Shell Midstream Partners LP

Latest Shell Midstream Partners LP News and Updates

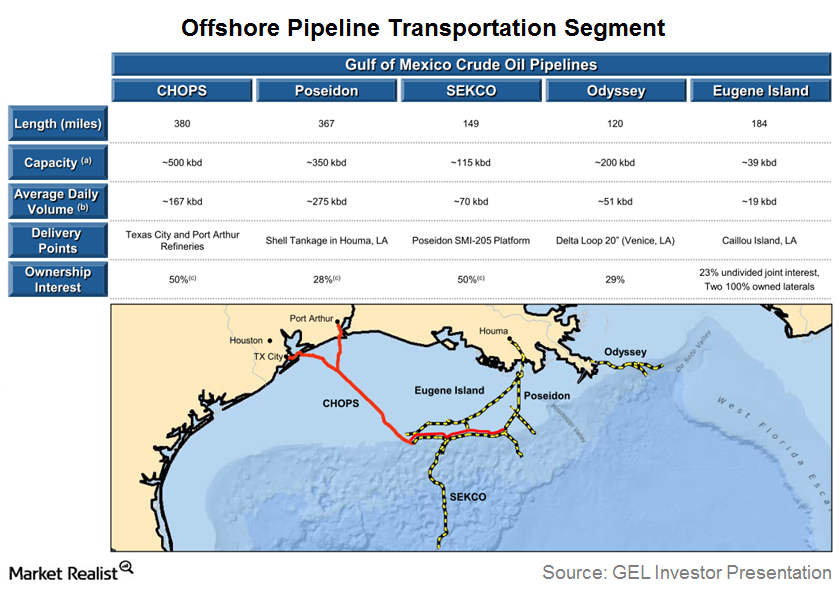

An Overview of Genesis Energy’s Offshore Pipeline Segment

Until recently, Genesis Energy’s Offshore Pipeline segment owned interest in ~1200 miles of offshore pipelines spread across five pipeline systems.

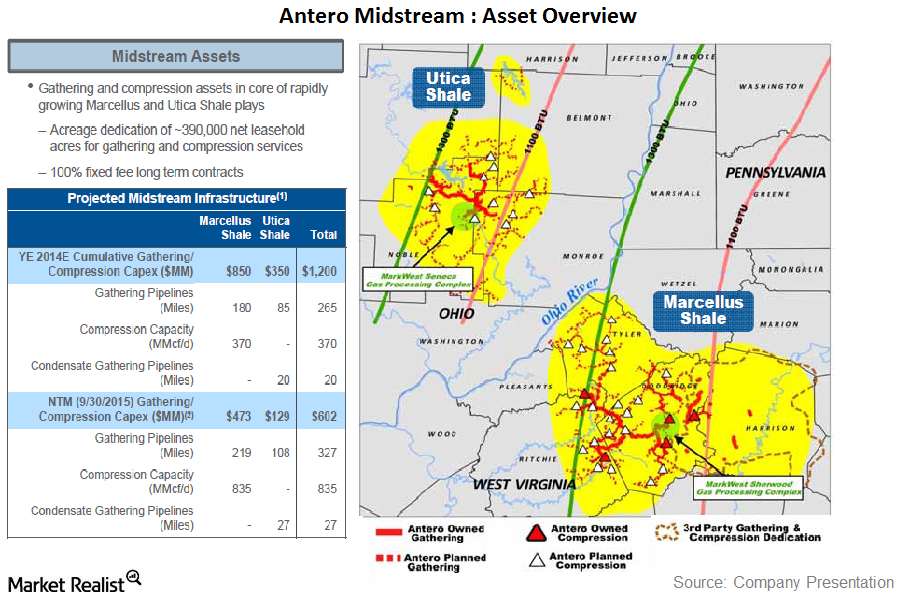

Must-know: A quick look into the Antero Midstream IPO

On October 27, Antero Resources Corporation announced the initial public offering of Antero Midstream Partners LP.

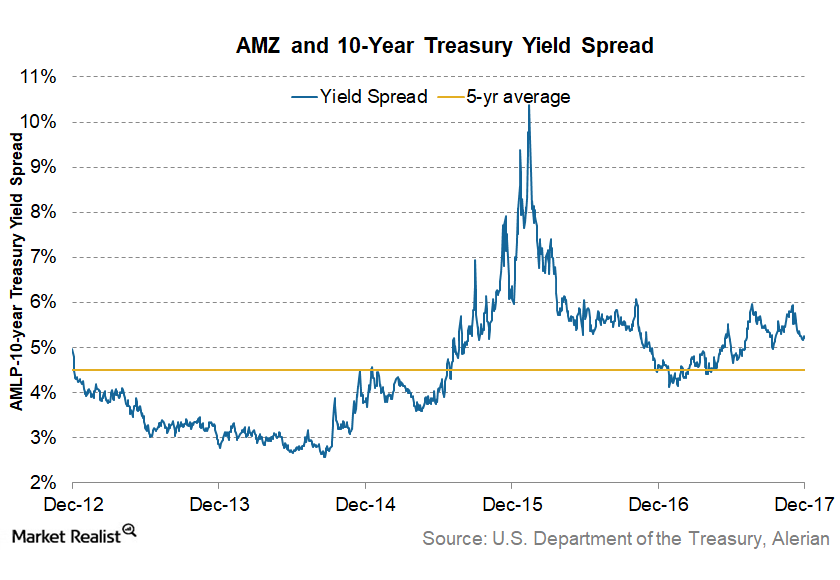

How Do These MLPs Look in 2018?

