Patterson-UTI Energy Inc

Latest Patterson-UTI Energy Inc News and Updates

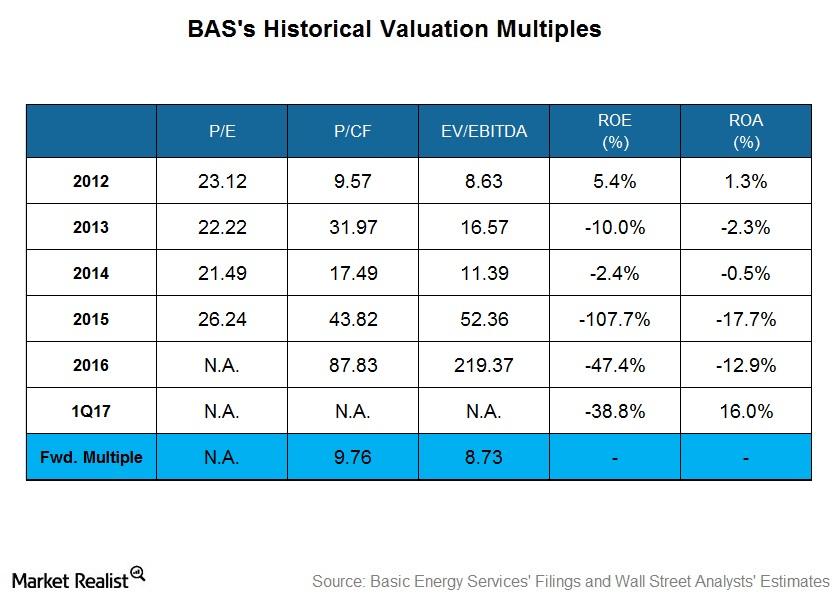

What Does Basic Energy Services’ Historical Valuation Suggest?

On March 31, 2017, Basic Energy Services’ (BAS) stock price had fallen 6% from December 30, 2016.

