Ensco PLC

Latest Ensco PLC News and Updates

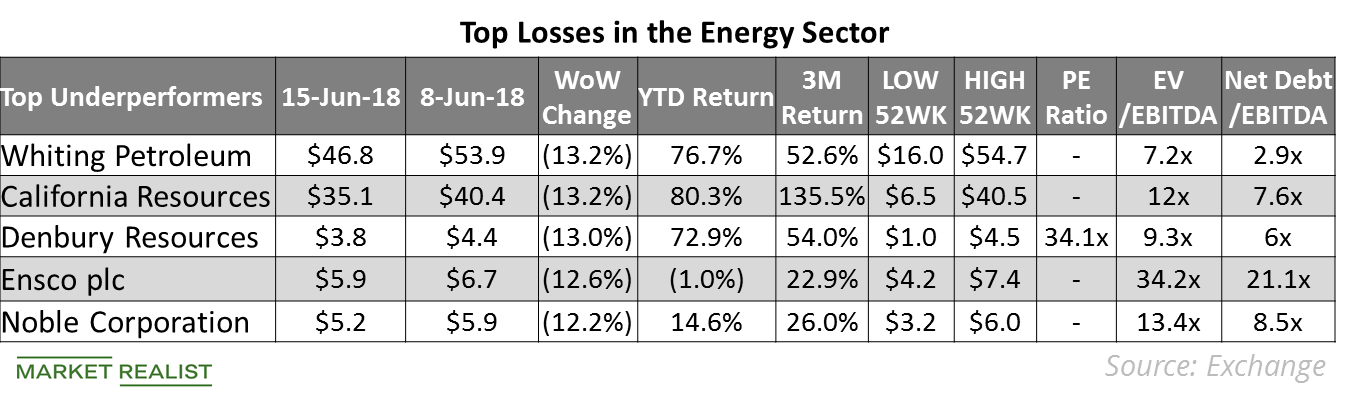

Top Energy Losses Last Week

On June 8–15, Whiting Petroleum (WLL) and California Resources (CRC) fell the most on our list of energy stocks.

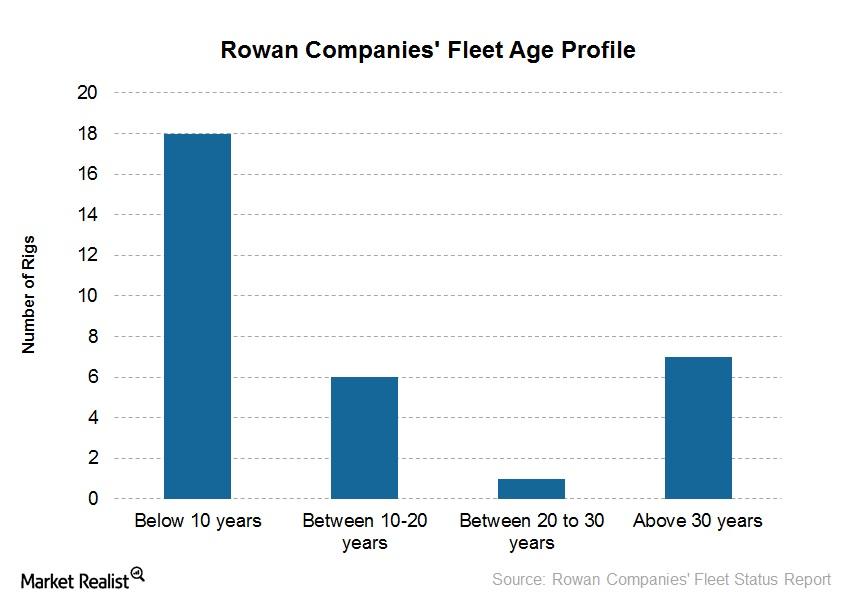

Analyzing Rowan’s Rig Scrapping and Stacking Activity in 3Q15

Offshore drilling (XLE) (IYE) is a capital-intensive industry requiring a large amount of money to keep rigs active and well-maintained.

