Red Hat Inc

Latest Red Hat Inc News and Updates

Why Red Hat Stock Rose More than 4% This Week

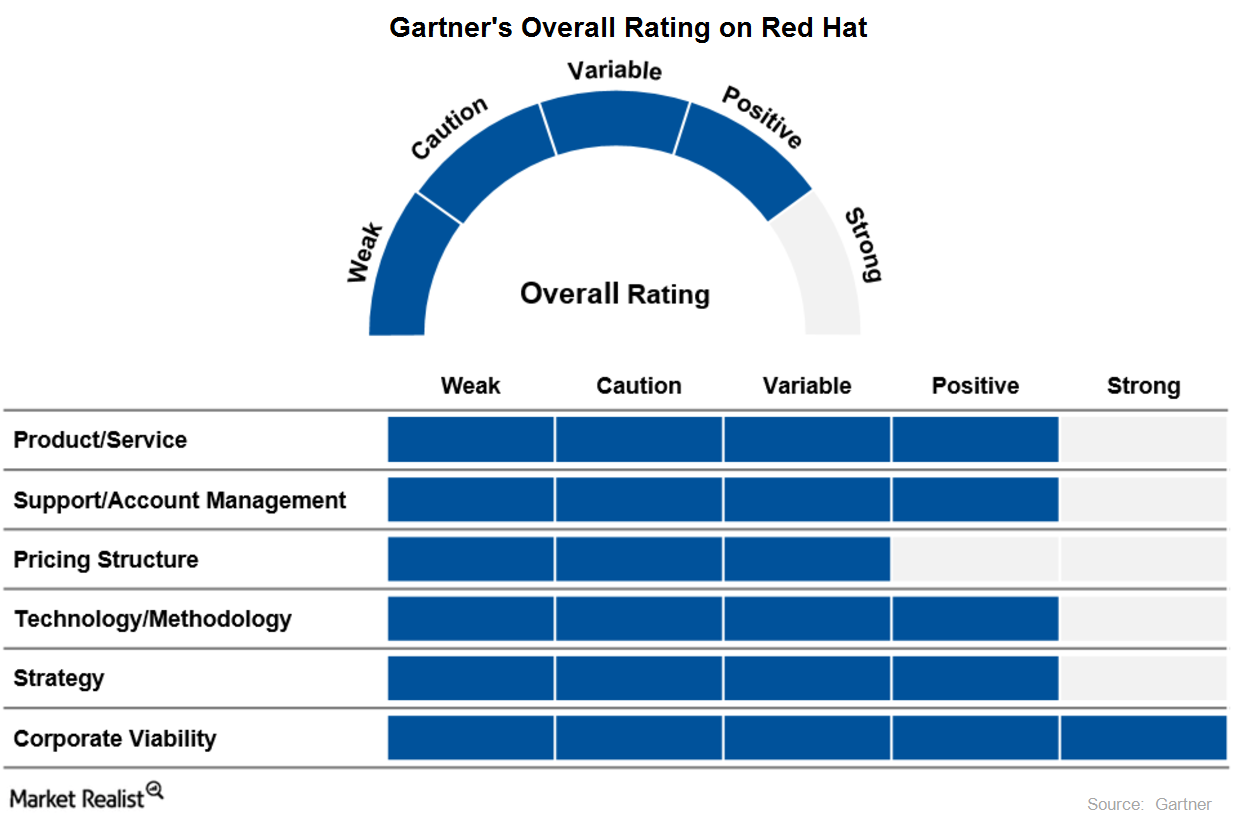

In the last seven years, Red Hat has met or exceeded analysts’ expectations each quarter with few exceptions.

What’s Oracle’s Value Proposition in the US Software Space?

