Ball Corp

Latest Ball Corp News and Updates

Bank of America/Merrill Lynch Upgrades Silgan Holdings to a ‘Buy’

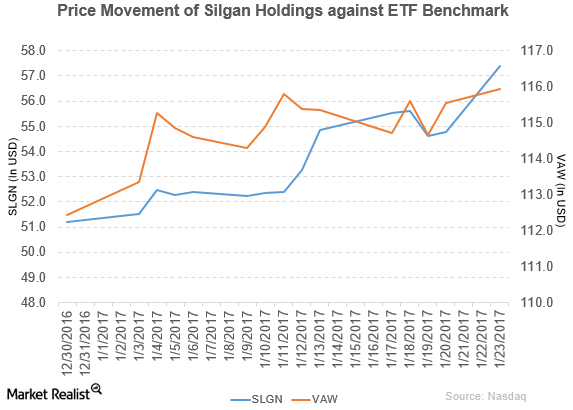

On January 23, 2017, Bank of America/Merrill Lynch upgraded Silgan Holdings’s (SLGN) rating to a “buy” from “underperform.”

Must Know: What Value Can Elliott Management Add to Alcoa?

Elliott Management noted that it plans to engage in a “constructive dialogue” with Alcoa’s (AA) board regarding Alcoa’s split transaction and “additional available opportunities to maximize shareholder value.”

What Moody’s Thinks of Silgan Holdings’ Rating

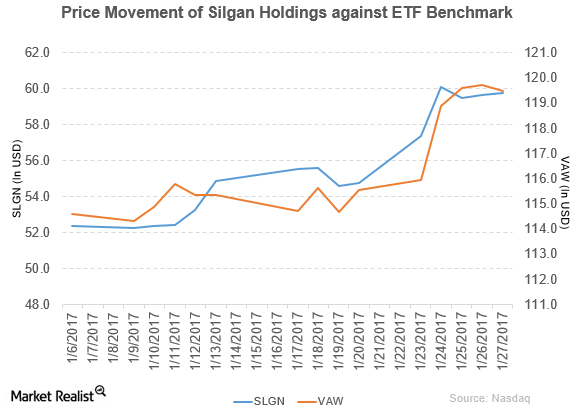

Silgan Holdings (SLGN) rose 9.1% to close at $59.77 per share during the fourth week of January 2017.

Ball Corporation Declared Dividend of $0.13 per Share

Ball Corporation declared a cash dividend of $0.13 per share on its common stock. It will be paid on March 15 to shareholders of record as of March 1, 2017.

What’s the Latest News on Ball Corporation?

Ball Corporation (BLL) reported 3Q16 net sales of $2.8 billion, a rise of 33.3% compared to net sales of $2.1 billion in 3Q15.

How Did Ball Corporation’s 3Q16 Results Turn Out?