MLPs had a strong start to the new year. The Alerian MLP Index rose 5% in the first week of 2018.

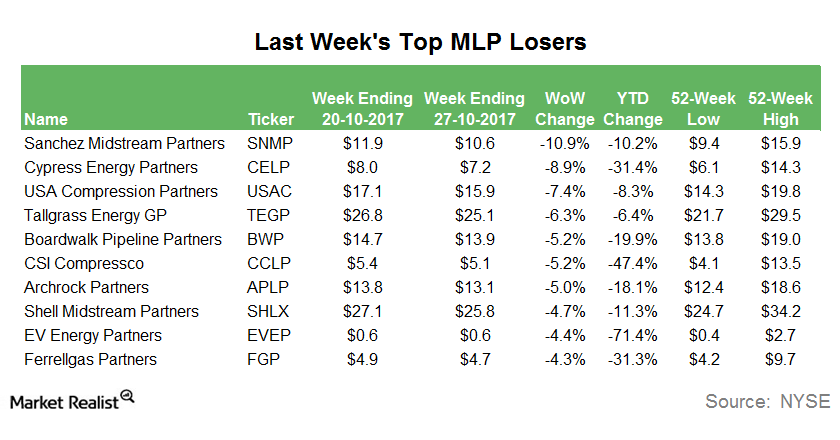

Last Week’s Biggest MLP Losers

Sanchez Production Partners (SNMP), the midstream MLP involved mainly in natural gas gathering, compression, and processing, was the biggest MLP loser last week.

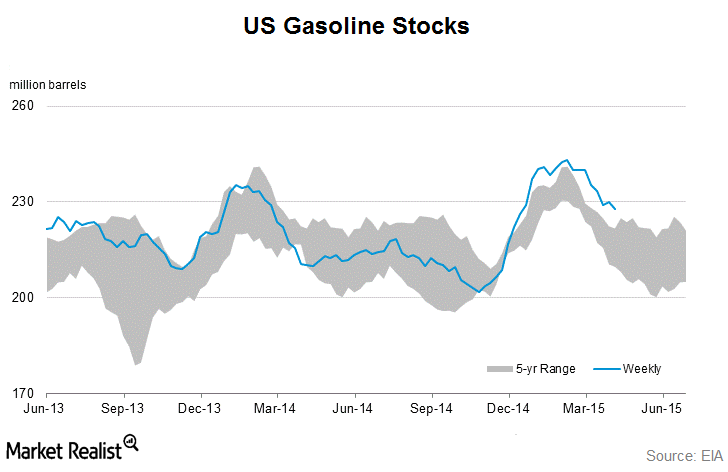

Gasoline Inventories Returned to Downtrend Last Week

Gasoline demand increased from ~8.61 MMbpd to ~8.91 MMbpd last week. Gasoline inventories remain outside the five-year range despite the draw in inventories reported on Wednesday.

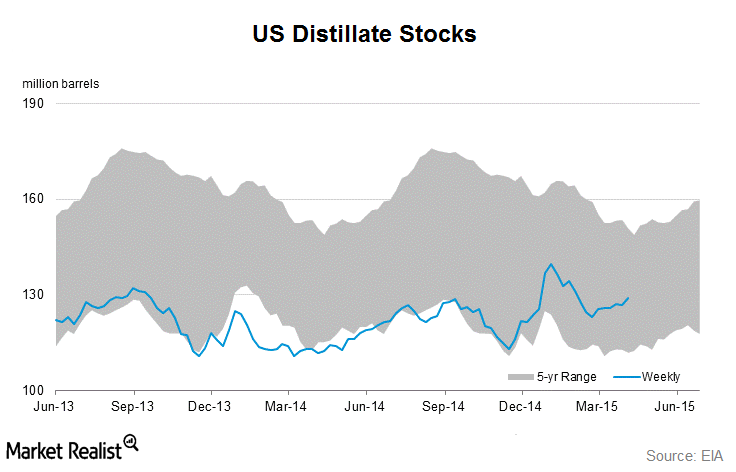

Distillate Inventories Increased Last Week

Distillate demand drives crude demand and crude prices. So, energy investors watch distillate inventories closely.

