Arrowhead Pharmaceuticals Inc.

Latest Arrowhead Pharmaceuticals Inc. News and Updates

How Analysts View Arrowhead Pharmaceuticals

In Q2, Arrowhead Pharmaceuticals reported revenues of $48.15 million—a YoY rise of 7,305.95%—ahead of the consensus estimate by $5.19 million.

What Led to Arrowhead Pharmaceuticals’ Revenue Surge in 2017?

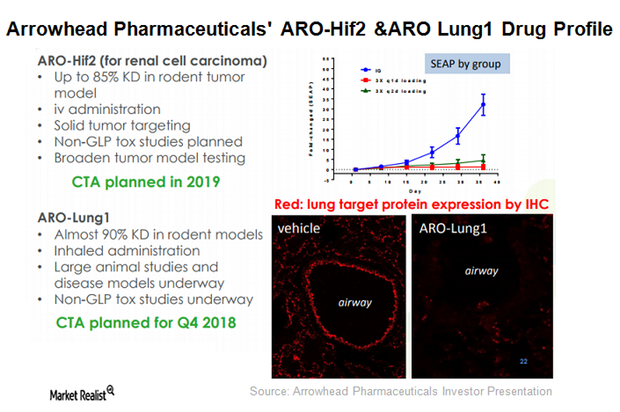

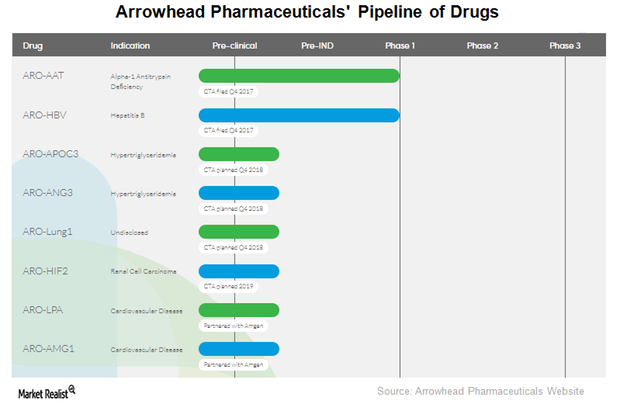

Arrowhead Pharmaceuticals’ therapeutic candidate ARO-LUNG1 is being developed for an undisclosed disease of the lung. This is the first candidate to utilize the company’s TRiM platform.

Arrowhead’s Candidates for Hepatitis B, Cardiovascular Diseases

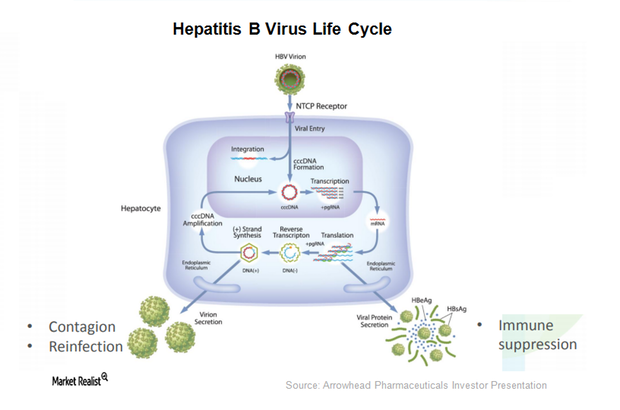

ARO-HBV is Arrowhead Pharmaceuticals’ (ARWR) investigational drug candidate for treating chronic hepatitis B infection.

Taking a Closer Look at Arrowhead Pharmaceuticals’ TRIM Platform

Arrowhead Pharmaceuticals’ (ARWR) prior efforts were aimed at clinical programs that utilized the dynamic polyconjugate (or DPC), also called the EX1 delivery vehicle.