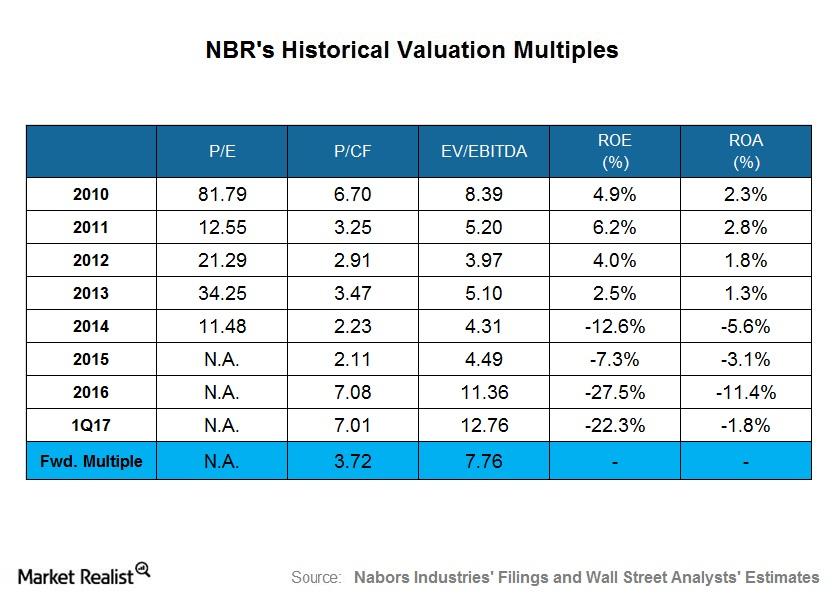

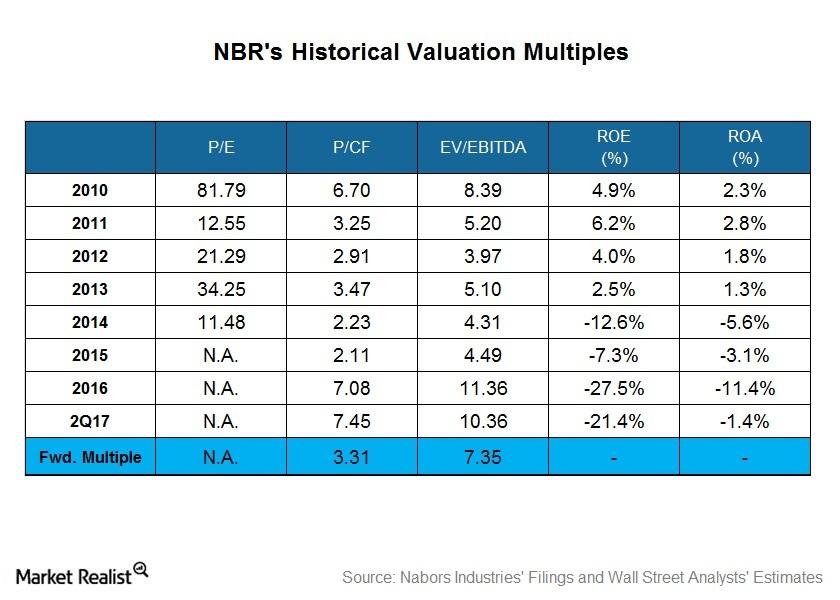

What Nabors Industries’ Historical Valuation Suggests

On March 31, 2017, Nabors Industries (NBR) stock was 20.0% lower than it was on December 30, 2016. In 1Q17, NBR’s adjusted earnings were negative.

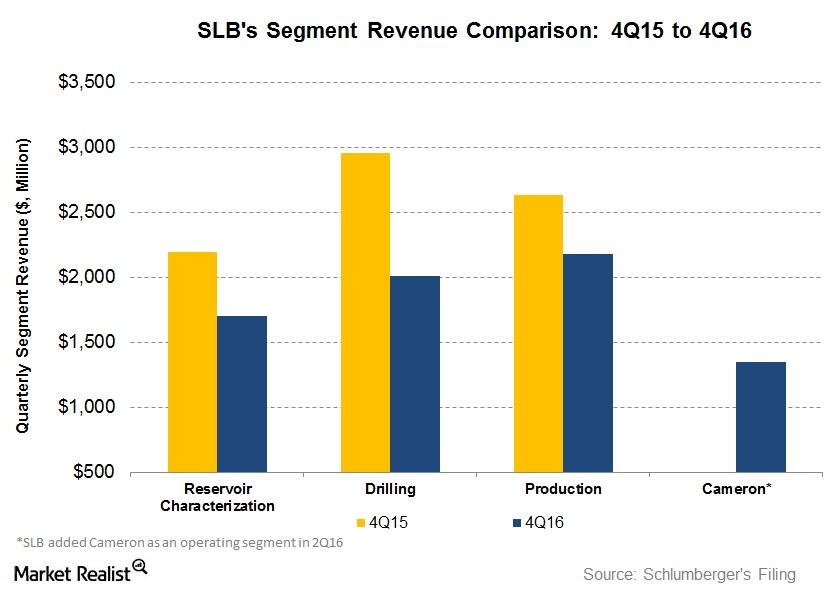

What Could Drive Schlumberger’s Performance in 1Q17 and Beyond?

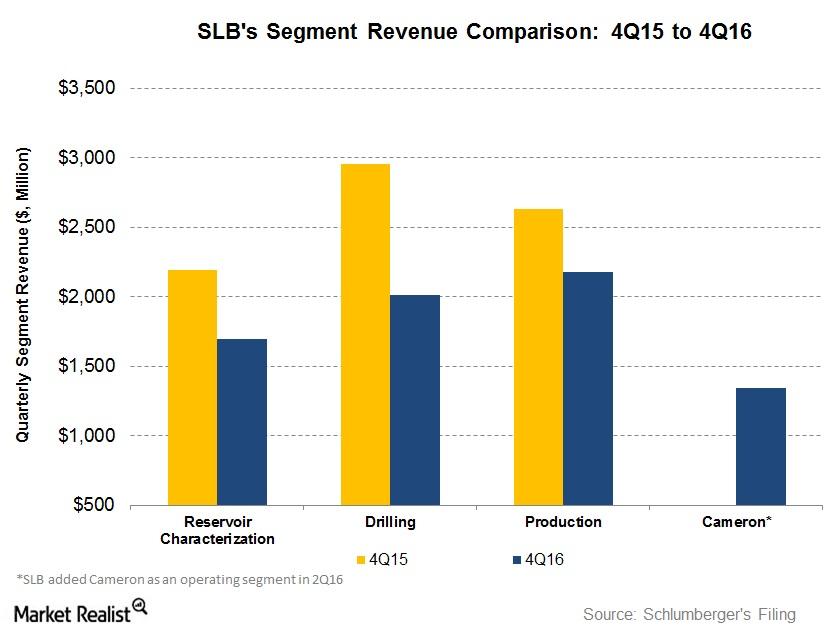

Schlumberger’s (SLB) Drilling segment witnessed the highest revenue fall of 32% in 4Q16 compared to 3Q16.

