Schlumberger NV

Latest Schlumberger NV News and Updates

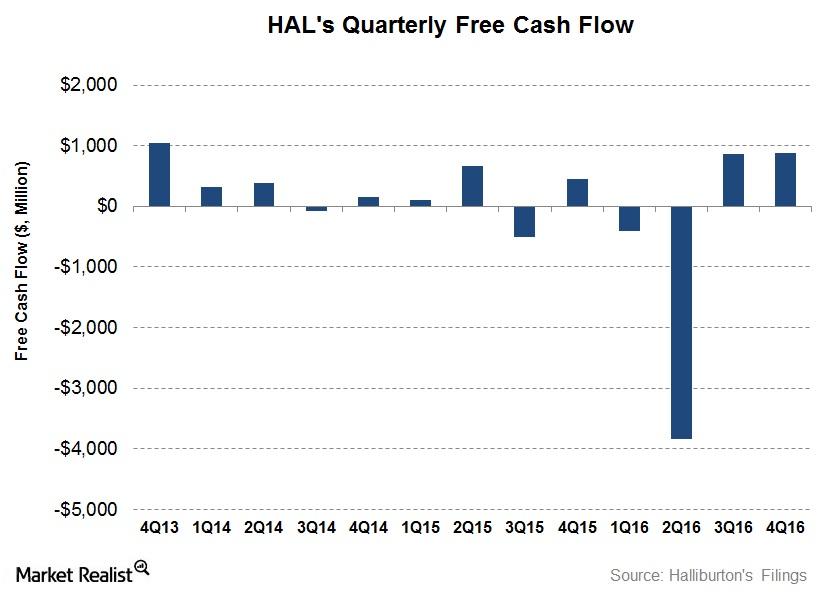

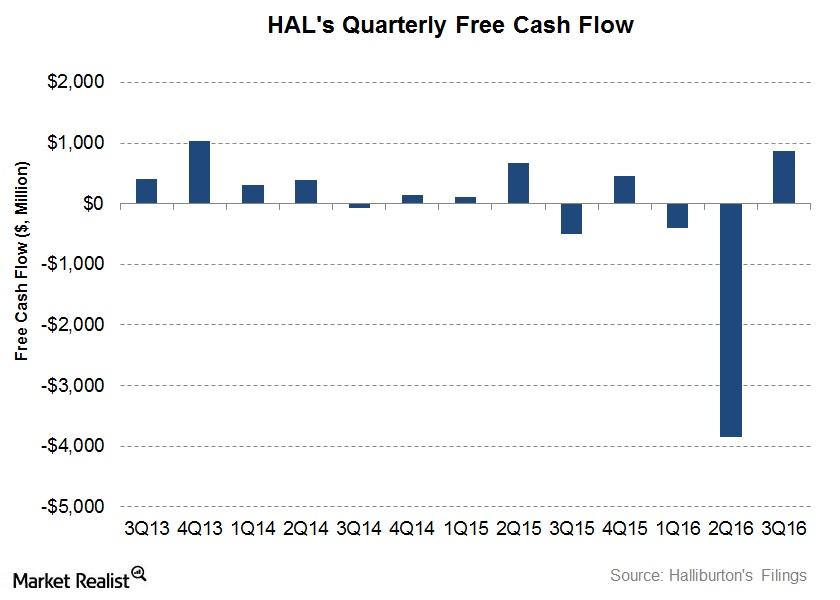

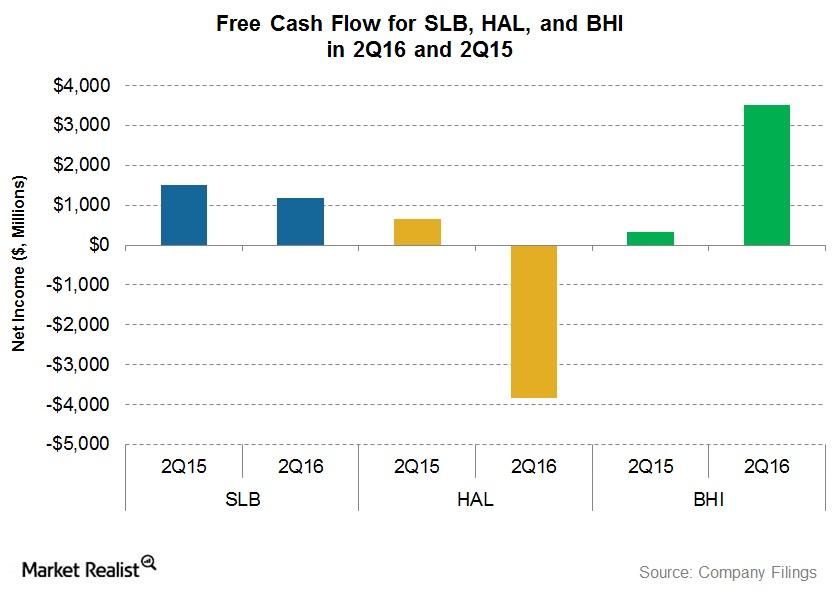

Analyzing Halliburton’s Free Cash Flow and Capex Plan

In this article, we’ll analyze how Halliburton’s (HAL) operating cash flows have trended over