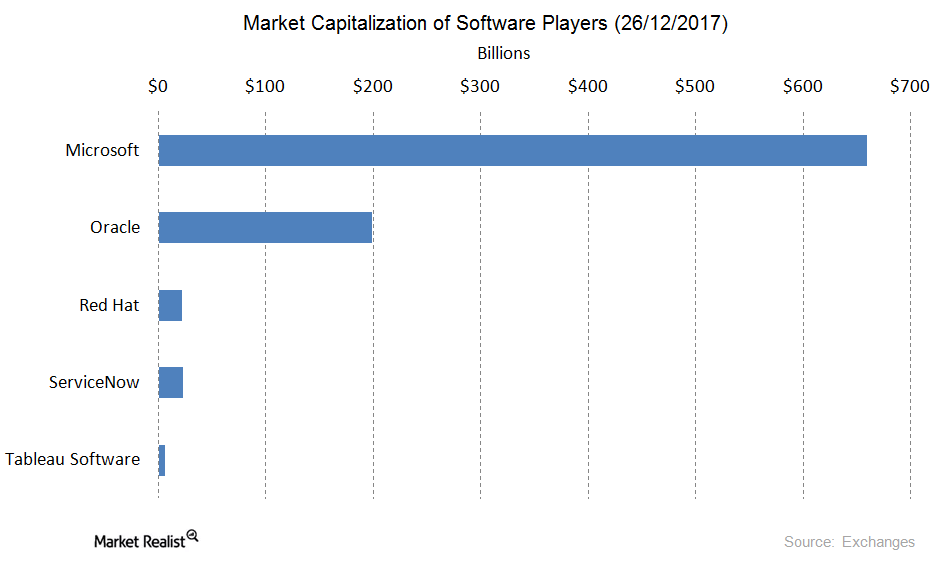

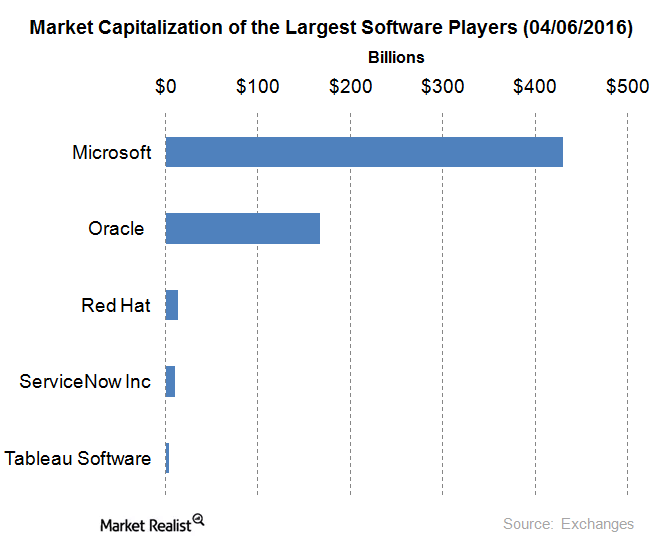

As of December 26, 2017, Microsoft (MSFT), with a market cap exceeding $650 billion, continued to be the largest software player. Oracle came in second.

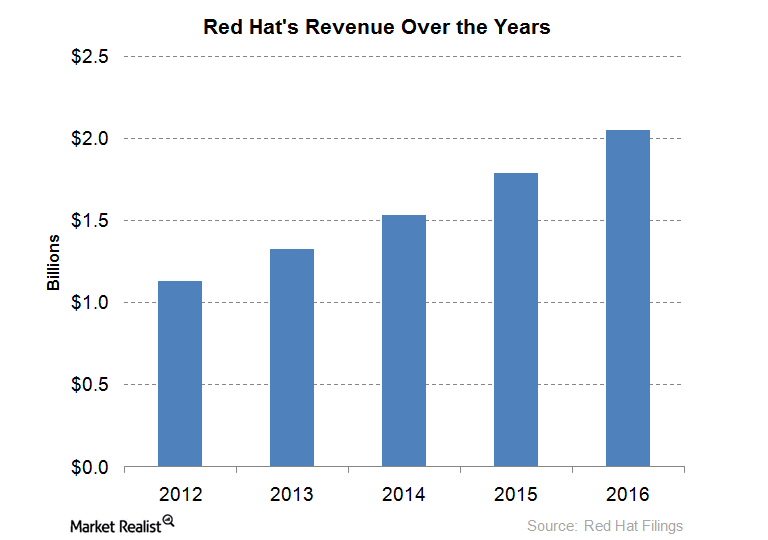

Red Hat: 56th Consecutive Quarter of Revenue Growth

Red Hat (RHT), a leading Linux software and open-source provider, was the latest in the technology space to announce its fiscal 4Q16 earnings.

