VanEck Vectors Emerging Markets High Yield Bond ETF

Latest VanEck Vectors Emerging Markets High Yield Bond ETF News and Updates

Opportunities in Emerging Market Credit Developments

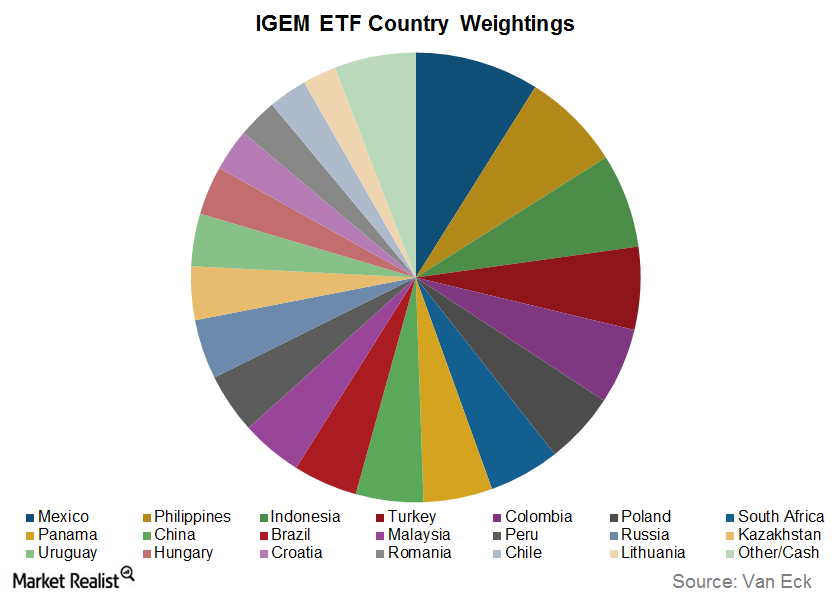

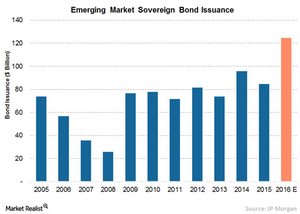

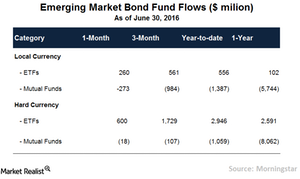

Strong investor interest in emerging market debt (EMLC) (HYEM) has continued despite adverse political and economic issues in some countries.

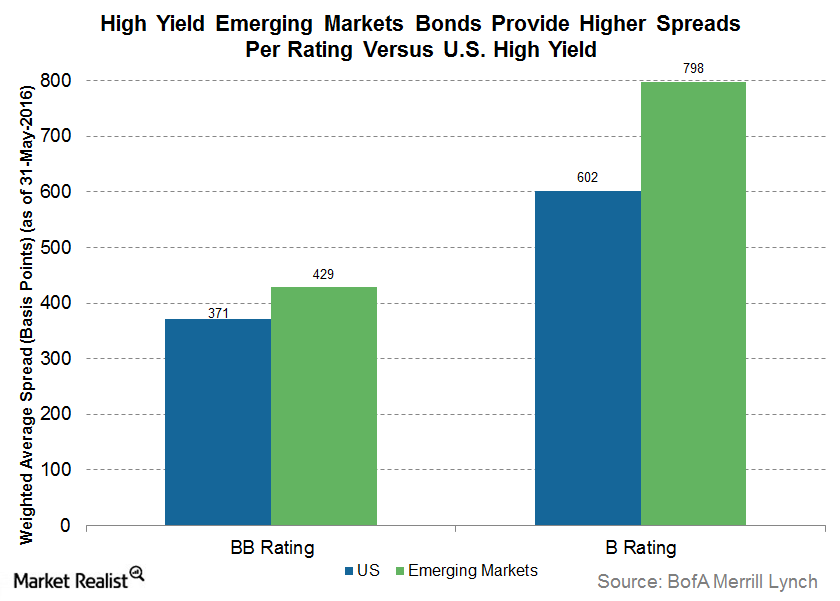

Quality May Provide Attractive Risk-Adjusted Returns

It’s useful to analyze the historical returns of credit rating categories within emerging markets bonds.

What Are the Attractive Characteristics of High Yield EM Bonds?

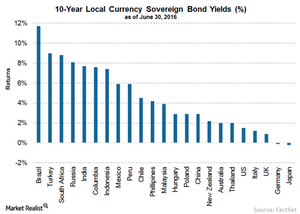

Investors are flocking to government bonds (BND) of developed markets, which is causing downward pressure on interest rates.

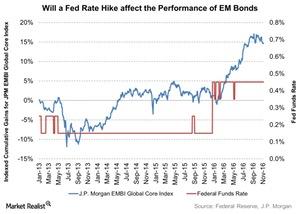

Can a Rate Hike Affect the Performances of Emerging Market Bonds?

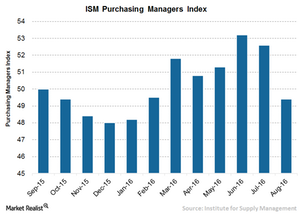

In her speech at the Jackson Hole Economic Symposium, Fed chair Janet Yellen expressed optimism about another rate hike in the United States.

Is Emerging Market Debt Immune to Rate Hikes?

The Federal Reserve kept its key interest rate unchanged in its policy meeting this week while signaling a possible rate hike in December.

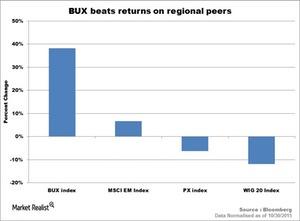

Emerging Market Debt Outperforms Other Risk Assets

While around 30% of developed market bonds (IHY) are trading at negative yields, emerging market debts (HYEM) are offering attractive returns.

Fed’s Rate Hike Decision to Drive the Markets

In the wake of disappointing economic indicators over the past month, the Federal Reserve kept the interest rate unchanged in its policy meeting this week.

Central and Eastern Europe Have the Brexit Blues

In the long term, Eastern Europe is largely affected by the United Kingdom’s exit from the European Union because of its strong trade links.

Time to Look at Emerging Market Debt

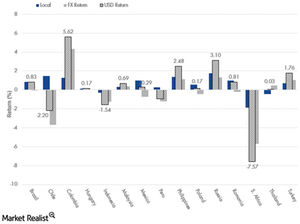

Global emerging markets (“EM”) debt, both hard and local currency, rebounded strongly in June after a significant retracement in May.

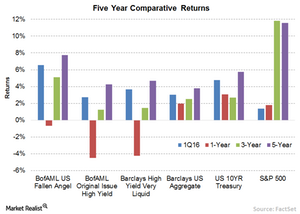

Interest Rate Outlooks Don’t Affect All Asset Classes: Here’s Why

Historically, it seems that fallen angels generally perform well across interest rate environments.