iShares US Preferred Stock

Latest iShares US Preferred Stock News and Updates

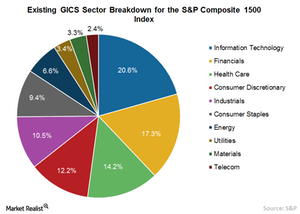

How REIT Classification Benefits Preferred Securities

S&P Dow Jones Indices and MSCI (MSCI) have decided to shift stock exchange-listed equity REITs and other listed real estate companies from the financial sector (XLF) to a new real estate sector.

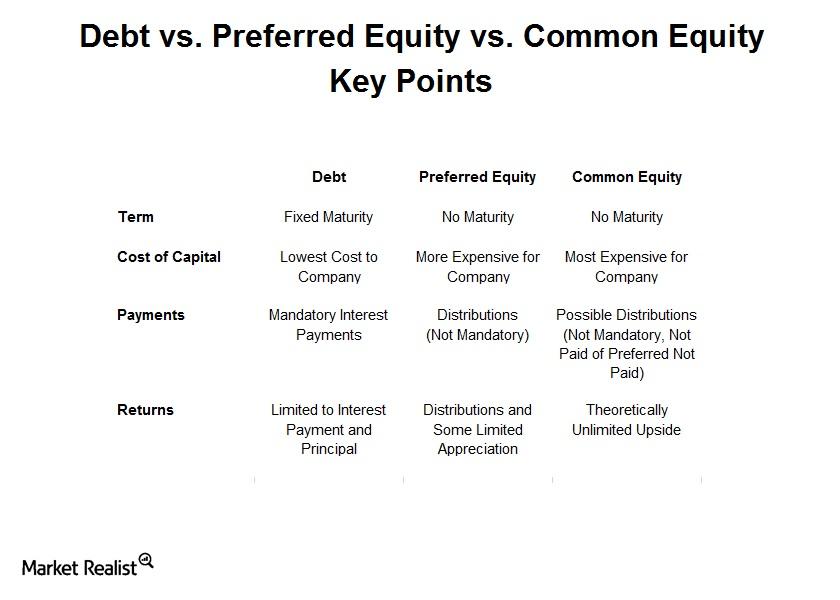

Why some companies may “prefer” to issue preferred equity

Companies may prefer to raise money through preferred equity for a few reasons. One possible benefit to issuing preferred equity is to reach a new pocket of investors

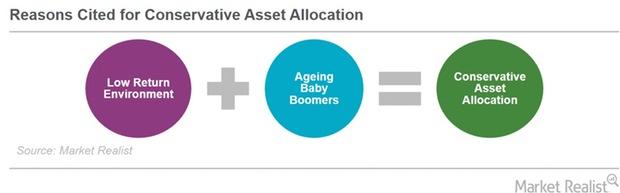

Demographics Driving Conservative Investment? Bernstein Says No

After stating that the market isn’t in a low return environment, Richard Bernstein moved on to discuss the reasons cited by many for conservative asset allocation.