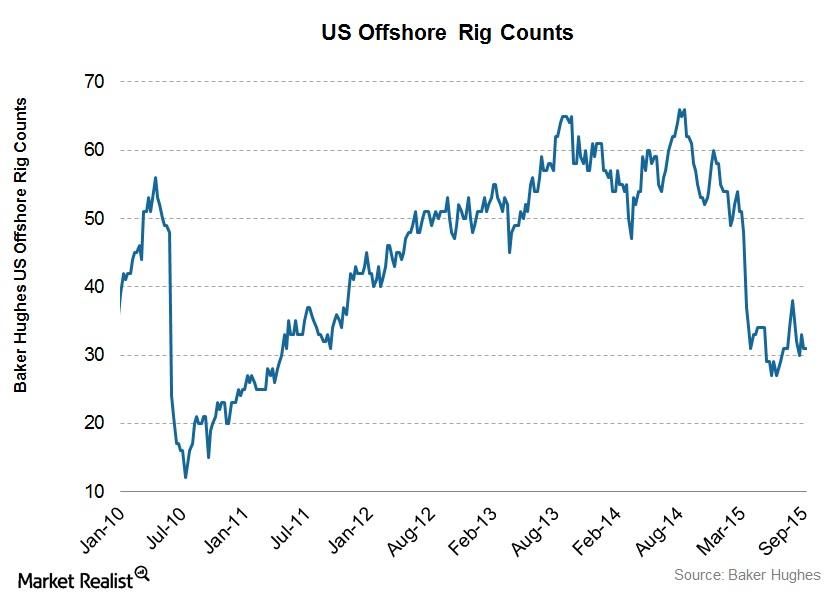

US Offshore Rig Count Was Steady in the September 18 Week

In the week ending September 18, 2015, the US offshore rig count didn’t change. The offshore rig counts have averaged 33 over the past eight weeks.

How Offshore Drilling Stocks Performed Last Week

Most offshore drilling stocks traded in the green in the week ended July 13. The best performer during the week was Noble.

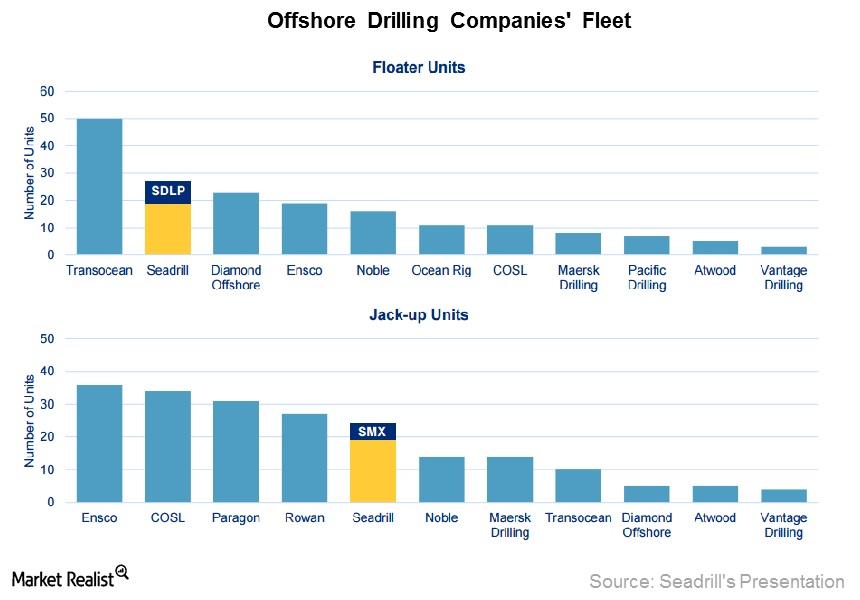

A Review of Floaters and Jack-Up Fleets for Offshore Drillers

Seadrill and Diamond Offshore have more than 20 floaters in their fleets. Ensco and Rowan Companies have more jack-ups in their fleets than peers have.

