Advance Auto Parts Inc

Latest Advance Auto Parts Inc News and Updates

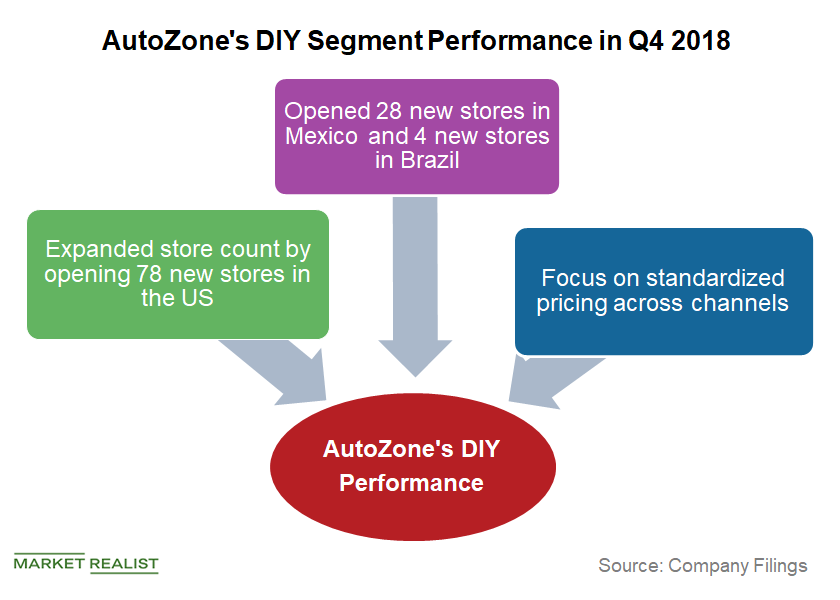

How AutoZone’s DIY Segment Performed in Fiscal Q4 2018

In the second half of fiscal 2018, AutoZone’s management decided to discontinue aggressive promotional discounts for its ship-to-home sales.

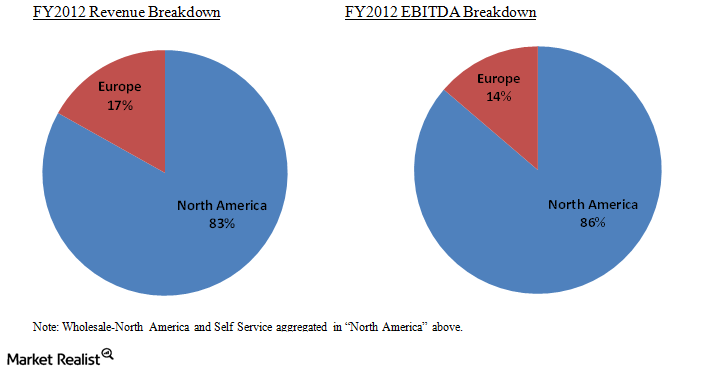

An investor’s must-know guide to LKQ’s 3 operating segments

LKQ is the nation’s largest provider of alternative vehicle collision replacement products and a leading provider of alternative vehicle mechanical replacement products.

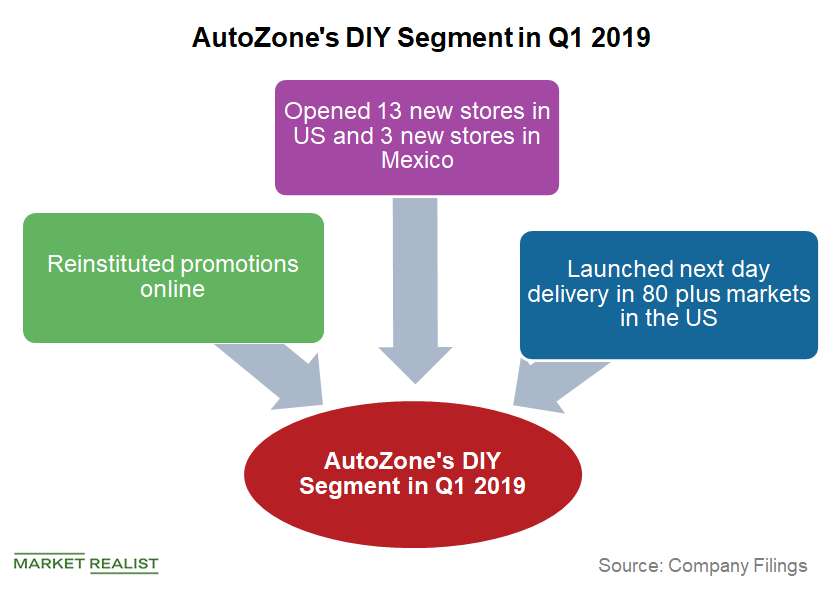

Did AutoZone Resume Its Promotional Strategy in Q1 2019?

