Invesco S&P Global Water Index ETF

Latest Invesco S&P Global Water Index ETF News and Updates

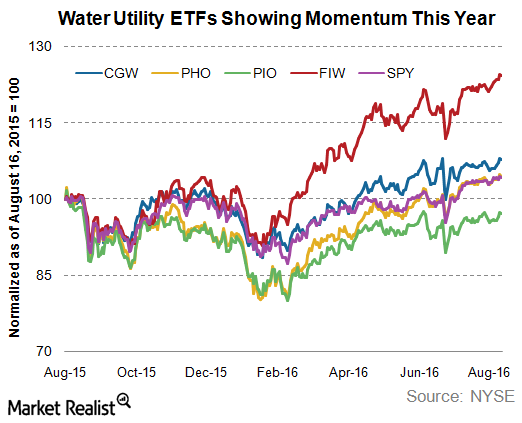

Why Do Water ETFs Yield More Than Water Utilities?

Water utility ETFs (exchange-traded funds) yield roughly 100–150 basis points more than what water utility holding companies yield.

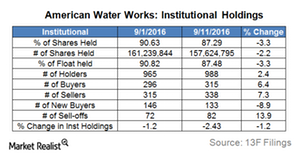

What Are Institutional Investors Doing with American Water Works Holdings?

Institutional investors have decreased their positions in American Water Works (AWK) in the past couple of months.

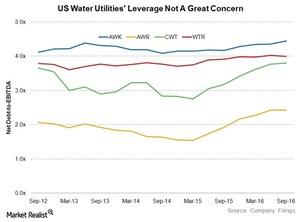

How Is American Water Works’ Leverage Compared to Peers?

Water utilities depend heavily on debt financing due to their capital projects for the longer term, and so company leverages can be useful for investors.

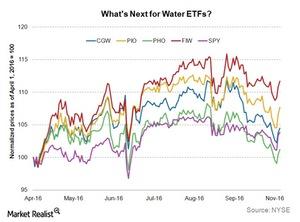

Why Are Water ETFs Yielding More than Water Utilities?

Water utility ETFs (exchange-traded funds) yield approximately 100–150 basis points more than what water utility companies yield.

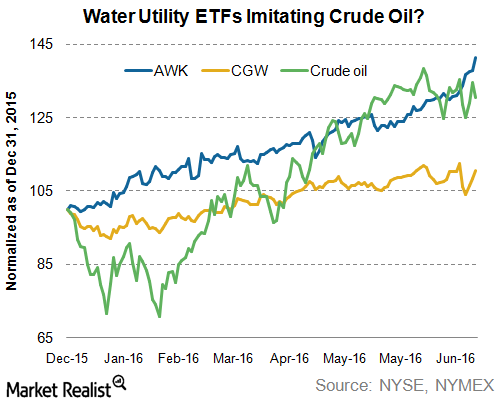

What Does the Correlation between Water Utilities and Crude Oil Mean?

Investors may find water utilities attractive due to their yields and stable earnings growth. However, they may not be as safe as they seem.

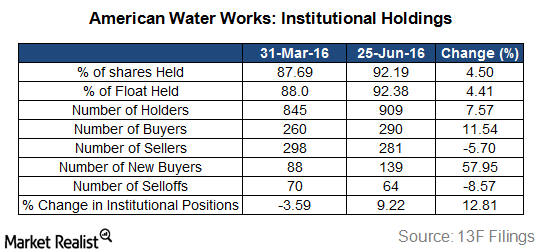

What Do Institutional Investors Think about American Water Works?

Institutional investors increased their positions in American Water Works (AWK) in 2Q16 as compared to where they stood on March 31, 2016.

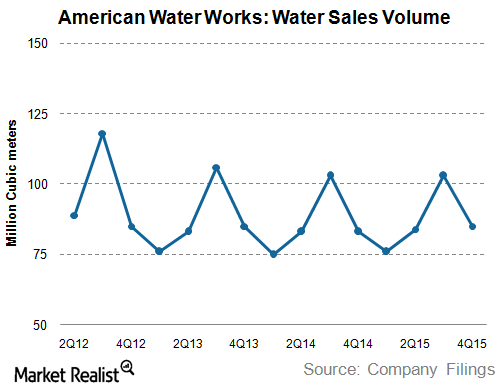

How Are American Water Works’ Sales Volumes Trending?

American Water Works (AWK) witnessed a sharp decline in its water sales volumes after 2010 despite a population increase and economic growth.

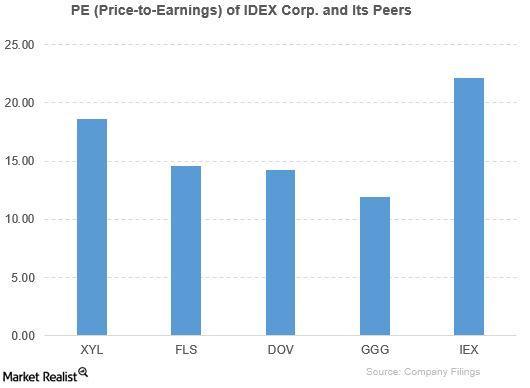

How Does IDEX Compare to Its Peers?

IDEX outperformed its peers based on the PE ratio and PBV ratio. The ETFs outperformed it based on the PE ratio. It’s ahead of its ETFs based on the PBV ratio.