Loxo Oncology Inc

Latest Loxo Oncology Inc News and Updates

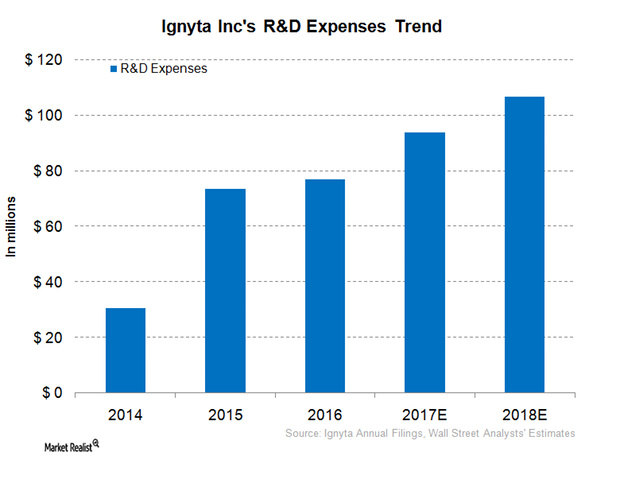

Inside Ignyta’s Financial Performance

Ignyta’s (RXDX) R&D (research and development) expenses increased from $16.6 million in 3Q16 to $21.7 million in 3Q17, a 30% rise.

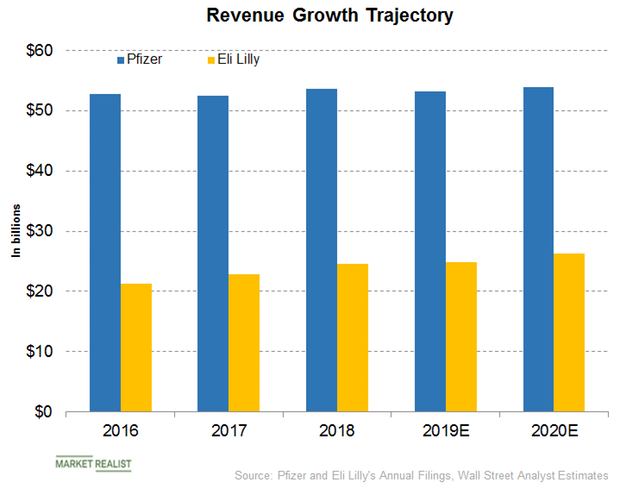

Pfizer or Eli Lilly: Who Will Report Better Revenue Growth?

In its fourth-quarter earnings conference call, Pfizer (PFE) has guided for revenues of $52 billion to $54 billion for fiscal 2019.

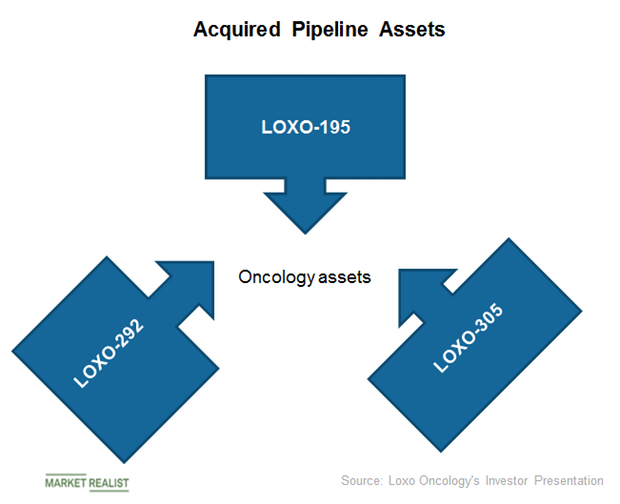

Eli Lilly and Loxo: A Robust Oncology Pipeline for Future Years

Eli Lilly’s acquisition of Loxo has added the FDA approved asset VITRAKVI and the early- and mid-stage oncology pipeline assets LOXO-305, LOXO-195, and LOXO-292.

