ProShares UltraShort Euro

Latest ProShares UltraShort Euro News and Updates

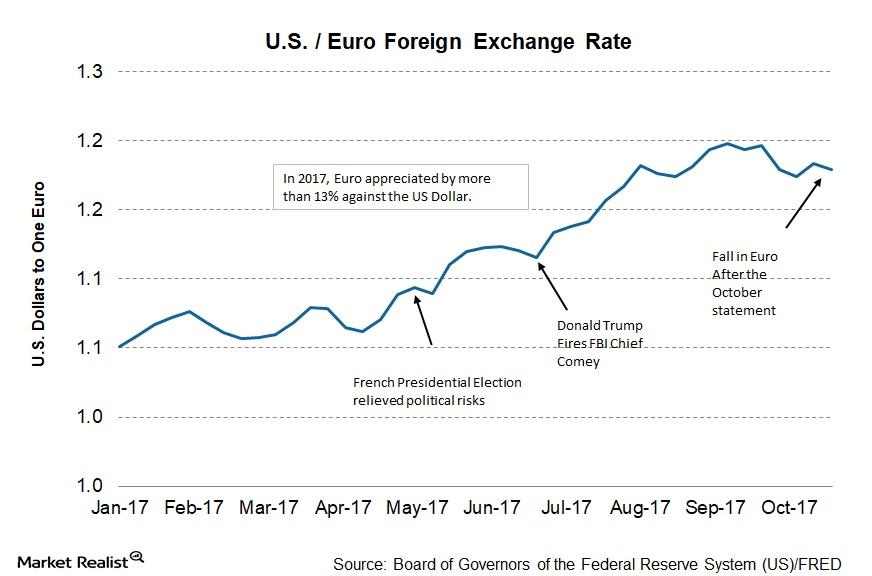

Why the ECB Isn’t Worried about the Appreciating Euro

In the ECB’s (European Central Bank) October policy meeting, the ECB didn’t explicitly talk about the appreciating euro.

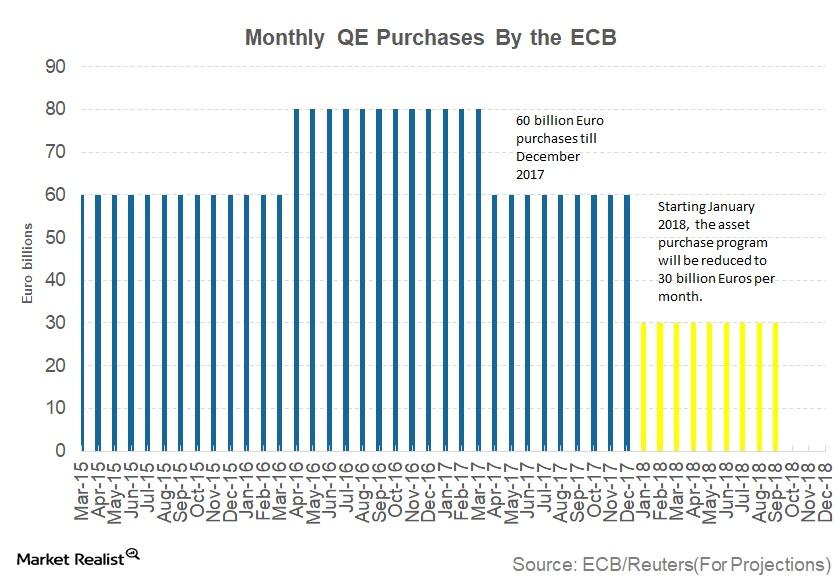

Update from the European Central Bank’s October Policy Statement

In the ECB’s (European Central Bank) October policy meeting, its laid out its plans for the QE (quantitative easing) program.