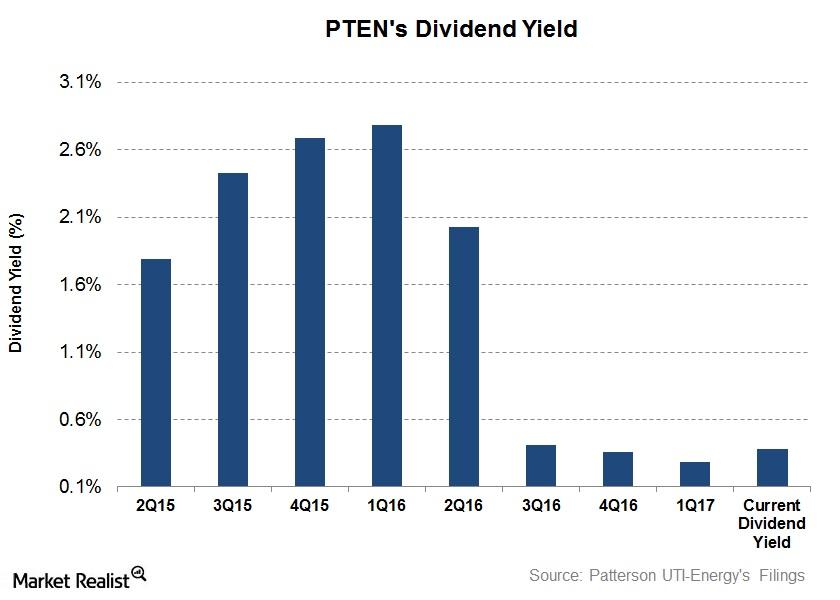

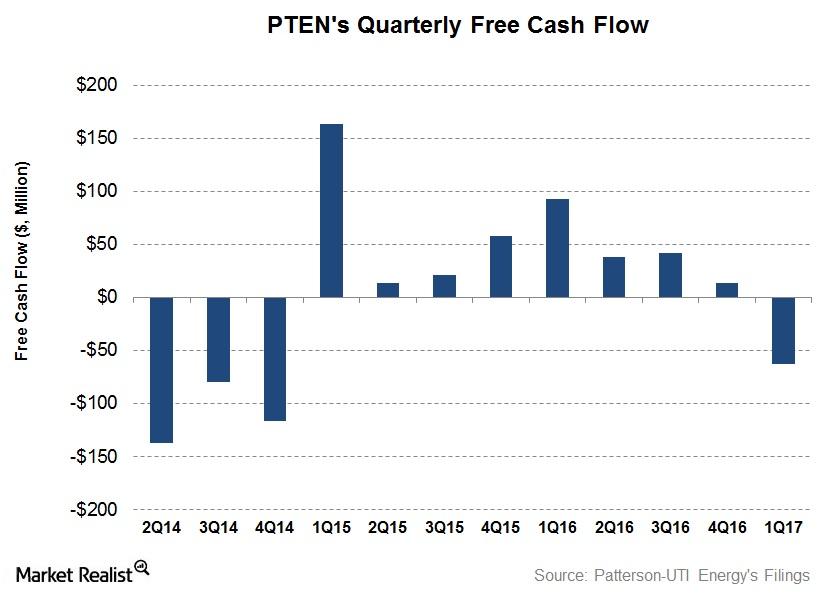

Patterson-UTI Energy’s Dividend Yield on June 2

Patterson-UTI Energy’s (PTEN) dividend yield fell to 0.29% on March 31, 2017. Since then, its dividend yield has risen to 0.38% as of June 2, 2017.

Analyzing the Factors Affecting Schlumberger’s Revenue

Schlumberger’s Drilling segment witnessed the highest revenue fall at 32% in 4Q16 compared to 4Q15. The segment was followed by the Reservoir Characterization and Production segments.

