Align Technology Inc

Latest Align Technology Inc News and Updates

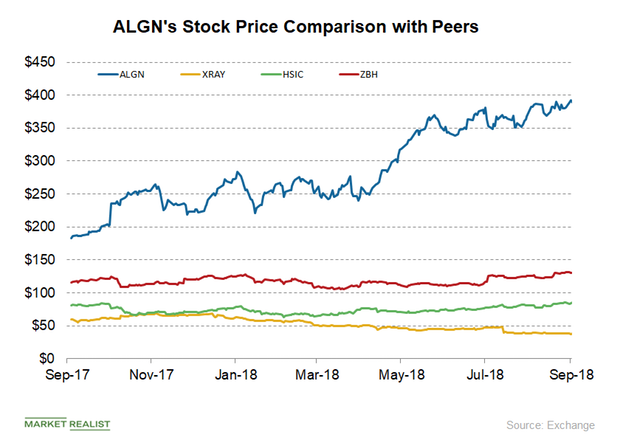

Align Technology Traded at Its 52-Week High in September

Align Technology was trading at its 52-week high of $398.88 on September 25. The stock reported its 52-week low of $180.31 on September 28, 2017.

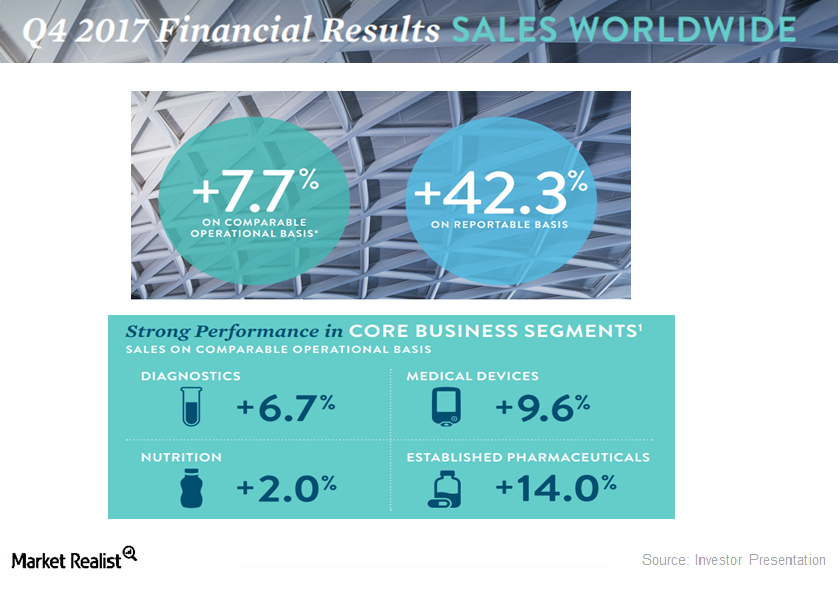

Understanding Dentsply Sirona’s New Organizational Structure

In 4Q17, Dentsply Sirona (XRAY) started reporting its operations under two segments, after a shift to three segments in fiscal 3Q17.

Align Technology to Execute on Key Strategic Priorities in 2018

Align Technology (ALGN) has been growing at a fast pace while it executes its strategic priorities around the world.

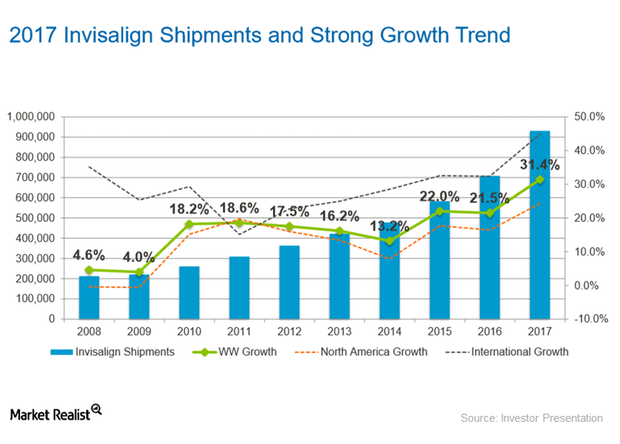

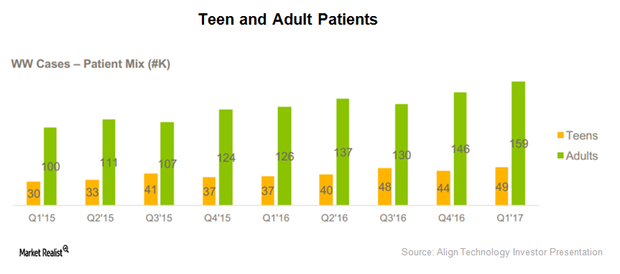

Align Technology’s Invisalign: Average Selling Price and Volumes

Increases in Align Technology’s (ALGN) Invisalign volumes and ASP were the major factors driving the company’s sales growth.

