Capital One Financial Corp

Latest Capital One Financial Corp News and Updates

Capital One Banks Are Closing Amid a Shift to Digital Banking

Capital One Financial Corporation has closed a large number of its physical banking locations over the past two years. Why are Capital One banks closing?

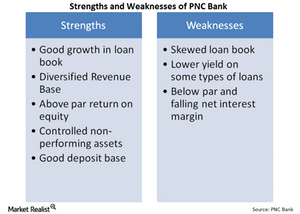

PNC Bank’s financial strengths outweigh its weaknesses

PNC Bank has done a good job at reducing its non-interest expenses, but the bank’s efficiency ratio still remains above 60%.

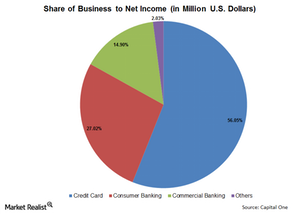

Analyzing Capital One’s business segments

Capital One (COF) can be understood best by breaking it into different business segments—Credit Card, Consumer Banking, and Commercial Banking.

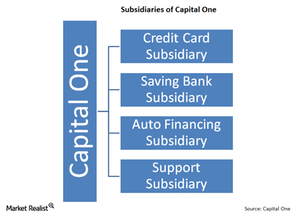

What are Capital One’s three main subsidiaries?

Capital One is organized into subsidiaries. Capital One’s principal subsidiary is a limited purpose credit card bank. It’s chartered in Virginia.

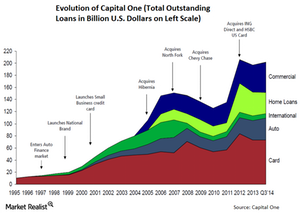

Capital One’s history: From credit cards to a diversified bank

Capital One’s history is shorter than other banks. In 1994, Signet Financial Corp. spun off its credit card business into a separate subsidiary—Capital One.

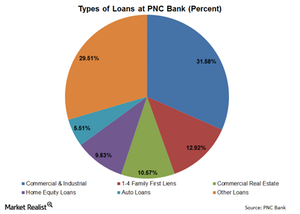

PNC Bank loan book carries some risks

PNC Bank’s loan book is skewed toward a few types of loans: commercial and industrial loans and 1–4 Family First Liens, about 44.5% of its total loans.

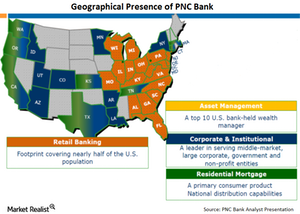

Does PNC Bank remain a strong long-term play?

With a strong presence in the East, South, and Midwest, PNC Bank offers community banking, wholesale banking, corporate banking, and asset management.