AuRico Gold Inc

Latest AuRico Gold Inc News and Updates

Miscellaneous How Is the Dollar Affecting Precious Metals?

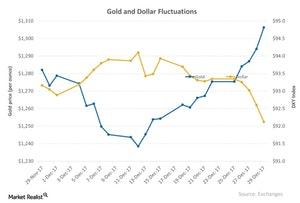

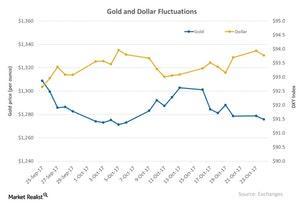

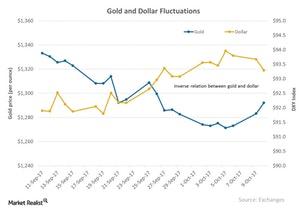

Besides ongoing geopolitical concerns, a crucial factor that gold keeps looking to for directional moves is the US dollar.

Analyzing Precious Metals: Dollar Had Its Worst Year since 2003

Although most of the upswing in precious metals has been due to the rise in geopolitical risks in 2017, the dollar has been the most crucial factor.

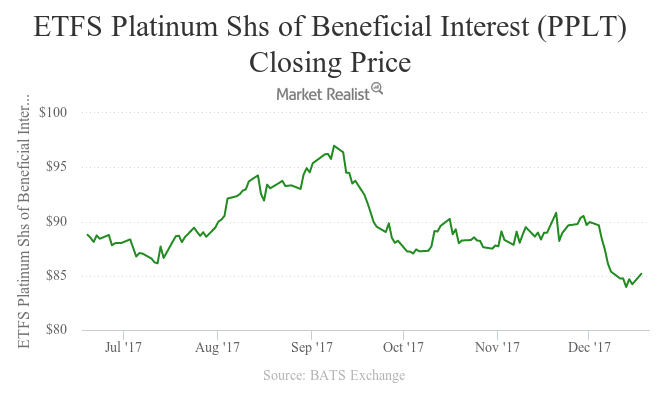

Why Platinum Led the Precious Metals Pack on December 18

All four precious metals except palladium witnessed an up day on December 18, 2017. Platinum touched the day’s high of $915.3 and ended up at $913.2 per ounce.

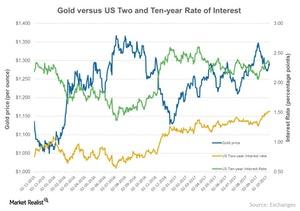

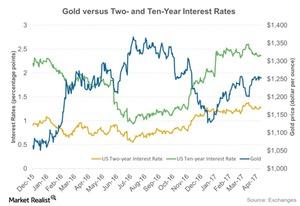

How the Federal Reserve’s Rate Hike Affected Precious Metals

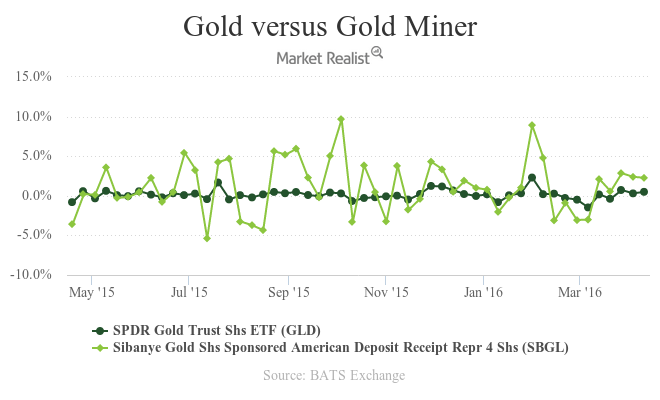

Precious metals and miners saw some relief on December 13 after the Fed raised rates as expected. Sibanye Gold (SBGL), Aurico Gold (AUQ), and Goldcorp (GG) rose 3.5%, 3.6%, and 5.8%, respectively.