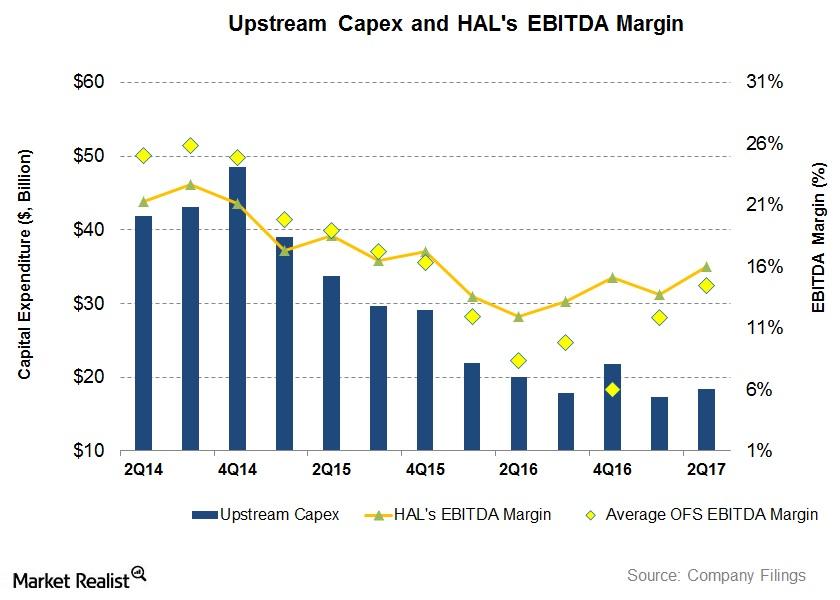

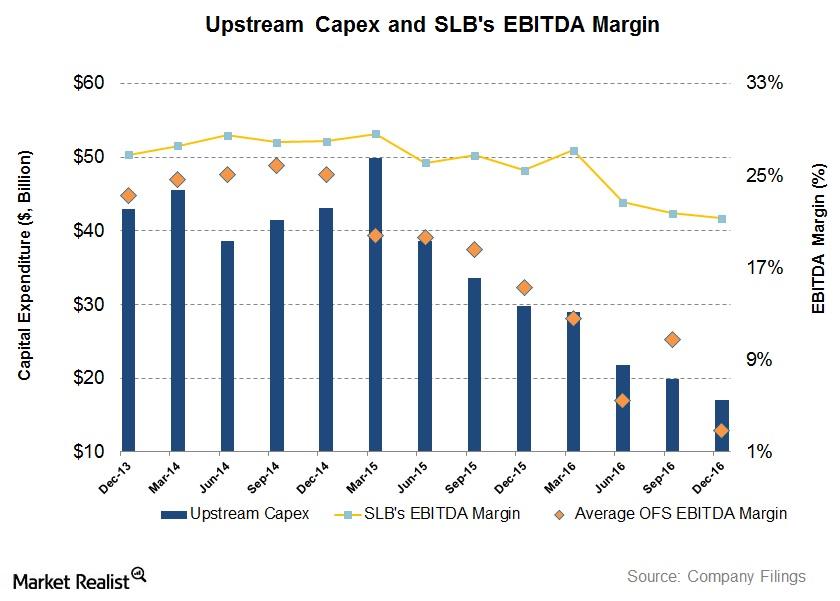

What Halliburton’s Margin Has to Do with Upstream Operators’ Capex

From 2Q16 to 2Q17, Halliburton’s (HAL) EBITDA margin (or EBITDA as a percentage of revenues) rose from 12% to 16%.

What Does Nabors Industries’ Historical Valuation Suggest?

Nabors Industries’ PE multiple was not meaningful in 2015 and 2016 as a result of negative adjusted earnings during this period.

A Look at Patterson-UTI Energy’s Higher 2017 Capex Plan

Patterson-UTI Energy’s capex budget for 2017 is $450.0 million. That’s 275.0% higher than its 2016 capex.

