Joy Global Inc

Latest Joy Global Inc News and Updates

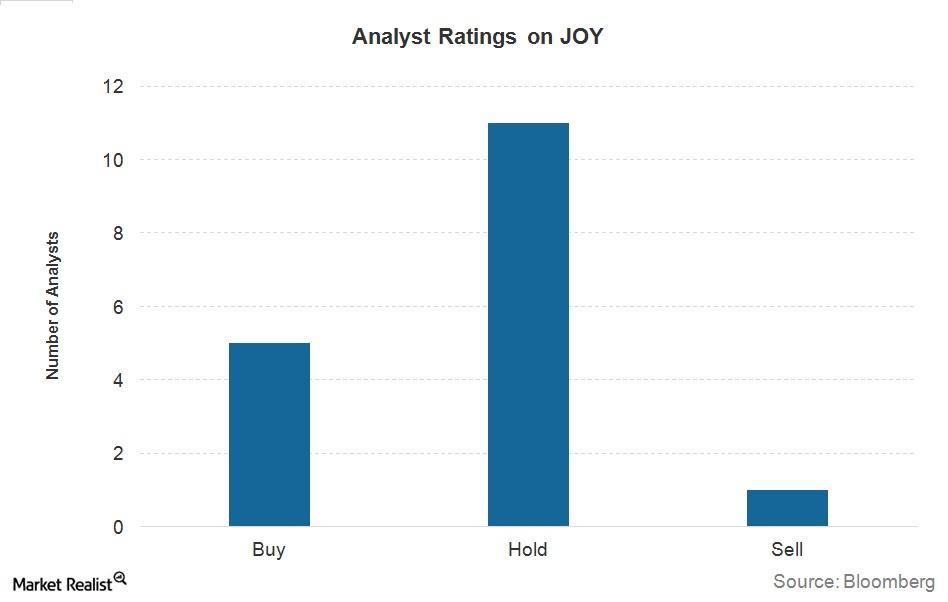

The Word on the Street: What Analysts Are Recommending for Joy Global Now

Of the 17 analysts surveyed by Bloomberg, only five issued “buy” recommendations for Joy Global, while 11 issued “holds,” and one issued a “sell.”

Caterpillar’s 3Q16 Earnings Bring ‘Inflection’ Back into Focus

Caterpillar, the world’s largest manufacturer of construction and mining equipment, will declare its 3Q16 earnings before the market opens on October 25.

More Losses? Caterpillar Puts Part of Its Mining Business on Sale

Caterpillar logged four consecutive quarters of operating losses in the Resource Industries segment—it houses the mining equipment business.

What Is the Market Outlook for Underground Mining Equipment?

The global underground mining industry is expected to grow at a compound annual growth rate of approximately 7% from 2015 to 2019.

A Quick Look at Joy Global’s History and Operations

Joy Global operates in two business segments, namely its Underground Mining Machinery and Surface Mining Equipment segments.