the past few quarters. We’ll also discuss its free cash flow (or FCF).

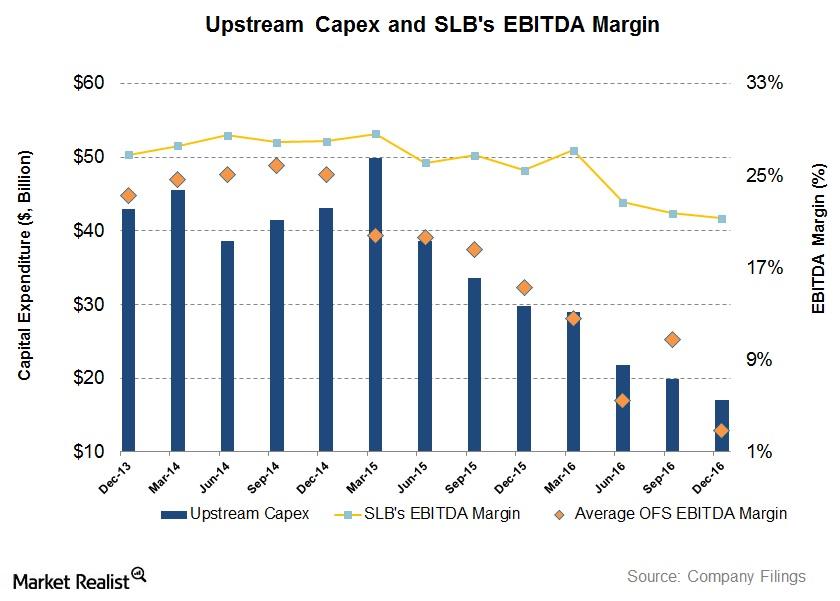

Will Upstream Operators’ Capexes Affect SLB’s 1Q17 Margin?

In the past couple of years, some major US upstream and integrated companies have reduced their capital expenditures (capex) following crude oil’s sharp fall.