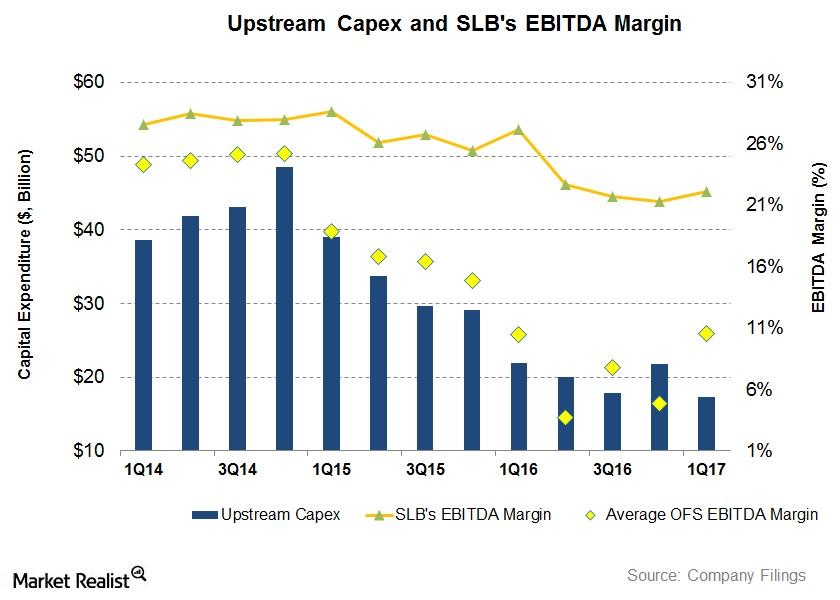

Upstream Operators’ Capex Could Impact Schlumberger’s Margin

Schlumberger’s EBITDA margin was impacted negatively as upstream companies slashed their budgets. From 1Q16 to 1Q17, Schlumberger’s EBITDA margin fell.

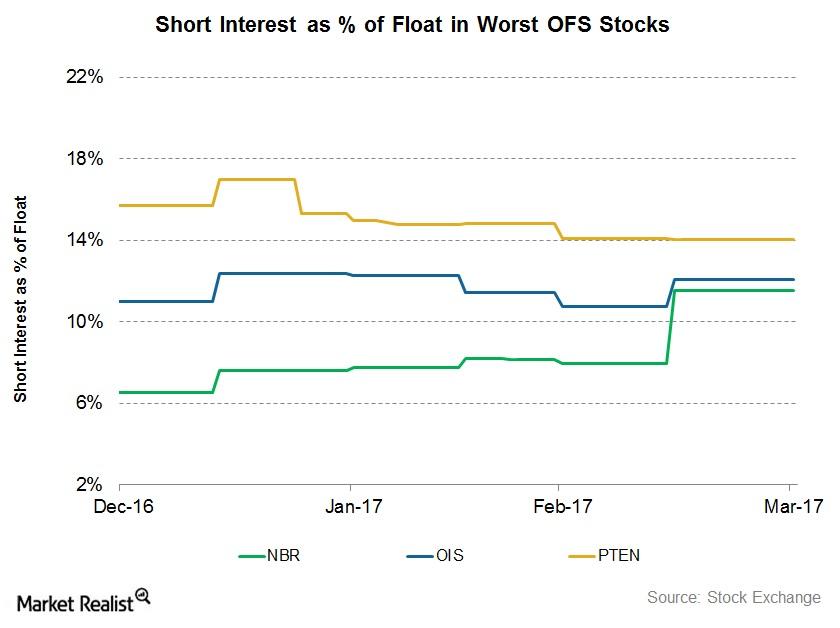

Short Interest: OFS Stocks with the Lowest Returns in 1Q17

Short interest in Nabors Industries (NBR), as a percentage of its float, rose to 11.5% as of March 31, 2017—compared to 6.5% as of December 30, 2016.