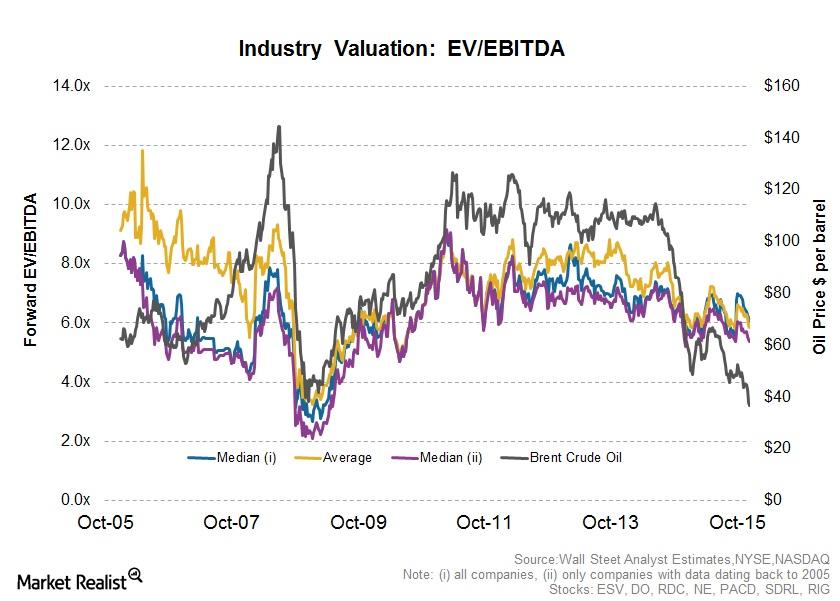

How to Interpret Valuation Multiples in the Offshore Drilling Industry

Offshore drilling companies are capital-intensive and have varying degrees of financial leverage. Thus, we use the EV-to-EBITDA multiple as a valuation.

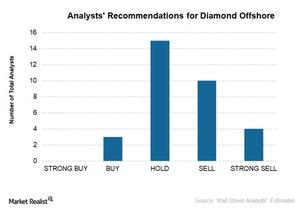

Jefferies Revises Target Prices for Diamond Offshore, Noble

Article focus In this article, we’ll discuss analysts’ target price revisions for offshore drilling companies in Week 8 of 2018 (ended February 23). Revisions in Week 8 Jefferies revised its target prices for two offshore drillers. On February 21, 2018, it reduced the target price for Transocean (RIG) to $12 from 413 and maintained a […]

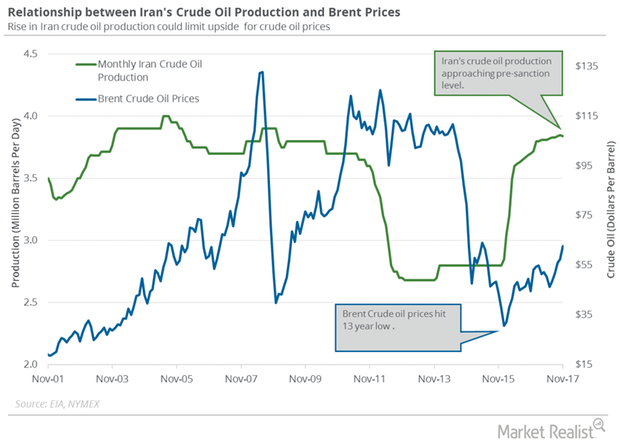

Will Crude Oil Futures and S&P 500 Move in the Same Direction?