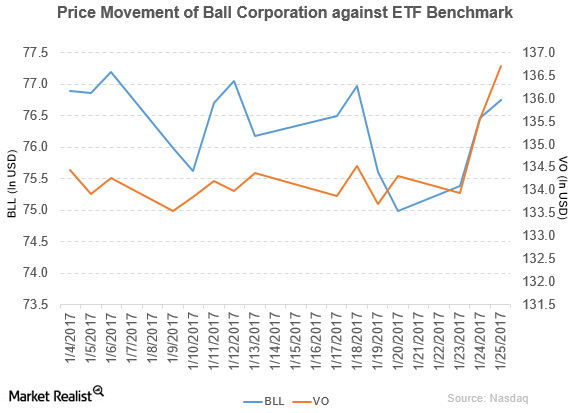

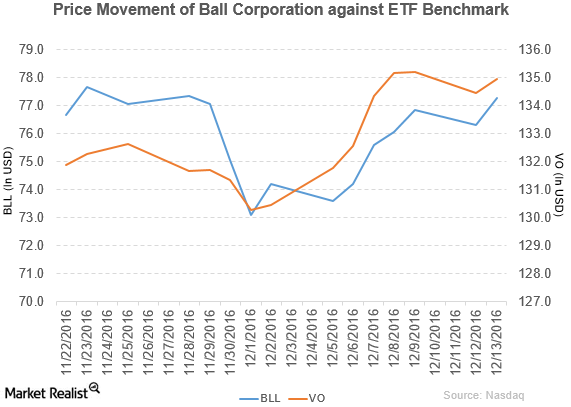

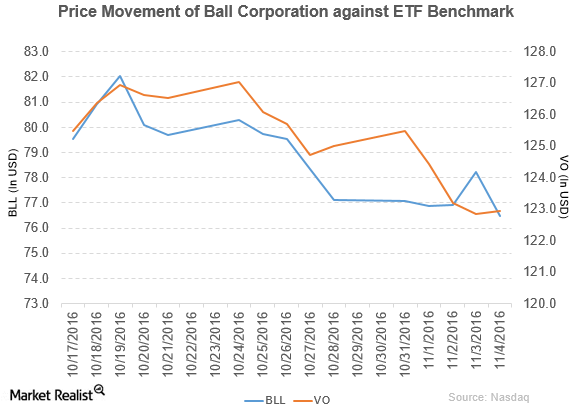

Ball Corporation (BLL) fell 0.80% to close at $76.48 per share during the first week of November 2016.

Ball Corporation Declares Dividend of $0.13 per Share

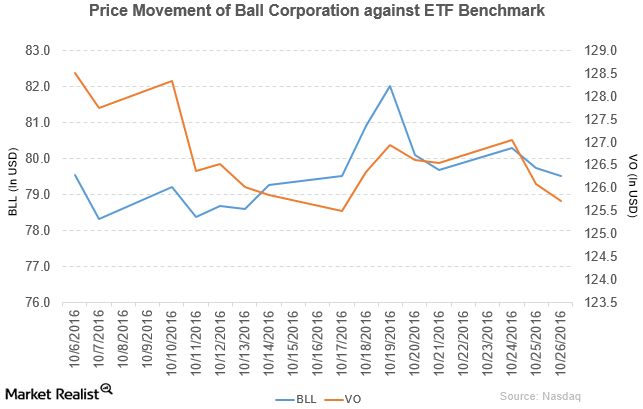

Ball Corporation (BLL) has a market cap of $13.9 billion. It fell 0.28% to close at $79.53 per share on October 26, 2016.

Ball Corporation Is Selling Its Specialty Tin Facility

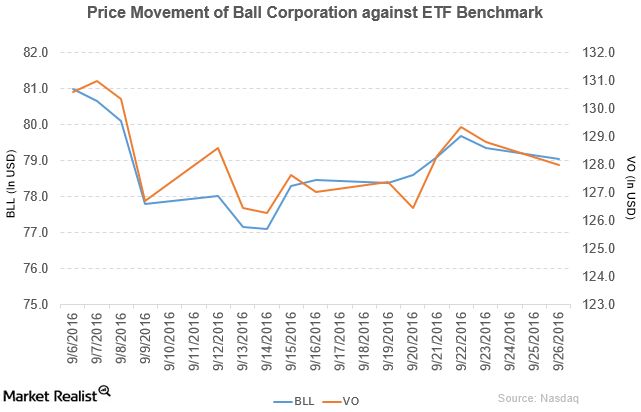

Ball Corporation (BLL) has a market cap of $13.8 billion. It fell 0.38% to close at $79.04 per share on September 26.

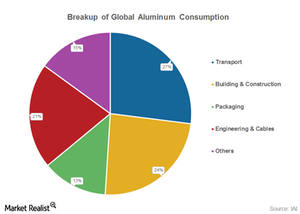

Will Aluminum Demand Grow 6% as Alcoa Is Projecting?

There are valid reasons for aluminum producers to feel upbeat about aluminum demand growth.

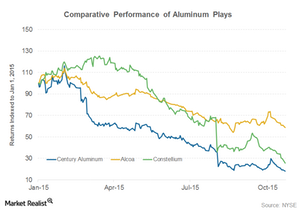

Will Century Aluminum Post a Larger-Than-Expected Loss in 3Q15?

Analysts expect Century Aluminum (CENX) to post a loss when it releases its 3Q15 results on October 29, 2015. Earnings season for the aluminum industry has started on a dull note.