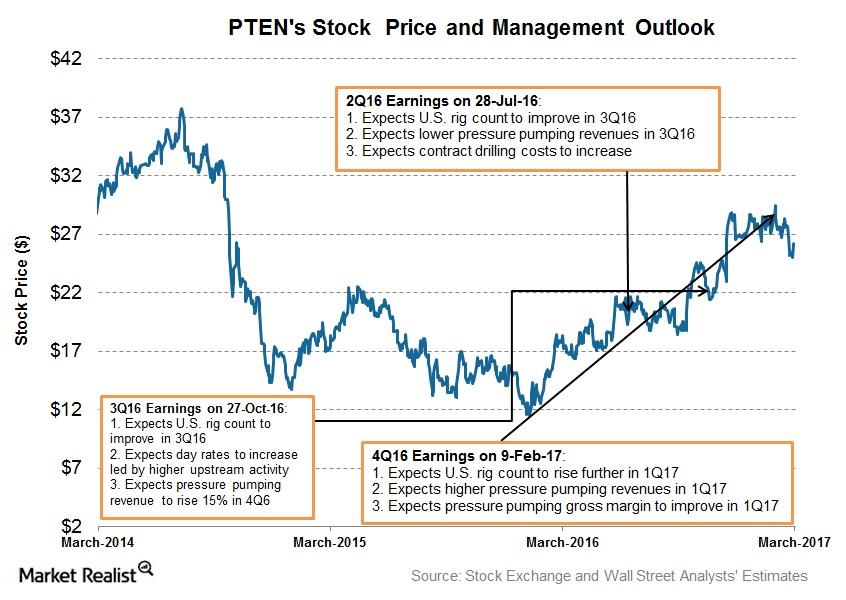

Patterson-UTI Energy’s Forecasts for 2017

Patterson-UTI Energy’s (PTEN) operated average US rig count is expected to rise 21.0% in 1Q17 compared to 4Q16.

Will Upstream Operators’ Capexes Affect SLB’s 1Q17 Margin?

In the past couple of years, some major US upstream and integrated companies have reduced their capital expenditures (capex) following crude oil’s sharp fall.

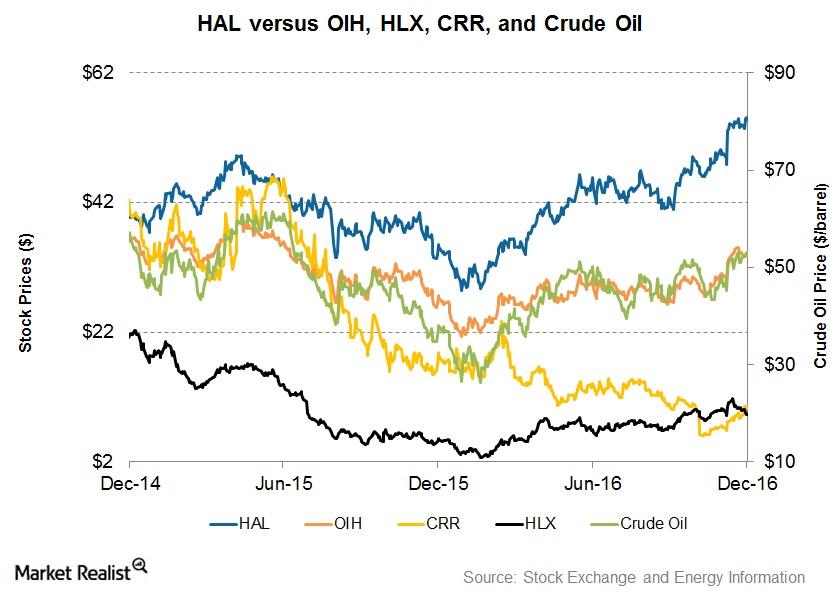

Analyzing Halliburton’s Stock Price Returns

From December 2014 to December 2016, Halliburton’s (HAL) stock price reached the highest level in December 2016. It troughed at ~$28 in January 2016.

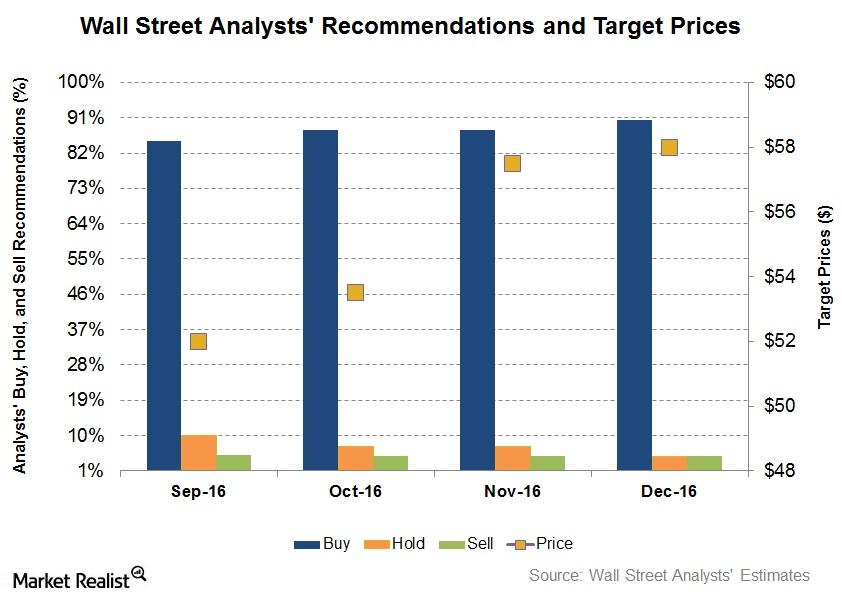

Are Analysts Changing Recommendations for Halliburton?