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

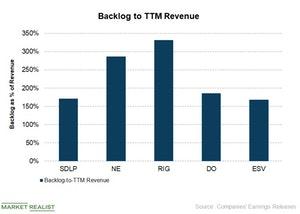

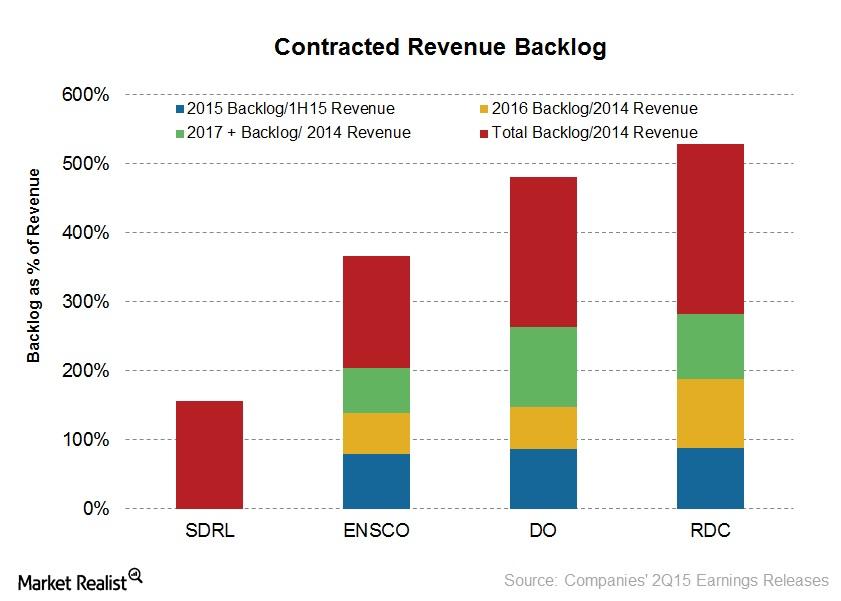

Transocean Has the Highest Backlog among Its Peers

In the last part of this series, we saw which offshore drillers had the highest and lowest falls in their backlogs. In this article, we’ll compare offshore drillers’ backlogs versus their revenues.

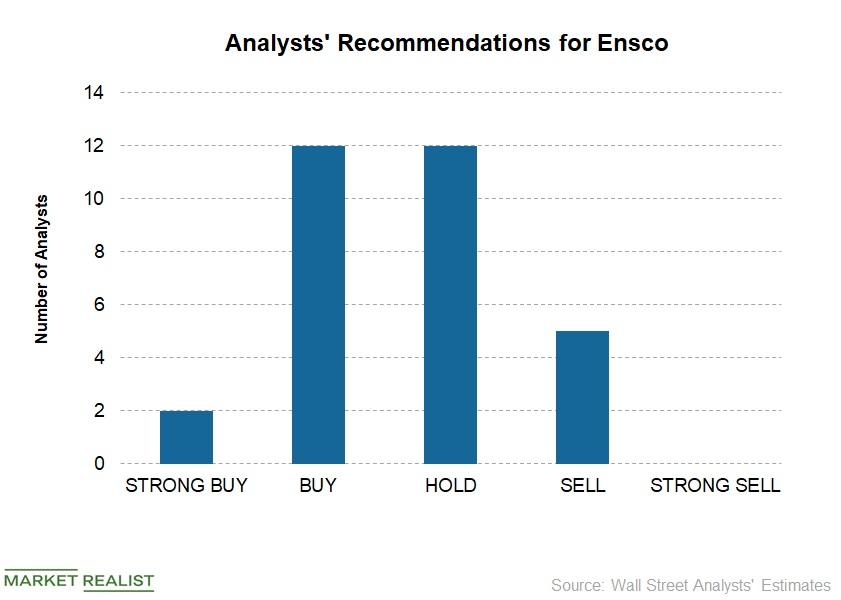

Jefferies Revises Ratings and Target Prices for Offshore Drillers

In Week 25, which ended June 22, Jefferies downgraded one offshore driller and revised the target prices for others.

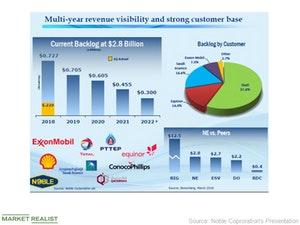

Analyzing Noble’s June Fleet Status Report

On June 7, Noble (NE) released its June fleet status report. Most of the offshore drilling companies don’t publish a monthly fleet status report.