Inside Abbott Laboratories’ 4Q17 Earnings Results: Key Highlights

Abbott Laboratories (ABT) reported sales of $7.6 billion and adjusted diluted EPS (earnings per share) of $0.74 for fiscal 4Q17.

Align Technology’s Customer Acquisition Strategy Driving Market Growth

In 3Q17, Align Technology trained nearly 1,000 doctors in China.

Align Technology’s Growth Prospects amid Increasing Competition

The Chinese market is Align Technology’s major growth driver. However, the company is starting to witness strong competition from startups focused on the clear aligners market.

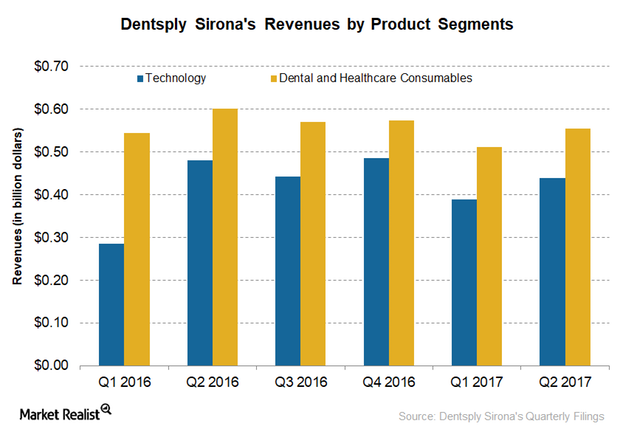

Dental and Healthcare Consumables Grew but Missed Expectations in 2Q17

In 2Q17, Dentsply Sirona’s (XRAY) Dental and Healthcare Consumables business contributed ~56% to the company’s total revenues and registered sales of ~$554 million.

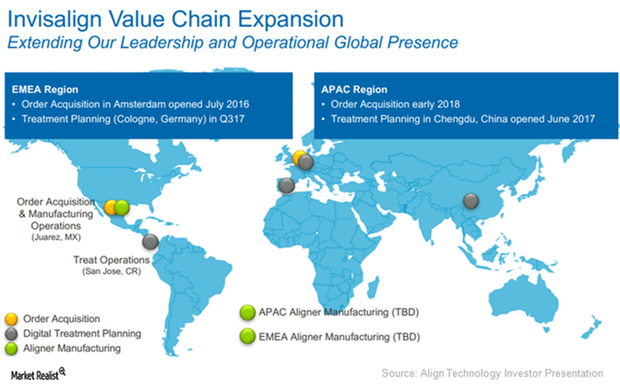

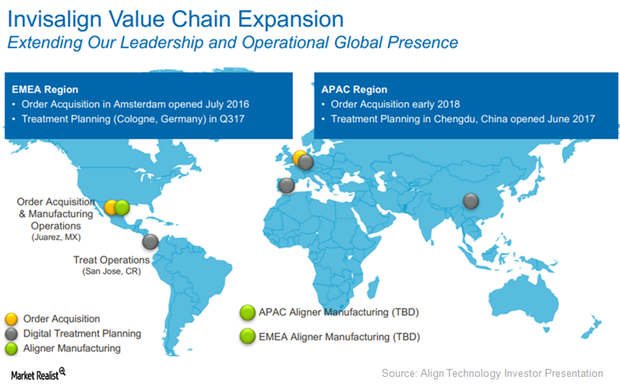

Align Technology Focuses on International Market Strategy

International market strategy In 2Q17, Align Technology (ALGN) reported 85,400 Invisalign case shipments in international markets, which is YoY (year-over-year) growth of ~37.4% and sequential growth of ~13.6%. This growth was mainly attributed to new customers in the EMEA (Europe, the Middle East, and Africa) and Asia-Pacific markets. If Align Technology continues to demonstrate solid […]

Inside Align Technology’s Market Expansion Strategy

In 1Q17, Align Technology (ALGN) also witnessed a robust rise of around 45.2% in volumes of Invisalign sold in Asia-Pacific markets on a YoY basis.

