Endo International PLC

Latest Endo International PLC News and Updates

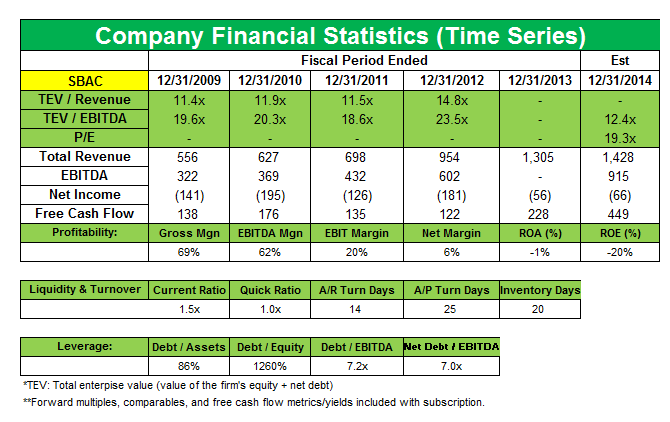

Why did Lone Pine Capital buy a stake in SBA Communications?

SBA Communications Corporation is a 2.11% position initiated by Lone Pine Capital in 4Q 2013.

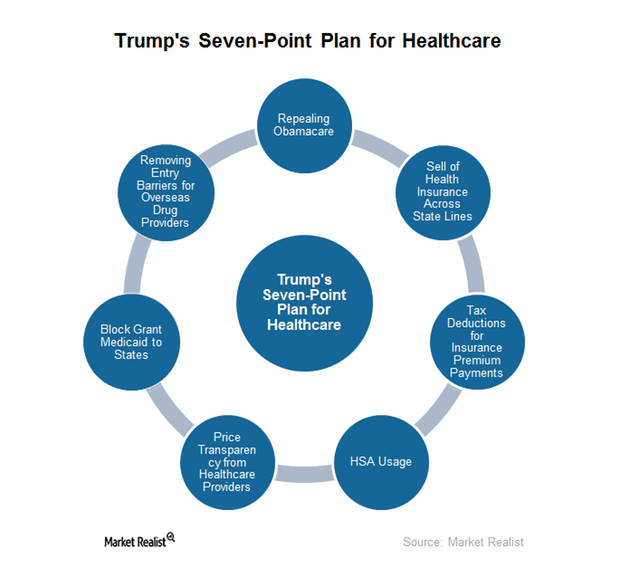

What Is Donald Trump’s Seven-Point Health Plan?

Trump’s healthcare agenda During his campaign, Trump came up with a seven-point plan for the healthcare industry. In this plan, he proposed to repeal the Affordable Care Act. Although a complete repeal doesn’t seem feasible, if applied, it would definitely take a toll on hospitals and insurance companies. In the next article, we’ll discuss the severity of […]

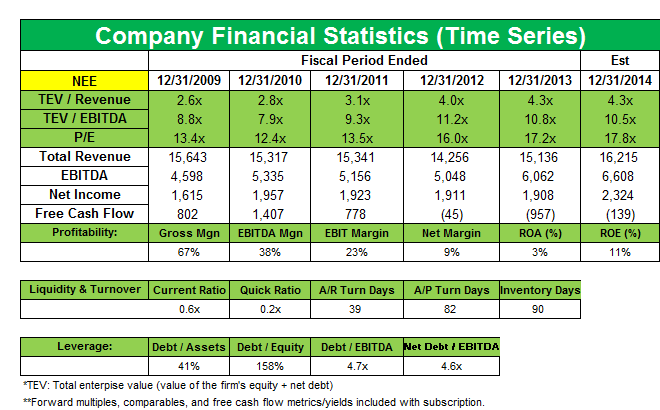

Millennium Management increases its stake in NextEra Energy

Millennium Management increased its stake in renewable energy generator NextEra Energy Inc. (NEE) from 1,789,954 shares to 3,333,627 shares.

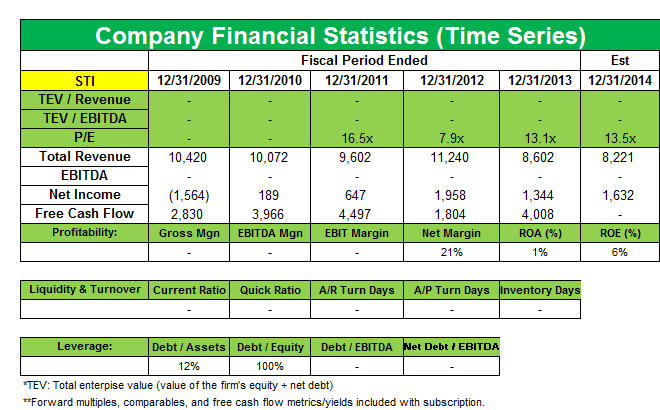

Millennium Management buys a new position in SunTrust Banks

Millennium Management started a new position in SunTrust Banks (STI) that accounts for 0.15% of the fund’s portfolio.