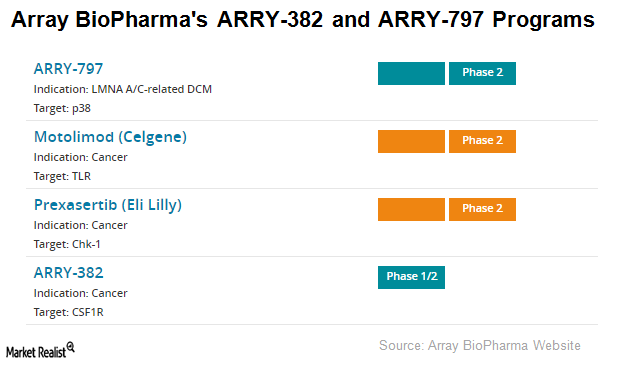

Array BioPharma’s ARRY-382 and ARRY-797

Array BioPharma (ARRY) completed its Phase 1b clinical trial of its investigational drug candidate ARRY-382 in combination with Merck’s (MRK) Keytruda for advanced tumor indications.

What Led to Arrowhead Pharmaceuticals’ Revenue Surge in 2017?

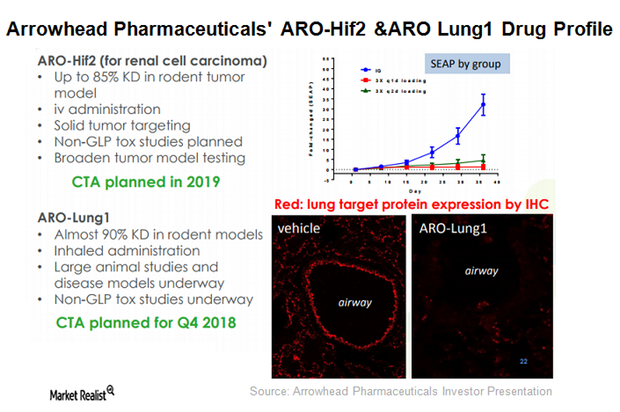

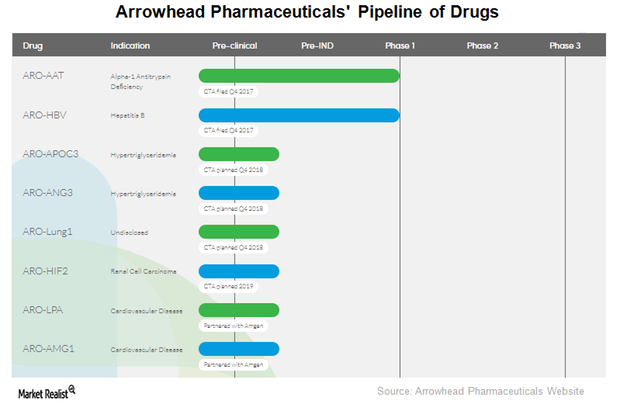

Arrowhead Pharmaceuticals’ therapeutic candidate ARO-LUNG1 is being developed for an undisclosed disease of the lung. This is the first candidate to utilize the company’s TRiM platform.

Arrowhead’s Candidates for Hepatitis B, Cardiovascular Diseases

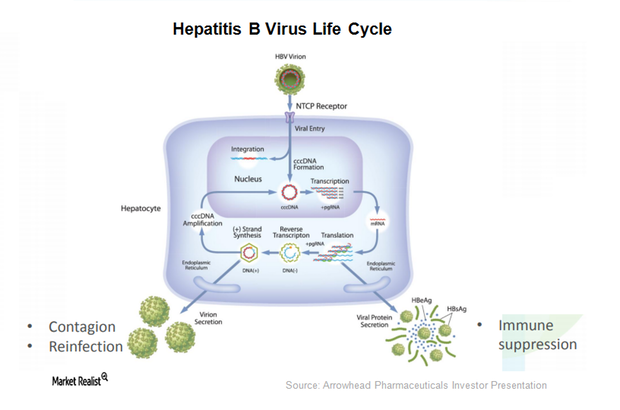

ARO-HBV is Arrowhead Pharmaceuticals’ (ARWR) investigational drug candidate for treating chronic hepatitis B infection.

Taking a Closer Look at Arrowhead Pharmaceuticals’ TRIM Platform

Arrowhead Pharmaceuticals’ (ARWR) prior efforts were aimed at clinical programs that utilized the dynamic polyconjugate (or DPC), also called the EX1 delivery vehicle.