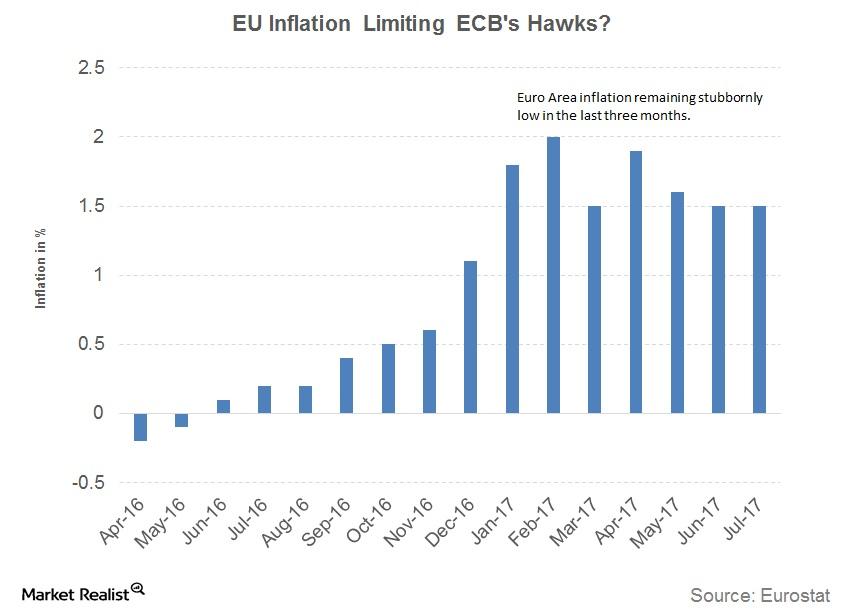

Why Did the ECB Downgrade Its Inflation Outlook?

In its September 7 policy meeting, the ECB (European Central Bank) downgraded the outlook for the EU economy’s inflation.

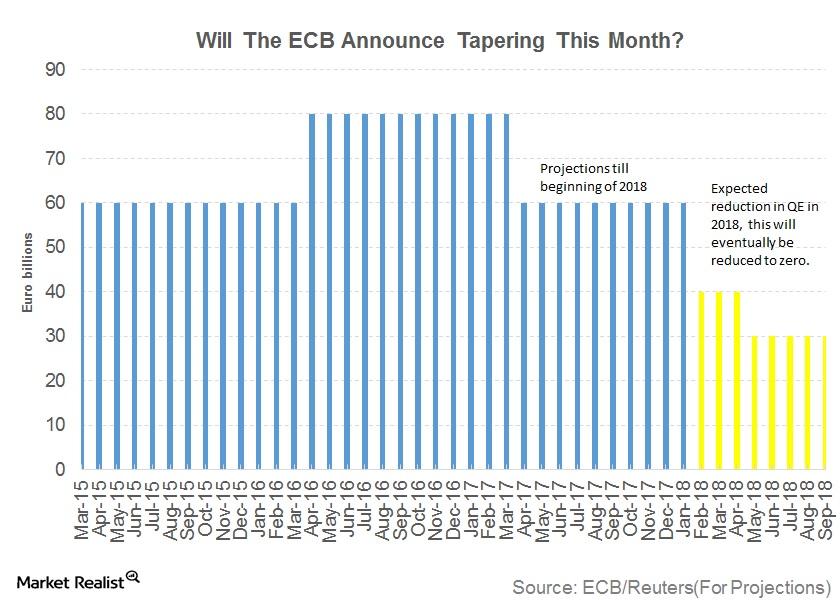

Will the ECB Surprise Markets with a Tapering Announcement?

The governing council of the European Central Bank (or ECB) is scheduled to meet on September 7 in Frankfurt, Germany. The meeting will be followed by a press conference.

Will Weak Data from the EU Derail the Euro?

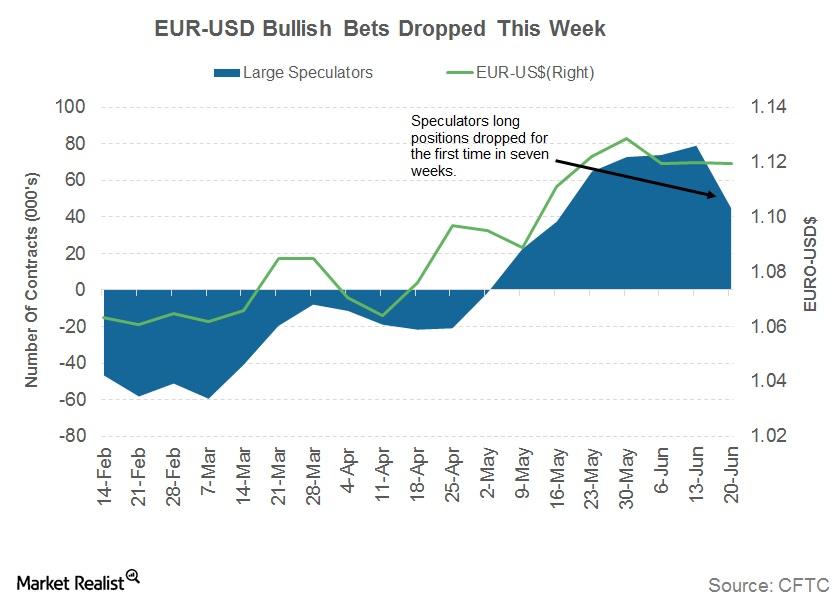

The euro (FXE) remained confined to a narrow range against the US dollar (UUP) in the previous week.