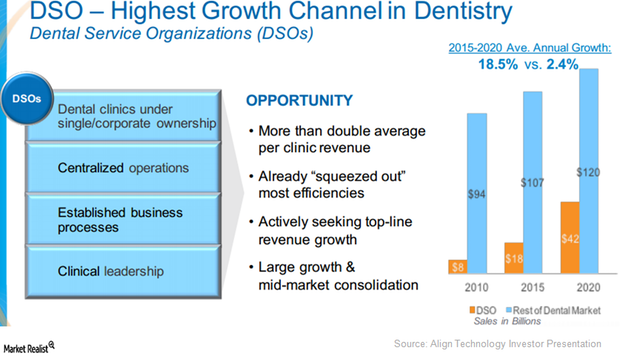

These Are Align Technologies Key Demand Drivers in North America

In 1Q17, Align Technology (ALGN) has started selling its new product Invisalign Go in North America, which involves a few DSOs (dental service organizations).

Behind Align Technology’s North American Expectations for 2017

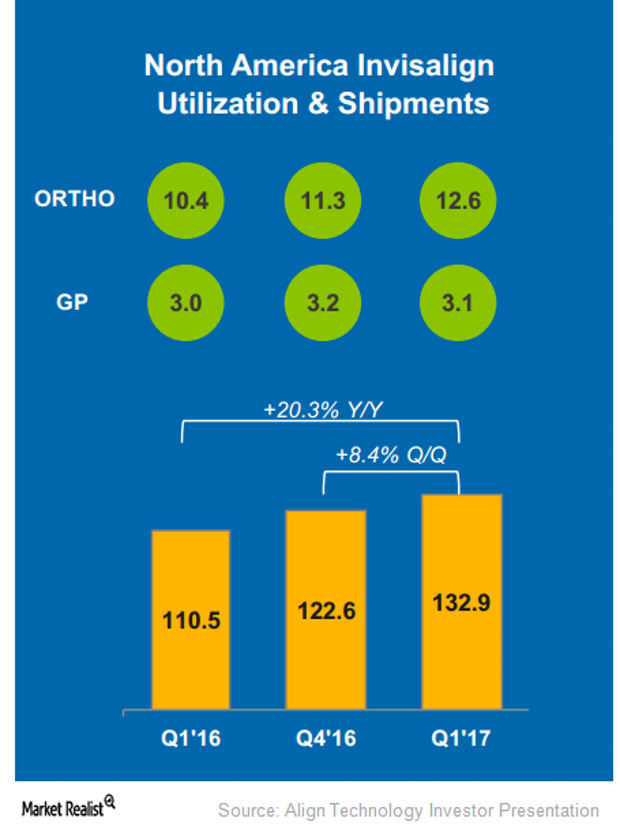

In 1Q17, Align Technology’s (ALGN) Invisalign sales volumes in North American markets rose YoY by 20.3% and QoQ by 8.3%.

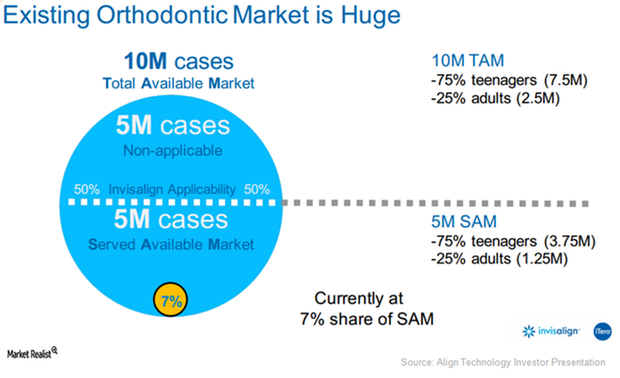

Why Align Technology’s Orthodontics Is a Solid Growth Opportunity in 2017

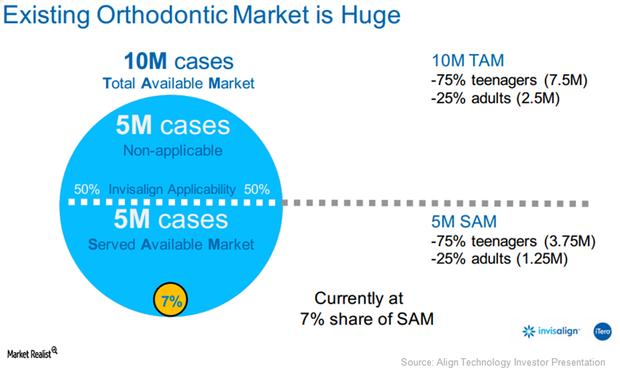

Align Technology (ALGN) is a medical device provider focused on malocclusion or teeth misalignment condition.

