iShares US Telecommunications

Latest iShares US Telecommunications News and Updates

Investment opportunities in the US telecom industry

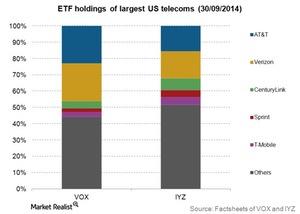

Investors that like the US telecom industry’s fundamentals—for example, stable cash flows and high dividend yield—may invest in telecom ETFs.Technology & Communications Must know: Why AT&T’s wireline business continues to decline

In this series, we’ll discuss the main drivers behind AT&T’s wireline business. AT&T’s wireline business is as important for the company as its wireless business.

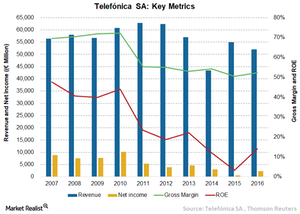

Telefonica Is a Dominant Player in Over 20 Countries

Telefonica SA (TEF SM) is headquartered in Spain and is one of the world’s largest telephone operators reaching more than 350 million customers.

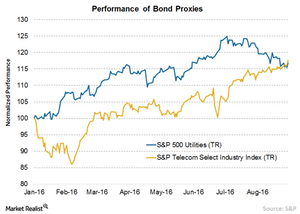

Why Some Popular Positions Become Risky

According to Factset data, around 93% of companies in the utilities (JXI) sector and 80% in the telecom (IXP) sector reported revenues below estimates in the second quarter of 2016.

Parker-Hannifin’s 2017 Guidance Suggests Slowdown in Industrials

Parker-Hannifin has guided its fiscal 2017 adjusted EPS at $6.40–$7.10. The midpoint of this range is roughly 4.5% higher than $6.46 in fiscal 2016.

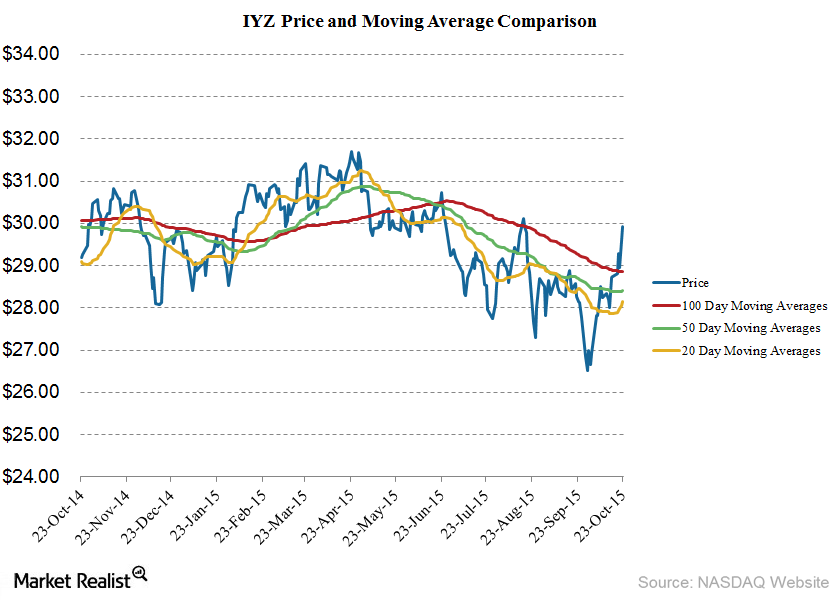

IYZ Sees -$143.8 Million in Fund Outflows in the Trailing 12 Months

The IYZ ETF generated investor returns of 4.3% in the trailing-12-month period, 5.2% in the trailing-one-month period, and 7.9% in the trailing three years.

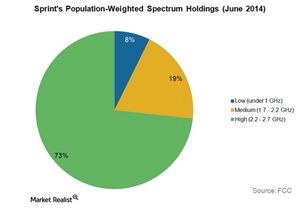

CEO Claure Plans to Harness Sprint Capacity Spectrum Holdings

Sprint plans to implement a considerable densification program to harness its capacity spectrum holdings, making capital expenditures of ~$5 billion in fiscal 2015.

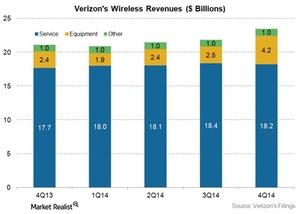

Verizon’s Wireless Revenues Grew in 4Q14

Verizon (VZ) reported its 4Q14 results on January 22, 2015. We’ll analyze the company’s quarterly performance while focusing on Verizon’s wireless revenues.Technology & Communications Why is the quality of the 4G network so important for Verizon?

Verizon continues to invest heavily in building its 4G LTE coverage and adding capacity for its existing coverage. Its capex spending increased from $3.6 billion in Q1 2013 to $4.2 billion in Q1 2014.