George Soros Buys Slack, Increases SPY Short Exposure

The 13F filing showed that George Soros bought almost 500,000 Slack (WORK) shares at an average price of $37.5 per share during the second quarter.

Why Microsoft Bought DataSense

Microsoft (MSFT) recently announced that it had bought education data management platform DataSense from BrightBytes.

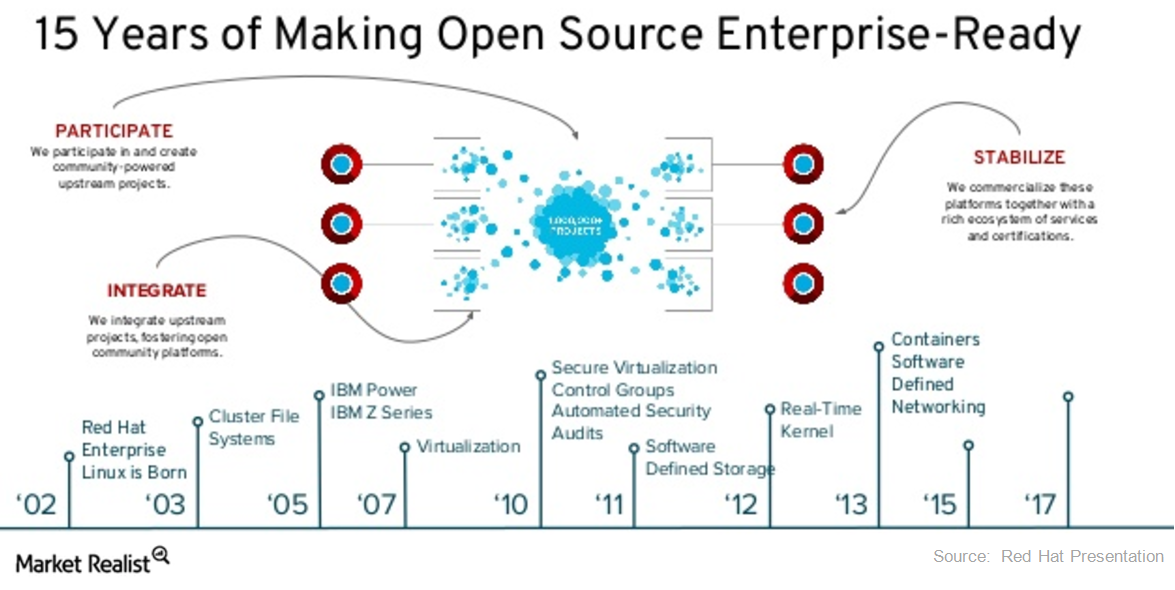

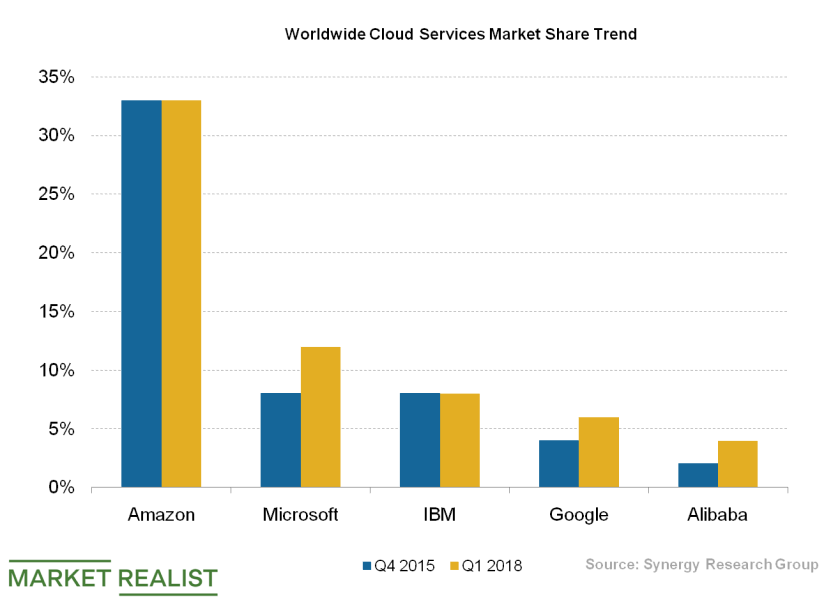

The Real Reason IBM Acquired Red Hat

In October, IBM (IBM) shocked the world by acquiring Red Hat (RHT) for $34 billion, marking its largest acquisition to date.