Inside Align Technology’s Robust Revenue Growth Projection for 2017

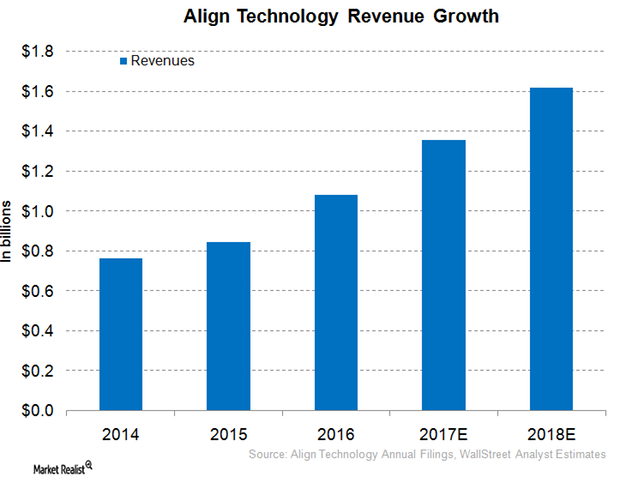

For fiscal 2017, Align Technology (ALGN) expects its 2017 revenues to grow operationally in the range of 15%–25% YoY.

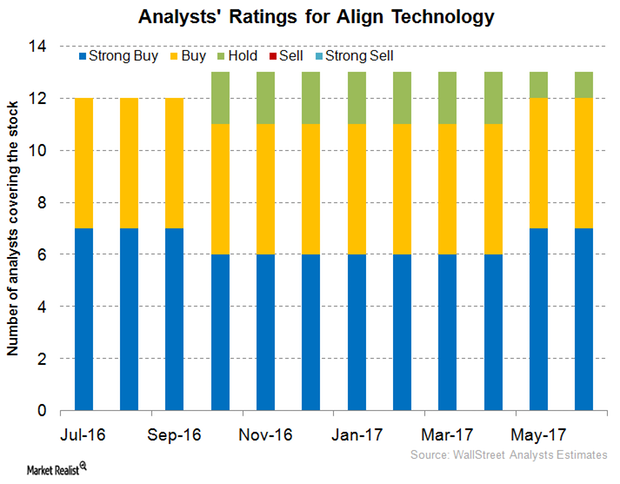

Align Technology versus Peers in June 2017: Analyst Recommendations

For 1Q17, Align Technology (ALGN) reported revenues close to $310.3 million, which represents YoY (year-over-year) growth of around 30.0%.

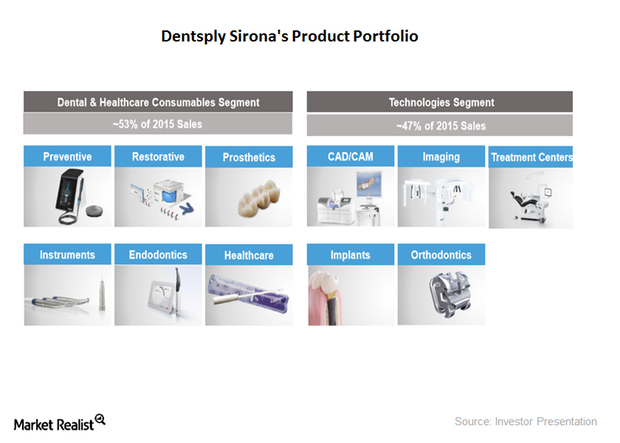

A Brief Look at Dentsply Sirona’s Business Model

Dentsply Sirona (XRAY) offers a broad portfolio of dental equipment and consumables that have urological and surgical applications.

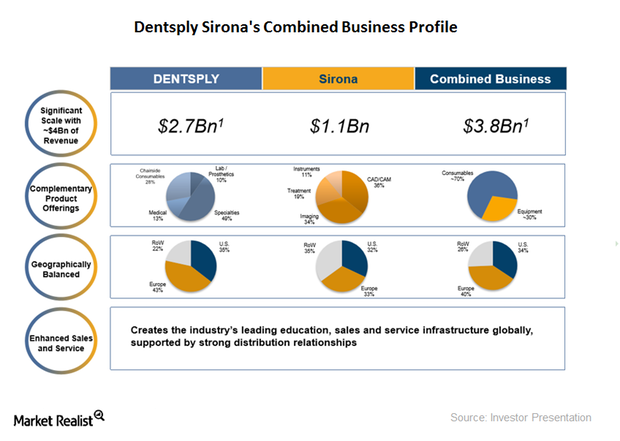

Introducing Dentsply Sirona, a Leading Dental Products Manufacturer

Dentsply Sirona (XRAY) is the largest manufacturer of dental equipment and technologies in the world. The company was formed in February 2016.