Will the US Dollar Rally?

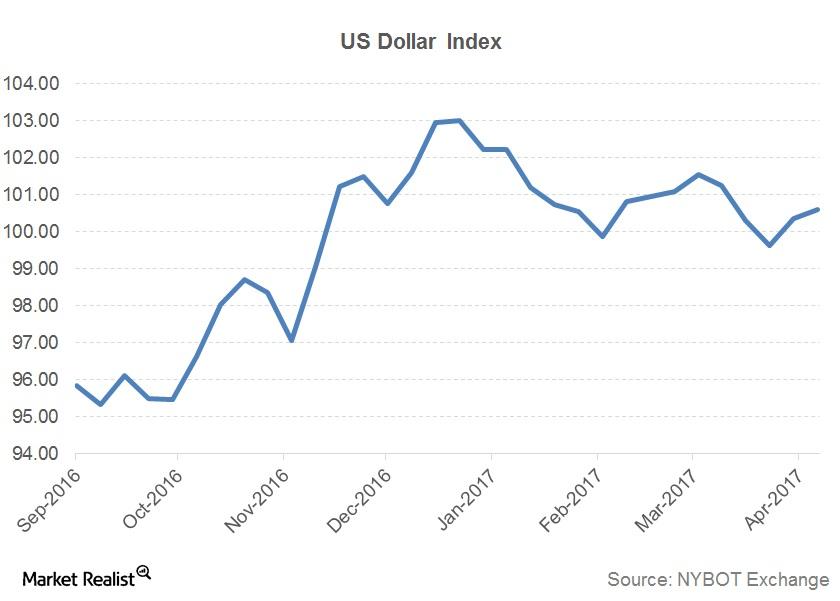

After the election results were announced in the US, the Dollar Index (UUP) surged to levels above the 103 mark in anticipation of fiscal stimulus, tax breaks, improving economic conditions, and the possibility of rate hikes.

Monetary Policy Statement: Why the ECB Kept Rates Unchanged

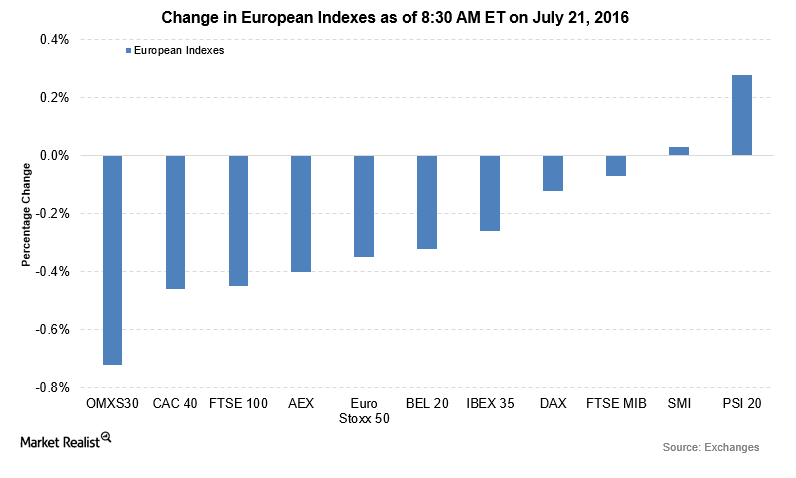

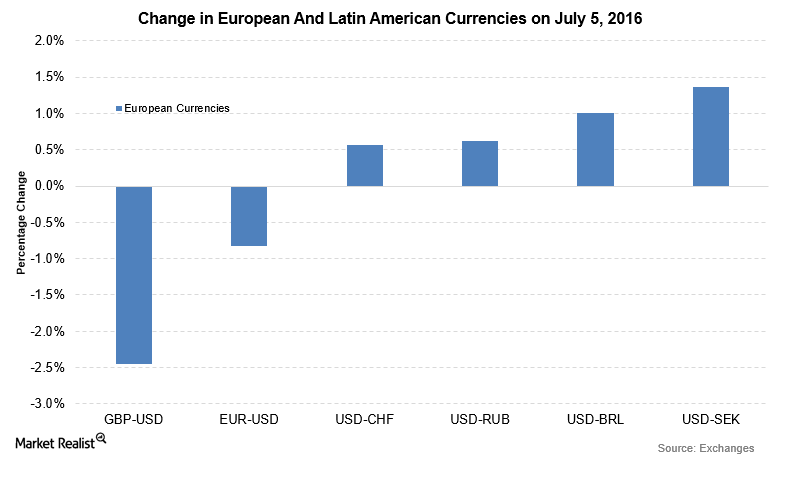

The ECB decided to keep the key rates unchanged in the monetary policy review on July 21, 2016. The pound was the major loser among the currencies.