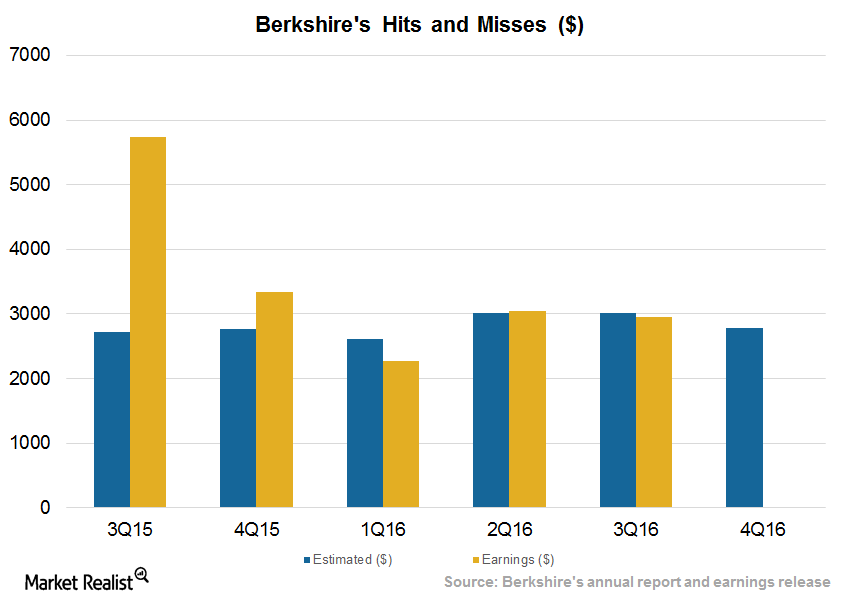

Buffett’s Berkshire Misses Estimates amid Volatile Environment

Berkshire Hathaway reported its third quarter earnings on November 5, 2016. The company missed analysts’ operating earnings per share estimates of $3,022 with reported EPS of $2,951.

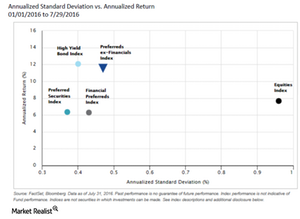

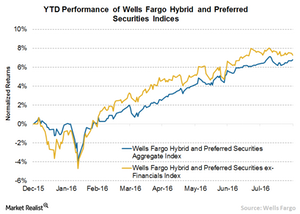

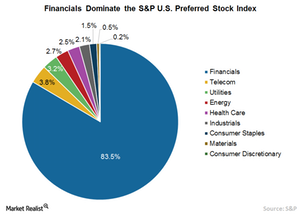

Ex-Financial Preferreds’ Attractive Risk-to-Return Trade-Off

Financials (XLF) have a heavy concentration in preferred securities. Consequently, financials have a significant influence on returns.

Why Ex-Financial Preferreds Offer Competitive Yield Potential

Preferred securities are some of the few investment avenues that still have the potential to provide attractive yields to investors.

Why Preferred Securities Attract Investors

Preferred securities (PFXF) are some of the most popular investments around. They appeal to investors seeking higher yields in a world of falling and even negative interest rates.

Why Is Comcast Offering Products Based on Market Segmentation?

By offering different products like triple-play services, Comcast is catering to millennials, who want different content and can be heavy video viewers.

History of Comcast

In 1969, American Cable Systems was renamed Comcast Corporation.

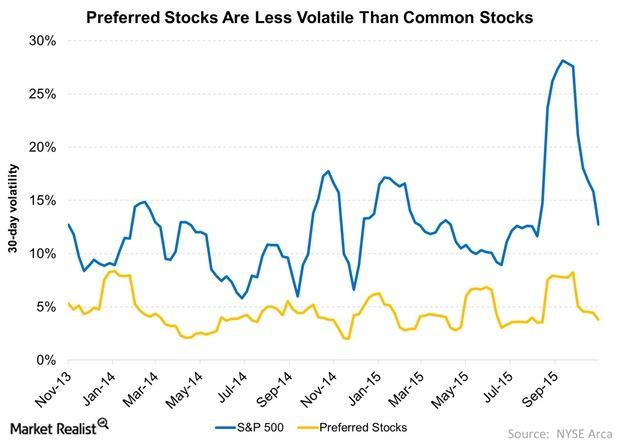

Why Preferred Stocks Are Less Volatile than Common Equities

Preferred stocks are less volatile compared to common equities. This is mainly because a larger portion of the returns comes from dividends, which tend to be stable.

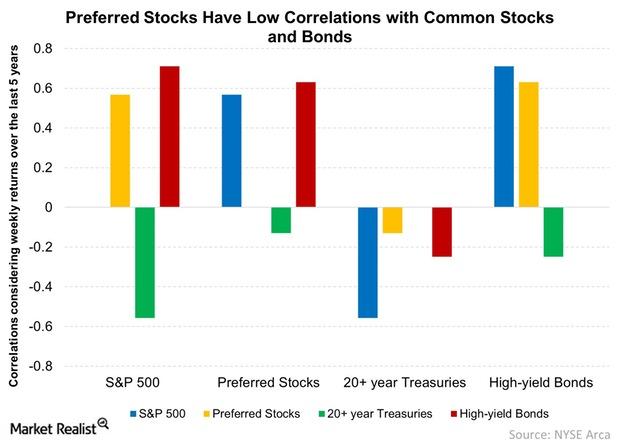

When Are Preferred Shares Appropriate for Your Portfolio?

Treasuries (TLO) add ballast to a stock-centric portfolio while providing low yields.