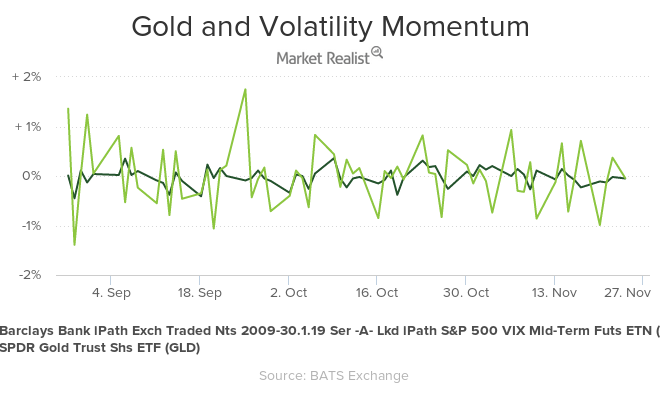

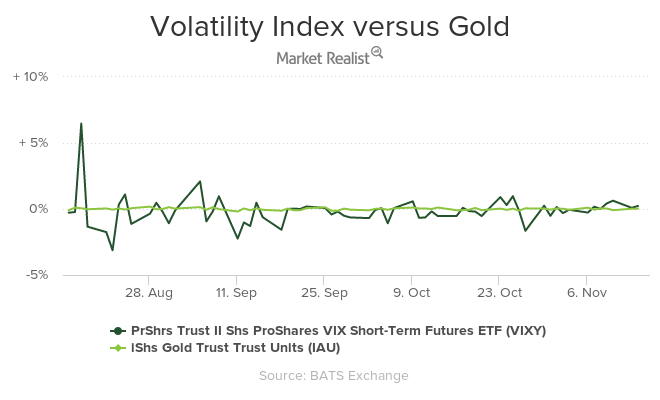

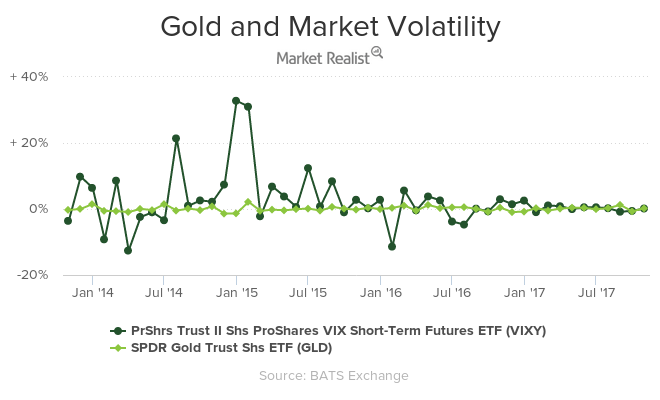

How Turbulence in the Market Has Moved Precious Metals

Often, gold, silver, platinum, and palladium react to the overall risk in the market.

An Update on the Precious Metals as November Comes to an End

The US stock markets were closed on Thursday, November 23, 2017, for Thanksgiving, and the next day (Black Friday) was quite slow for precious metals. Gold played in a narrow range that day.

Analyzing Gold’s Market Performance

Besides the impact of interest rates, there are also other global indicators that could play on precious metals—the most important being the US dollar.

Gauging Global Risk against Gold

All four precious metals rose on Monday, October 30, as multiple speculations in the market gripped investors’ attention.

These Factors Are Affecting Gold

Gold, silver, platinum, and palladium have a five-day trailing loss of 0.67%, 0.44%, 1.1%, and 1.5%, respectively.

Which Elements Impact Precious Metals?

Gold fell for the third consecutive day on October 18, 2017, as the US dollar regained strength. However, October 19 was an up day for gold and silver.

Gold and Other Precious Metals Fell on May 18

Gold futures for June expiration fell 0.47% and ended May 18 at $1,252.8 per ounce. The call implied volatility in gold rose to 11.3%.

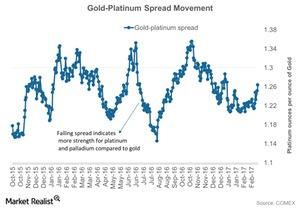

Platinum Is the Worst Performer So Far—Reading Its Spread

The gold-platinum spread was ~1.3 on April 26, 2017. The gold-platinum spread RSI on that day was 59.

Where Is the Gold-Silver Ratio Headed?

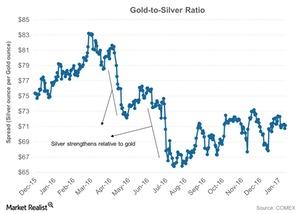

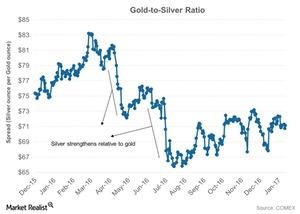

When analyzing the precious metals market, it’s important to take a look at the relationship between gold and silver.

Reading the Ups and Downs of the Gold-Silver Spread

The gold-silver spread was trading at 68.5 on February 23, 2017. The spread suggests that it took 68.5 ounces of silver to buy a single ounce of gold.

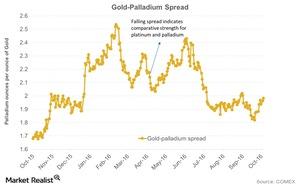

Where Is the Gold-Palladium Spread Headed?

The gold-palladium spread has seen its ups and downs over the past few months. But the United Kingdom’s Brexit vote resulted in some strength for palladium.

What’s Next for Gold Investors?

Gold gave steady returns to investors for the first two months of 2016 as unrest and instability continued in the markets. However, March started with some ups as well as downs for gold.

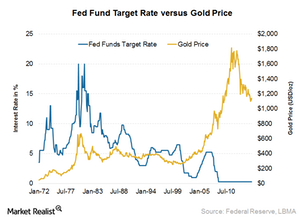

How the Fed Interest Rate Hike Is Expected to Affect Gold Prices

The Fed rate hike has been a major driver for gold prices since mid-2015. Higher interest rates usually diminish gold’s appeal due to its non–interest yielding nature.