In December so far, 90% of the analysts tracking Halliburton rated it a “buy” or some equivalent.

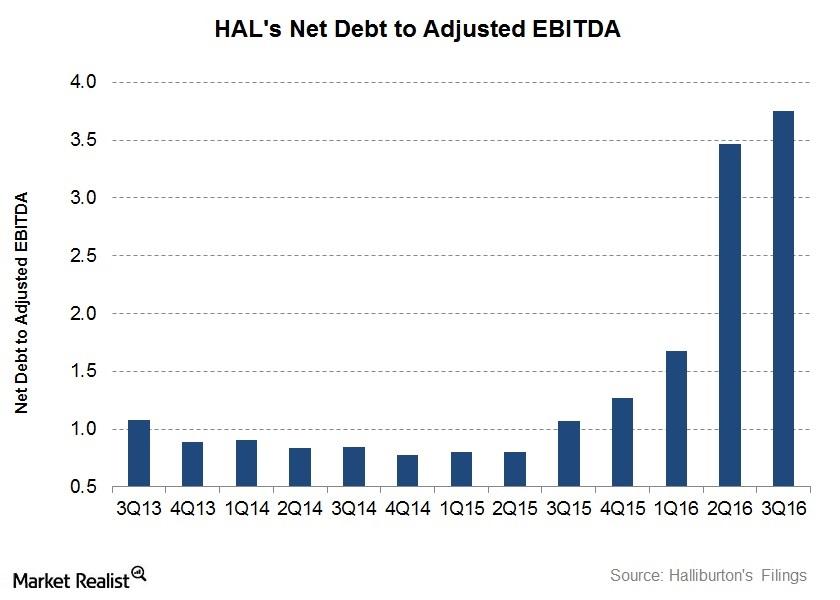

Is Halliburton’s Indebtedness on the Rise?

In 3Q16, Halliburton’s net-debt-to-adjusted-EBITDA multiple was ~3.8x, or 251% higher than it was a year ago.

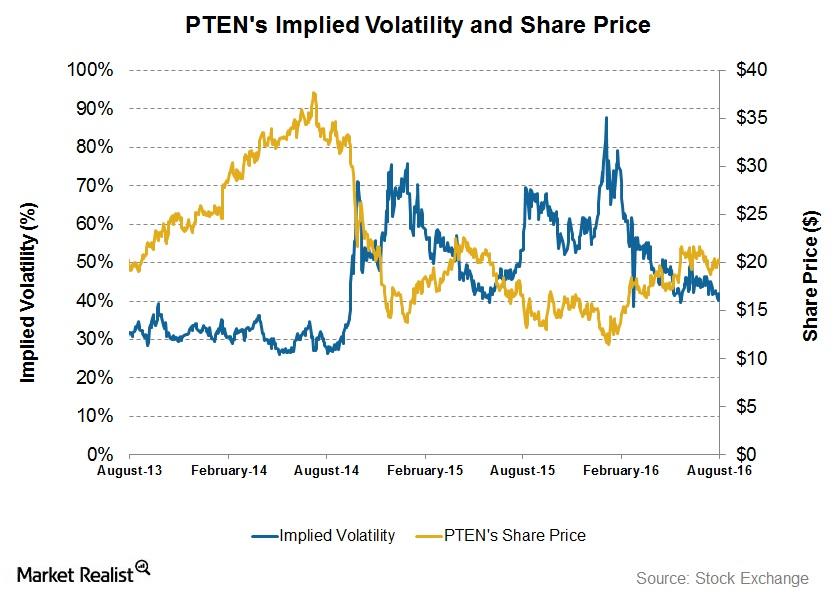

How Volatile Is Patterson-UTI Energy after 2Q16?

On August 19, Patterson-UTI Energy had an implied volatility of ~40%. Since its 2Q16 results were announced, its implied volatility has fallen from ~45%.

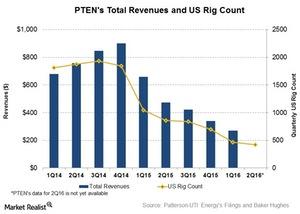

Will Rig Count Affect Patterson-UTI Energy in 2Q16?

In 1Q16, the US rig count declined by 56% over 1Q15. During this period, the international rig count decreased by only 21%.