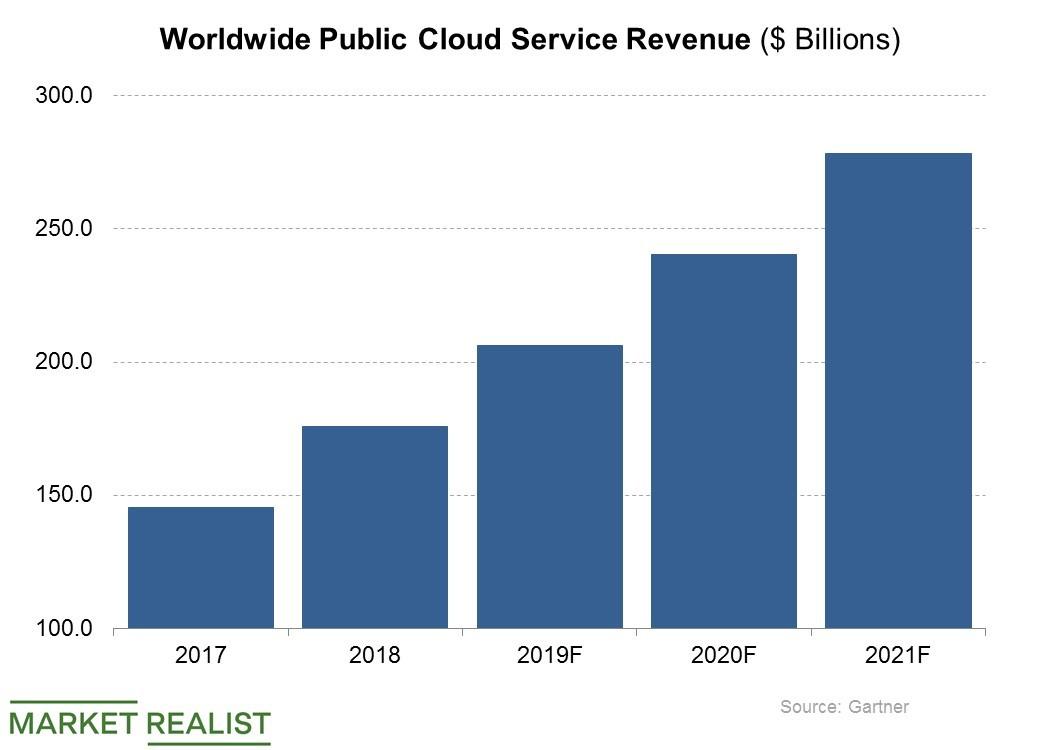

What Is Hybrid Cloud’s Role in Red Hat’s Growth?

Red Hat’s dominant presence in the Linux space will further enable it to cross-sell its OpenStack to new and existing clients as hybrid cloud adoption increases.

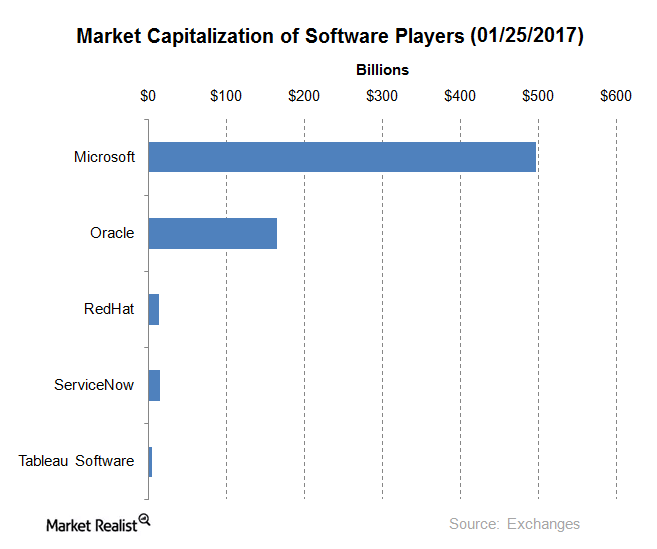

What Is Microsoft’s Value Proposition in the US Software Space?