Why Were the United Kingdom’s Growth Forecasts Slashed?

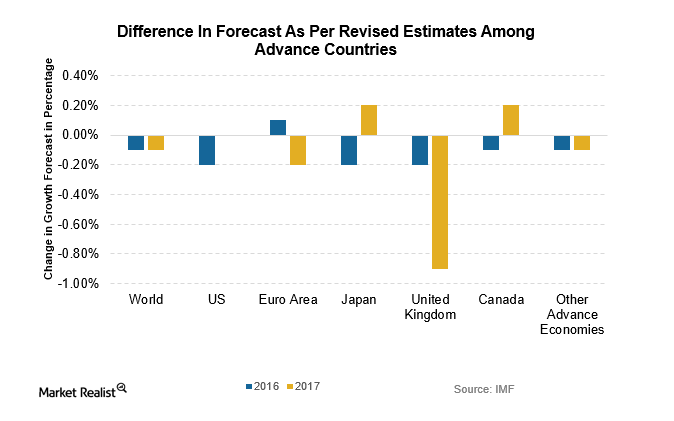

Looking at the change in growth forecasts in advanced economies, the United Kingdom suffered the largest downward revision of estimates.

Why Did the Bank of England Relax Regulatory Requirements?

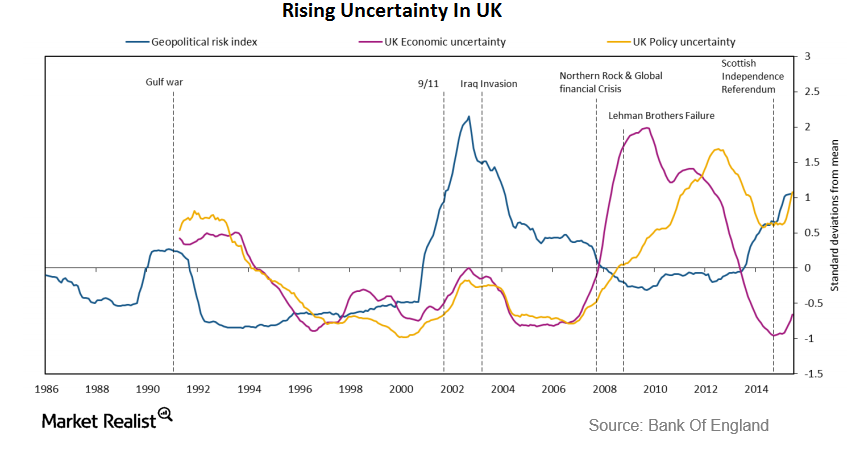

The BOE (Bank of England) released the Financial Stability Report on July 5, 2016. It warned multiple times about the repercussions of a Brexit.

Pound Falls, BOE Summer Stimulus Hopes Rise after Carney’s Speech

On June 30, BOE (Bank of England) governor, Mark Carney, gave a speech signaling the BOE’s possible actions after the Brexit referendum on June 23.

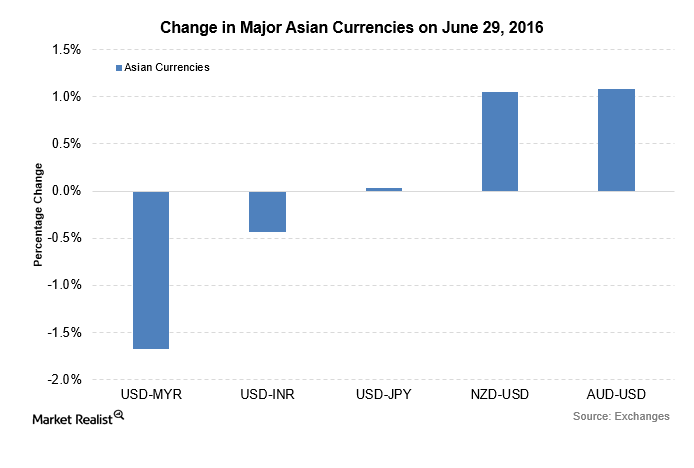

What Were the Best-Performing Currencies on June 29?

The Malaysian ringgit led the rise in Asian currencies as the US dollar-ringgit currency pair, which is inversely related to the ringgit, fell by 1.7%.