SPDR® Nuveen Barclays ST Muni Bd ETF

Latest SPDR® Nuveen Barclays ST Muni Bd ETF News and Updates

What a Trump Presidency Means for Municipal Bonds

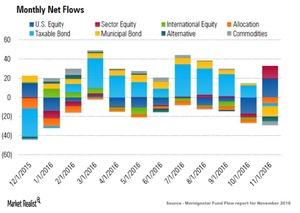

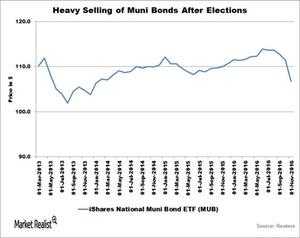

After investors’ post-election U-turn, some tailwinds turned to headwinds for municipal bonds. Investors moved money out of bond funds amid expectations of a Fed rate hike.

Is There an Opportunity in a Muni Sell-Off?

With their high yields, low prices, and tax-efficient returns, muni bonds (HYD) (ITM) could be available to investors at a dirt cheap rate in the coming months.

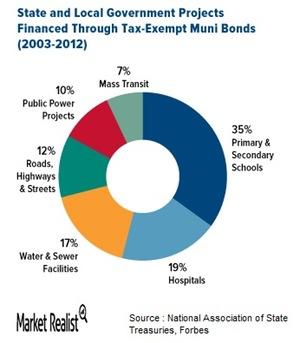

Increased Muni Issues to Fund Infrastructure Spending

The downfall for muni bonds (HYD) (ITM) (MLN) began in October 2016 after the muni market was flooded with new issues for state and local governments.

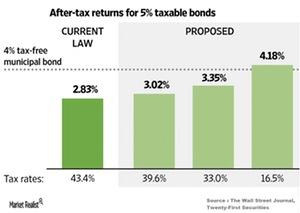

Tax Reform Is Full of Unknowns

President-elect Donald Trump’s tax reforms could bring cheers from taxpayers, but the tax bracket changes may not be well received by muni bond investors.

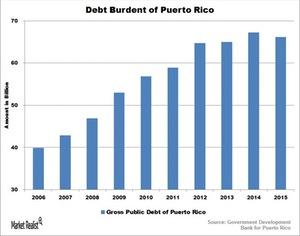

Looming Uncertainty of Puerto Rico’s Debt Crisis

Puerto Rico is currently in a meltdown mode. Over the past decade, it has accumulated $70.0 billion in public debt, which is close to 68.0% of its GDP.

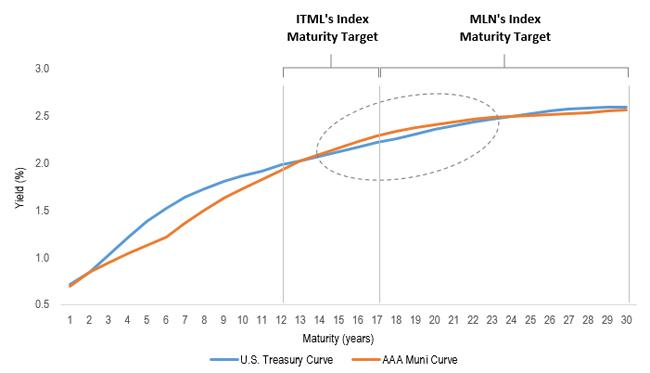

Attractive Relative Yields from Muni Bonds

We believe recent municipal bond weakness is an opportunity to put money to work at lower prices than what we have seen for some time. High quality, triple-A rated municipal bonds with maturities between 13 to 23 years currently offer higher nominal yields than 10-year U.S. Treasuries, making them particularly attractive, as shown in the […]