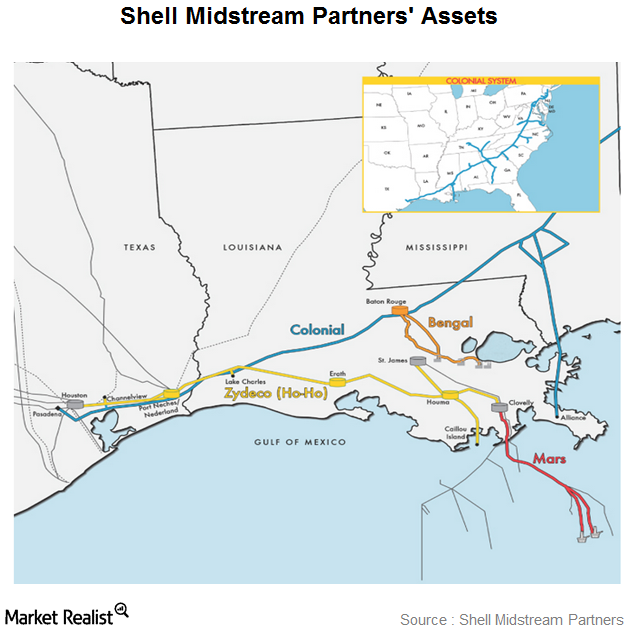

A Brief Overview of Shell Midstream Partners

Shell Midstream Partners (SHLX) is a MLP formed by Shell Pipeline Company, an affiliate of the international integrated energy giant, Royal Dutch Shell.

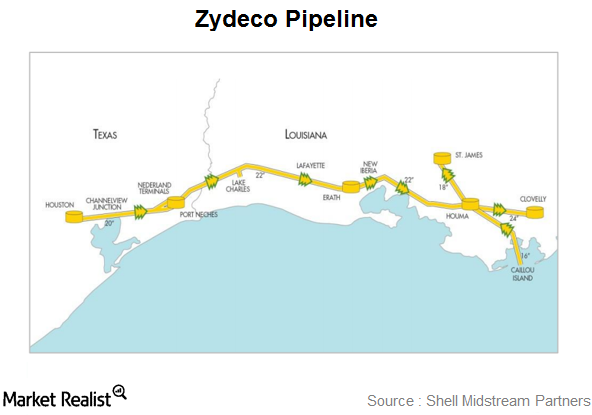

Zydeco Pipeline: A Shell Midstream Partners Key Asset

Shell Midstream Partners (SHLX) has a 42% ownership in the Zydeco pipeline, and Shell Pipeline Company, or SPLC, owns the remaining 57% interest.

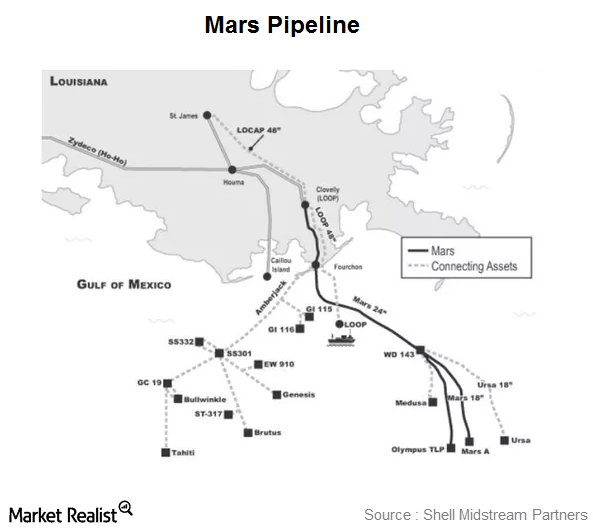

Shell Midstream’s Mars: A Corridor Pipeline Servicing the Gulf

Shell Midstream Partners (SHLX) has a 28.6% ownership in the Mars pipeline, and Shell Pipeline Company has a 42.9% interest.

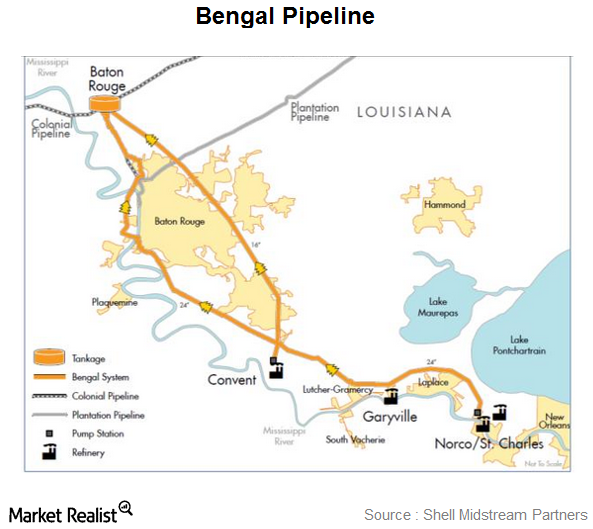

Shell Midstream Partners Refined Products Pipeline Systems

The Colonial pipeline system is the largest refined products pipeline in the US based on barrels per mile transported.