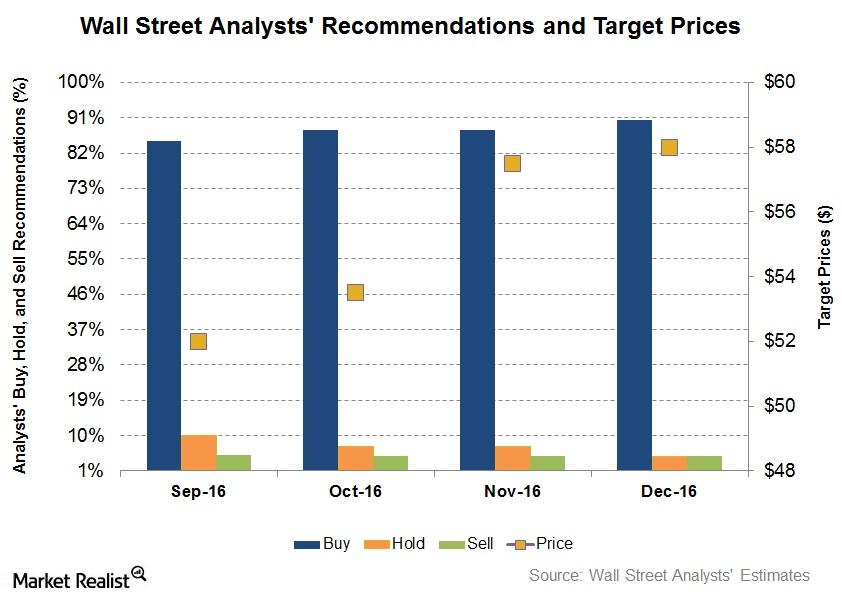

Are Analysts Changing Recommendations for Halliburton?

In December so far, 90% of the analysts tracking Halliburton rated it a “buy” or some equivalent.

Why Did Halliburton’s Free Cash Flow Improve?

Halliburton’s cash from operating activities (or CFO) turned positive in 3Q16.

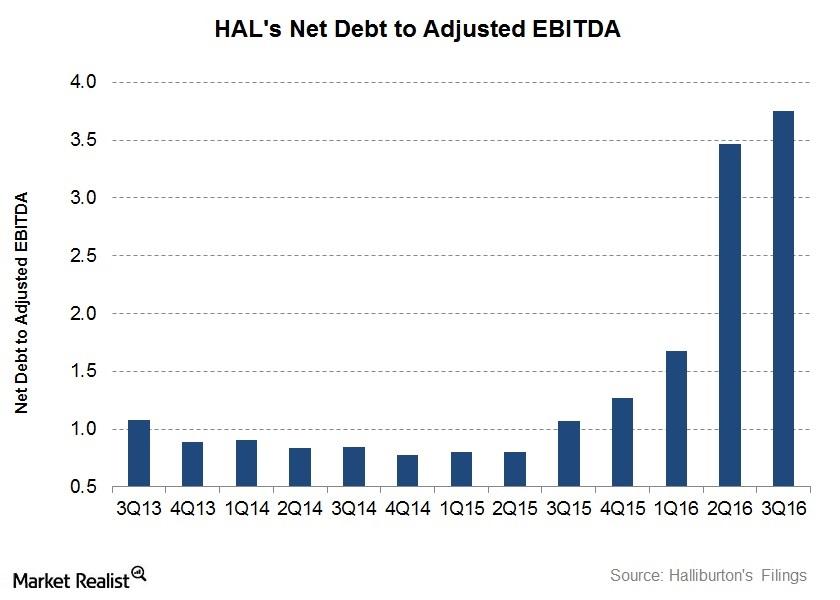

Is Halliburton’s Indebtedness on the Rise?

In 3Q16, Halliburton’s net-debt-to-adjusted-EBITDA multiple was ~3.8x, or 251% higher than it was a year ago.

