Exelixis Inc

Latest Exelixis Inc News and Updates

Sarepta Therapeutics Stock Rose 96% in 2018

On January 4, Sarepta Therapeutics (SRPT) stock closed at $115.43, which represents ~8.21% growth from its prior close.

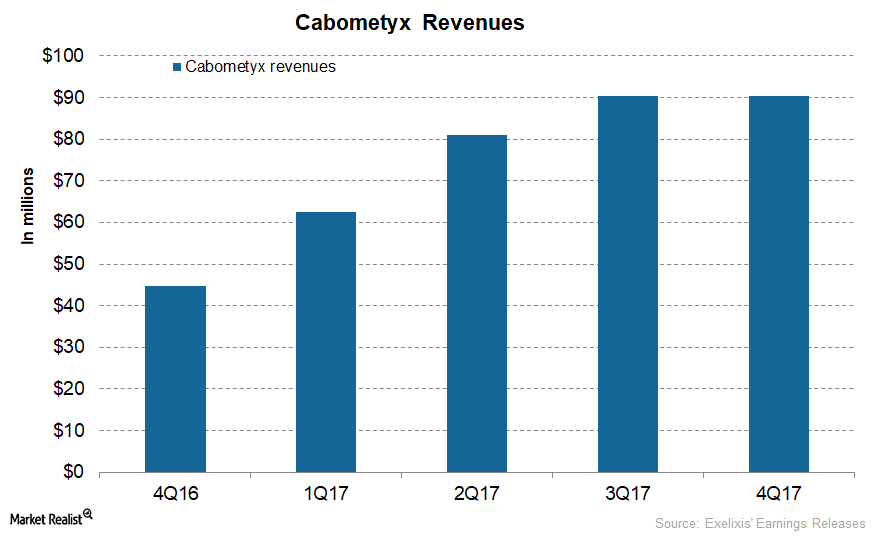

Cabometyx Could Be Exelixis’s Long-Term Growth Driver

In March 2018, the FDA accepted Exelixis’s (EXEL) supplemental New Drug Application (or sNDA) for Cabometyx.

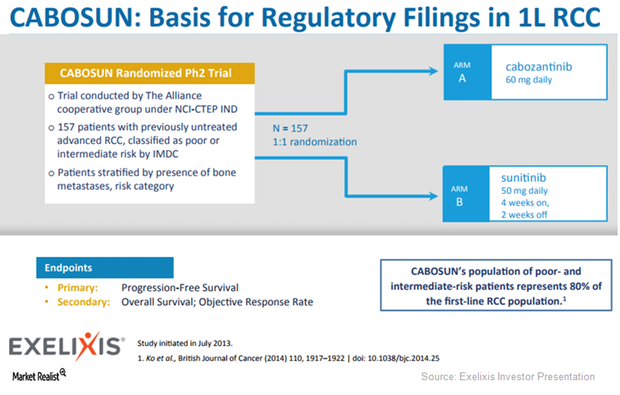

Behind Exelixis’s Cabometyx Strategy for 2018

Exelixis (EXEL) expects the FDA’s approval for Cabometyx for first-line RCC (renal cell carcinoma) to be a major revenue driver.

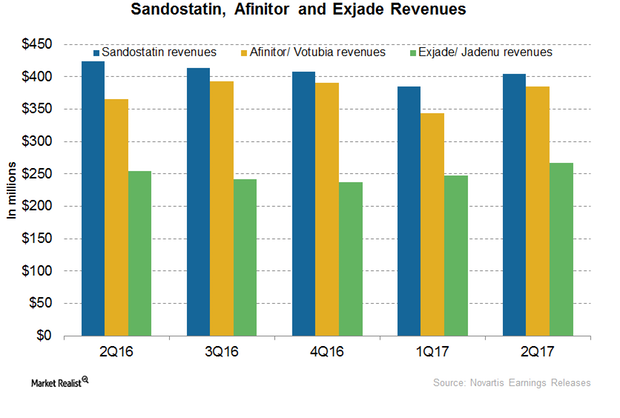

An Update on Novartis’s Sandostatin, Afinitor, and Exjade

In 1H17, Novartis’s (NVS) Sandostatin generated revenues of around $789 million, which reflected a ~4% decline on a year-over-year (or YoY) basis.

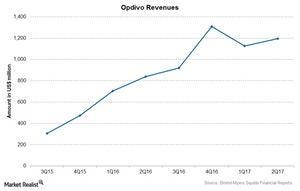

Bristol-Myers Squibb’s 2Q17 Earnings: Opdivo

Bristol-Myers Squibb’s (BMY) blockbuster drug Opdivo reported revenue of $1.2 billion in 2Q17, a 42% rise compared to $840 million in 2Q16.

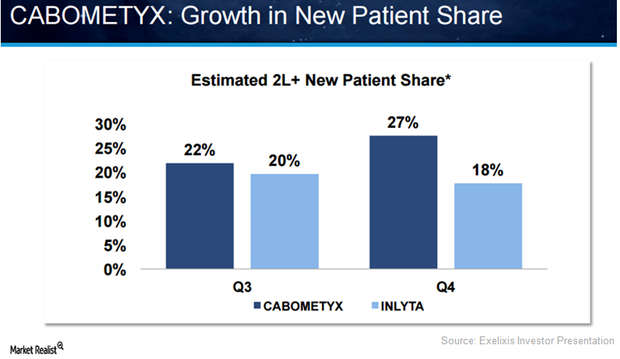

Behind Exelixis’s Successful Commercial Launch of Cabometyx in 2016

Launched in the US in 2Q16, Exelixis’s (EXEL) Cabometyx managed to fetch revenues of $31.2 million and $44.7 million in 3Q16 and 4Q16, respectively.