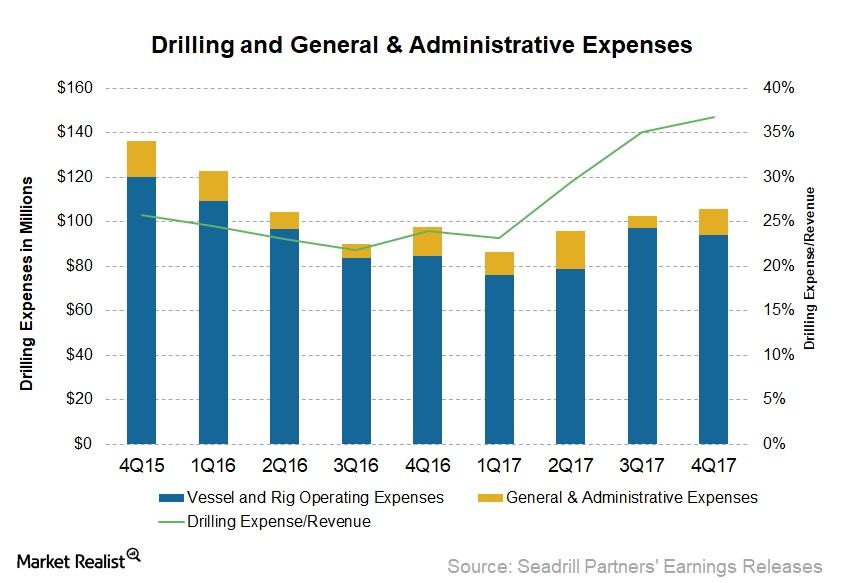

A Look at Seadrill Partners’ Cost Performance in 4Q17

Seadrill Partners’ (SDLP) vessel and rig operating expenses fell 3% to $94 million in 4Q17 compared to $96.9 million in 3Q17.

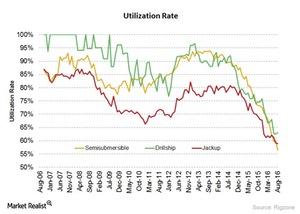

How Are Offshore Drilling Rig Utilization Rates Trending?

The rig utilization rate has drastically fallen compared to its historical rates. The utilization rate is an important indicator to gauge demand and activity in the offshore drilling industry.

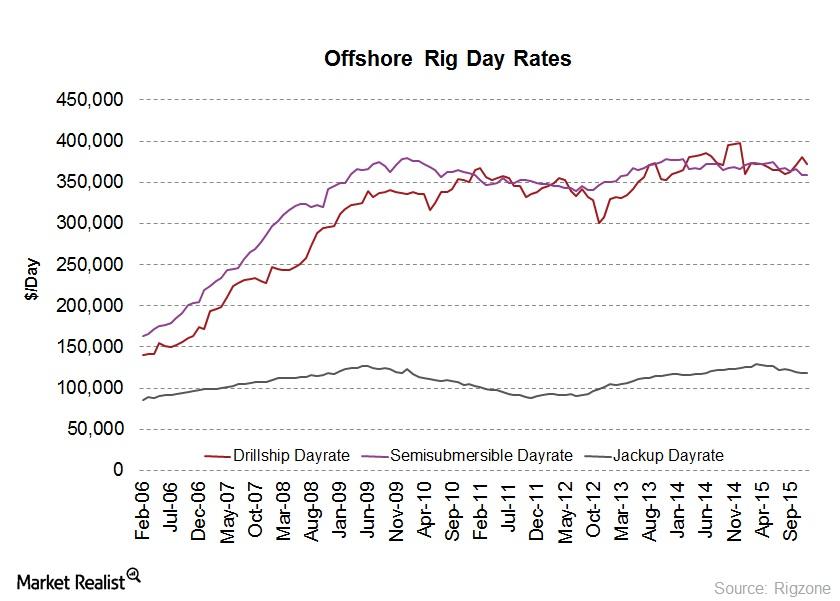

Day Rates and Lifelines of Offshore Drilling Companies

Even in the same category of rigs, different water depth capabilities cause offshore drilling day rates differ. Day rates are also impacted by region.

Rowan Companies Has Highest Backlog among its Peers

Overall, Rowan Companies (RDC) has a comparatively stronger backlog. Higher backlogs are associated with stable revenues in the short to midterm, which reduces risk for investors.

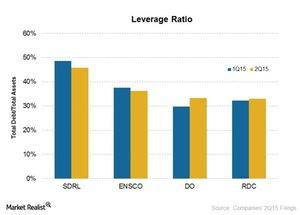

Which Offshore Driller Is the Most Leveraged?

As the above chart shows, Seadrill (SDRL) has the highest leverage, with a debt-to-asset ratio of 46%. Ensco (ESV) has the second highest ratio at 36%.

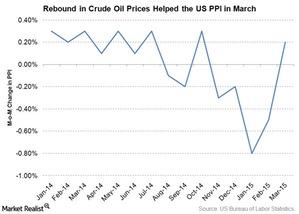

A Rebound in Crude Oil Prices Helped the PPI in March

On Tuesday, April 14, the U.S. Bureau of Labor Statistics released its PPI (Producer Price Index) figures for February. The PPI gained 0.2% in March.