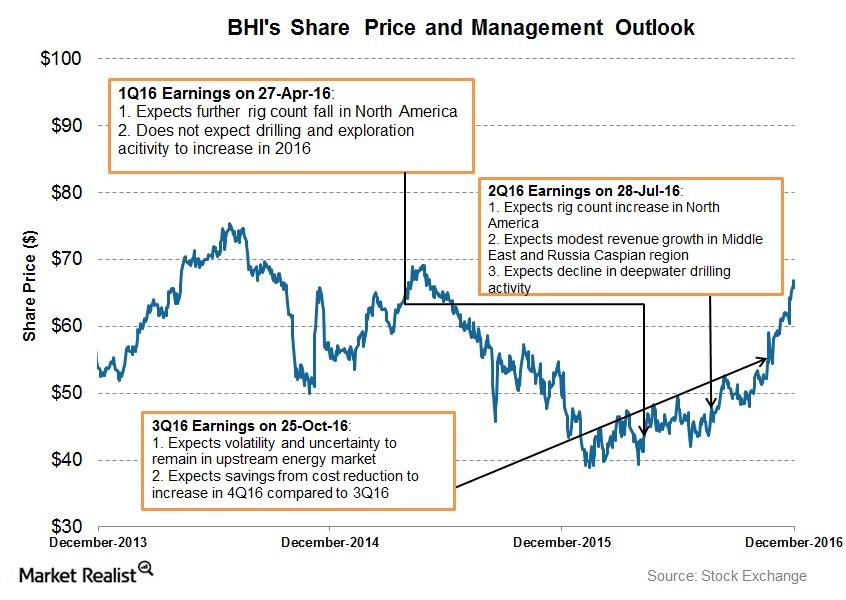

How Does Baker Hughes’s Management View 4Q16?

In 4Q16, Baker Hughes’s (BHI) management expects a trade-off between strong North American upstream activity and a weaker international energy environment.

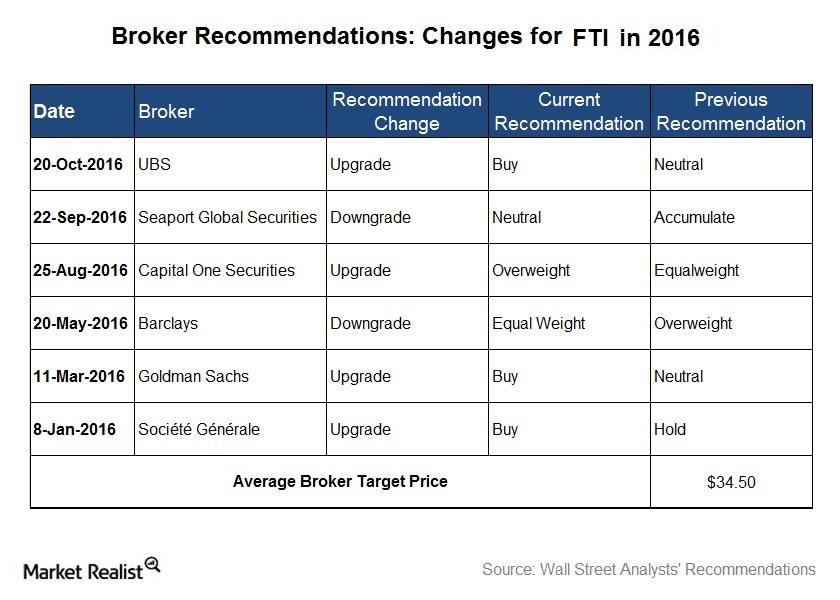

What Do Analysts Recommend for FMC Technologies?

In November, 34% of the analysts tracking FMC Technologies rated it a “buy,” ~55% rated it a “hold,” and only 3% of the analysts rated it a “sell.”