As of January 25, 2017, Microsoft continues to be the largest software player by market capitalization on a global scale.

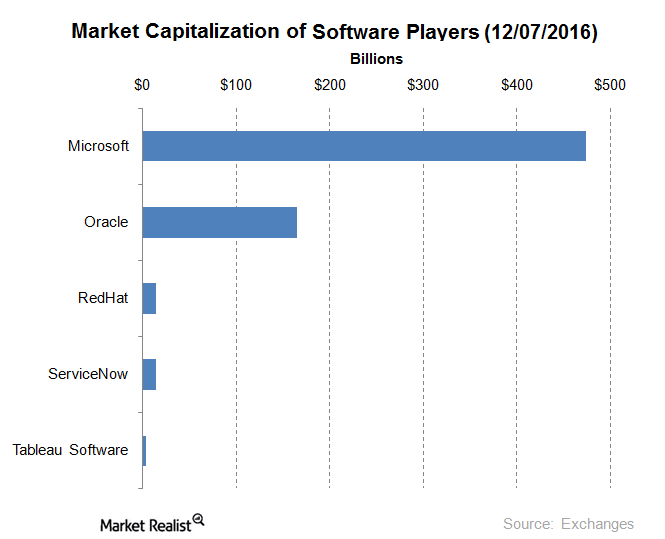

Understanding Oracle’s Value Proposition in the Software Space

Oracle was trading at a forward EV-to-EBITDA multiple of ~8.3x on December 8, 2016. This metric was lower than Microsoft’s multiple of ~10.3x.

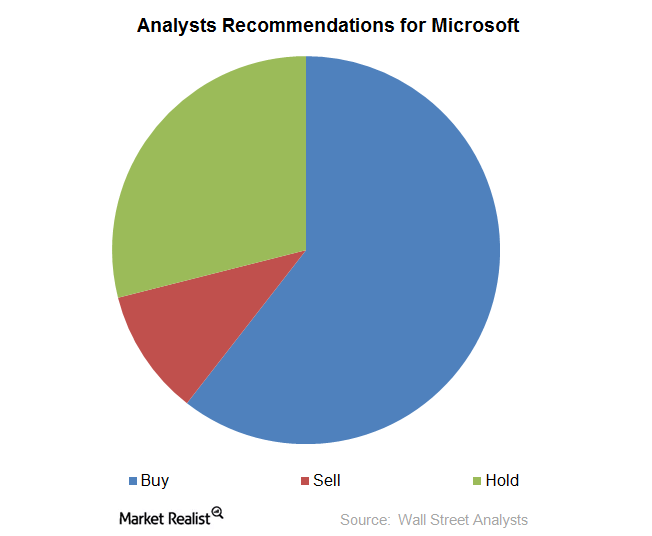

What Are the Analysts’ Recommendations for Microsoft?

Of the 38 analyst recommendations on Microsoft’s stock, 60.5% were “buys” as of April 6. Meanwhile, ~29% of recommendations were “holds.” The remaining ~10.5% of recommendations on the stock were “sells.”

Microsoft’s Value Proposition in the US Software Space

As of April 6, 2016, Microsoft was the largest software player by market capitalization on a global scale. It was followed by Oracle (ORCL).

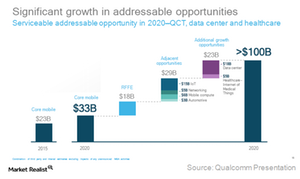

Qualcomm Is Targeting a $100 Billion Market by 2020

Qualcomm (QCOM) has stated that its total SAM (serviceable addressable market) is expected to grow from $23 billion in 2015 to about $100 billion in 2020.Technology & Communications Overview: Understanding the software industry cost structure

R&D costs typically form 10%–20% of the revenues for software companies.