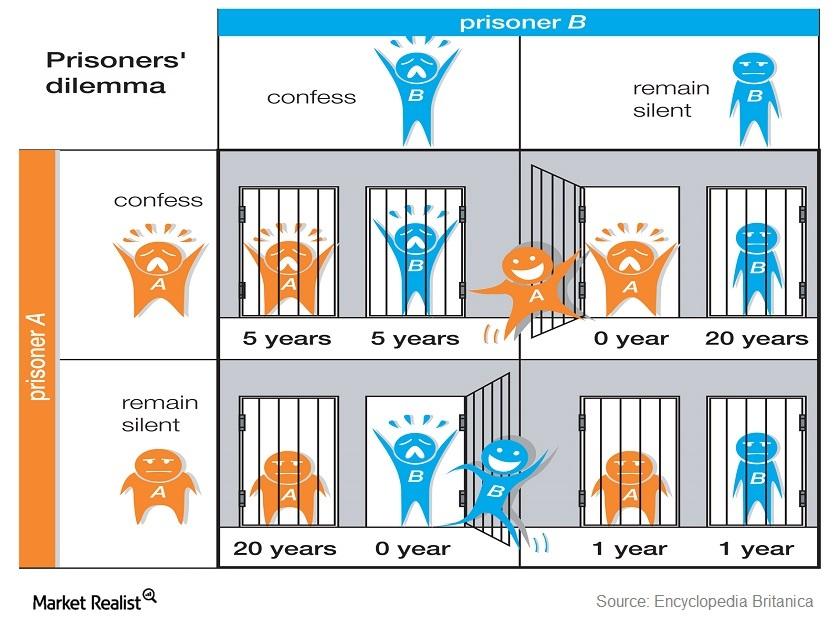

Falling commodity prices and the prisoner’s dilemma

There’s mistrust in the global commodity markets. From crude oil to met coal and iron ore, producers haven’t cut production. They’re waiting for others to do it first.Consumer Must-know: An overview of Appalachian coal

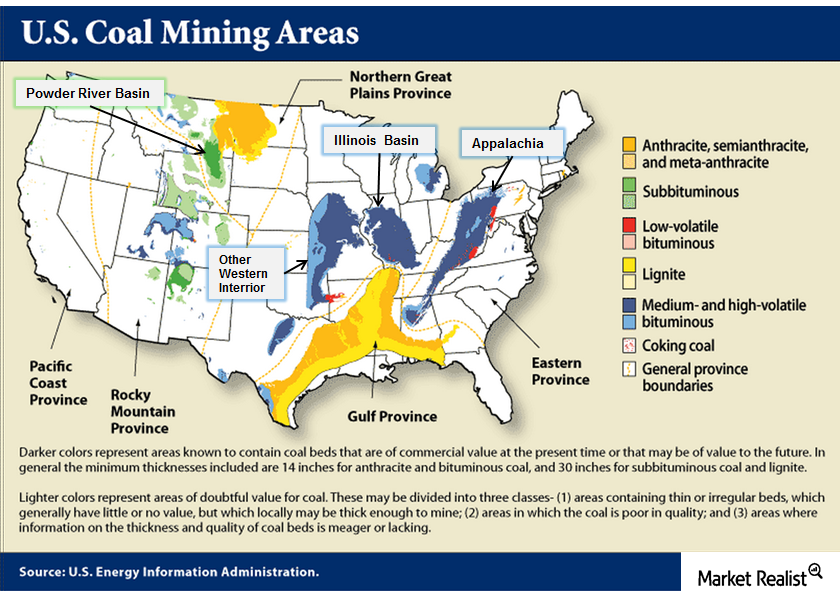

The Appalachian coal region is the oldest coal producing region in the U.S.—geologically and commercially. The Appalachian’s coal seams are ~300 million years old. They’re the oldest coal seams in the U.S. Appalachian coal fueled most of the Industrial Revolution after the Civil War in the 19th Century.

Must-know: The US coal mining areas and coal specifications

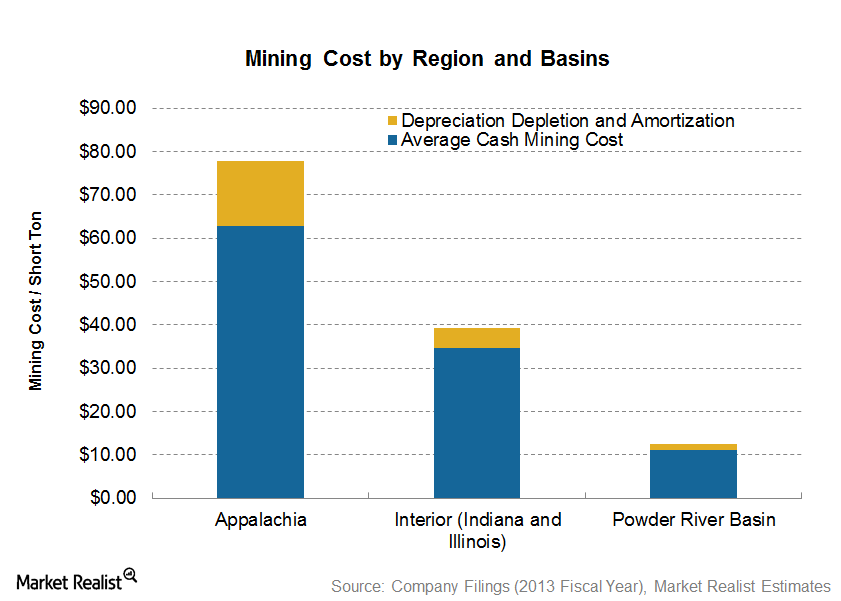

Coal mining in the U.S. can be segregated into three main areas: Appalachia, Interior, and West.

Why underground mines cost higher compared to surface coal mines

Underground mining is more expensive because it’s more capital intensive. Coal companies have to drill more, and use more expensive and complicated machines.