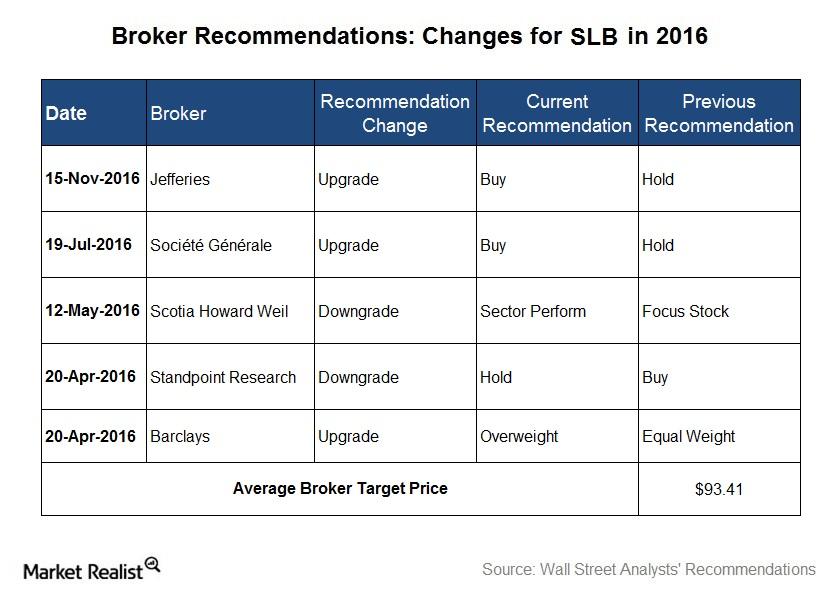

Wall Street Analysts’ Recommendations for Schlumberger

In November, 83% of the analysts tracking Schlumberger rated it a “buy” or some equivalent. The other 18% of the analysts recommended a “hold” or a “sell.”

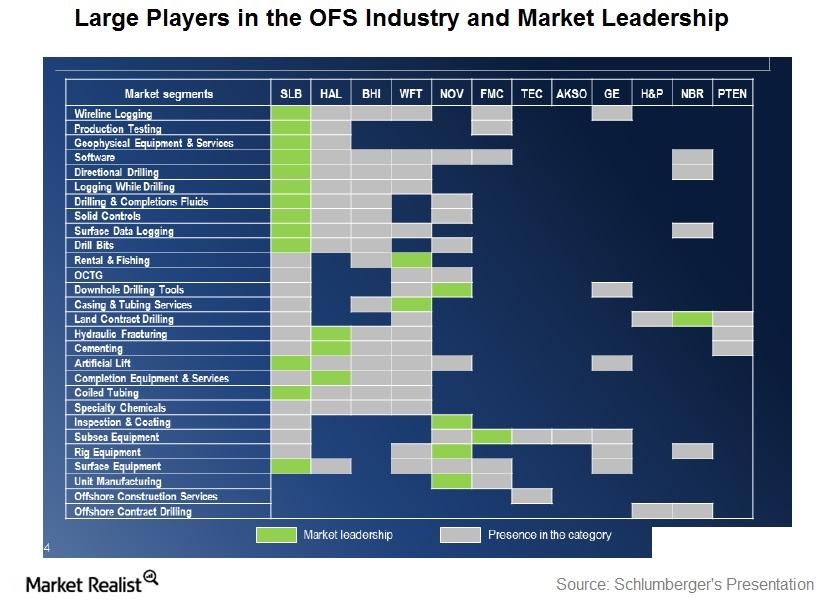

The Oilfield Services Industry: A Brief Introduction

The oilfield equipment and services industry refers to all products and services associated with the oil and gas exploration and production process, or the upstream energy industry.

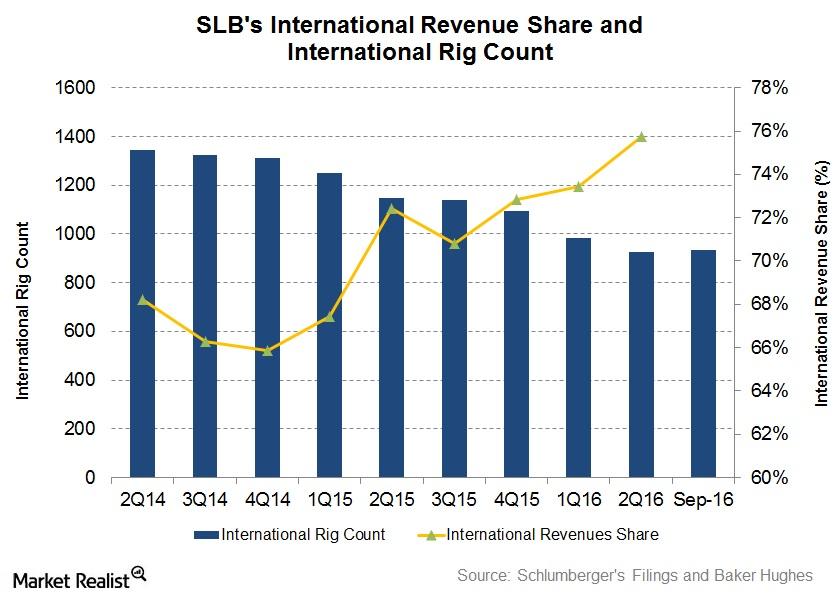

How Important Are International Rig Counts to Schlumberger?

SLB’s international revenues rose to 76% of its total revenues in 2Q16, as compared to 72% in 2Q15.

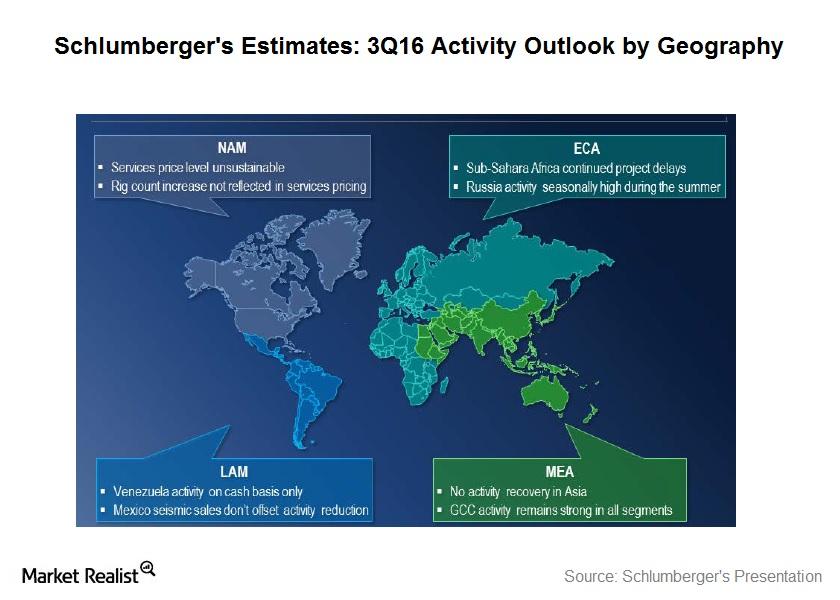

Which Geography Is Working the Best for Schlumberger?

Schlumberger’s business model is diversified and not overly dependent on any particular line of business, catering to upstream companies’ needs.

Why Is Schlumberger’s Free Cash Flow So Remarkable?

In this part of the series, we’ll take a look at free cash flow for Schlumberger (SLB), Halliburton (HAL), Baker Hughes (BHI), and FMC Technologies (FTI).

How Business Models Affect SLB’s or WFT’s Performances

In the OFS industry, Schlumberger has clearly been dominant while Weatherford International is now considered one of the weaker names.

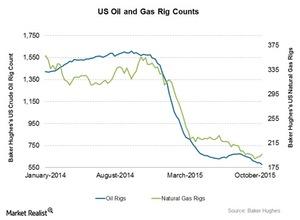

How the Late October Oil Rig Count Dip Hurt the Total US Rig Count

By October 30, 2015, the total US rig count fell by 16 crude oil rigs. The number of crude oil rigs has continued to fall in the past nine weeks.

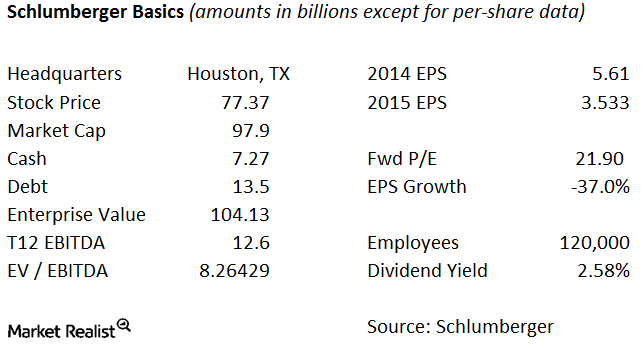

Basics of Schlumberger

Schlumberger (SLB) provides technology, project management, and information technology services to the oil and natural gas exploration and production industry.

Must-know: An overview of Halliburton

Halliburton (HAL) is a Texas-based energy company. It’s an oil and gas equipment and service provider. In the past year, Halliburton’s stock price went down ~22%.