AutoZone’s performance is mainly divided into two business segments: DIY (do it yourself), or Retail, and DIFM (do it for me), or Commercial.

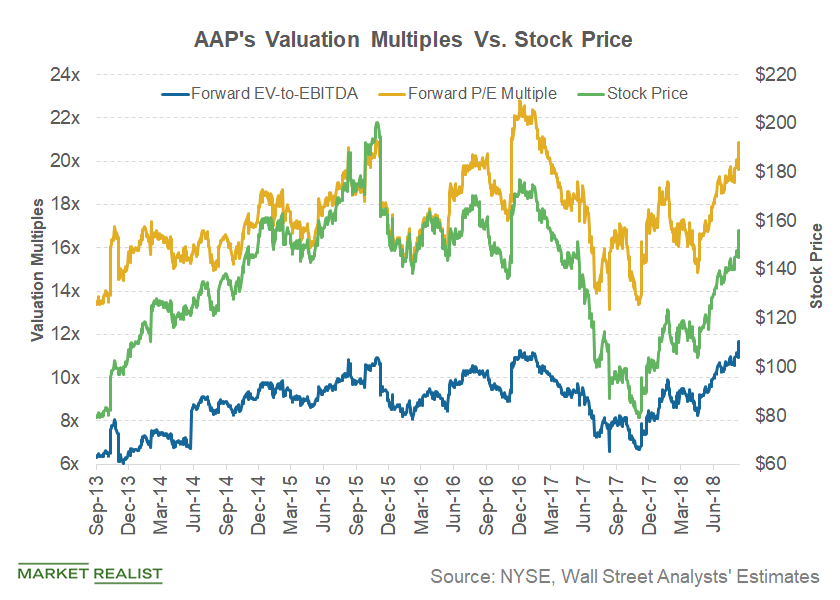

Advance Auto Parts’ Valuation Multiples in Q3 2018

As of August 14, Advance Auto Parts’ forward EV-to-EBITDA multiple was 10.8x. Currently, Advance Auto Parts’ forward PE multiple is 20.8x.

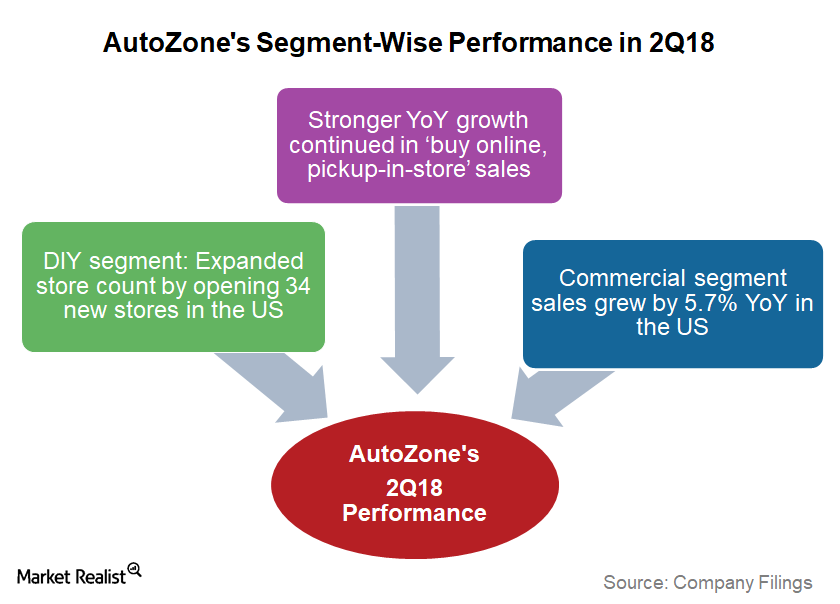

Analyzing AutoZone’s Segment-Wise Performance in 2Q18

AutoZone’s business segments AutoZone’s (AZO) results are divided into two business segments: the DIY (Do-it-yourself) segment and the Commercial or DIFM (Do-it-for-me) segment. The DIY segment, which targets retail customers, yields wider margins than DIFM. Let’s take a look how these business segments performed in 2Q18 and AutoZone’s other key growth priorities. DIY segment in 2Q18 AutoZone’s […]

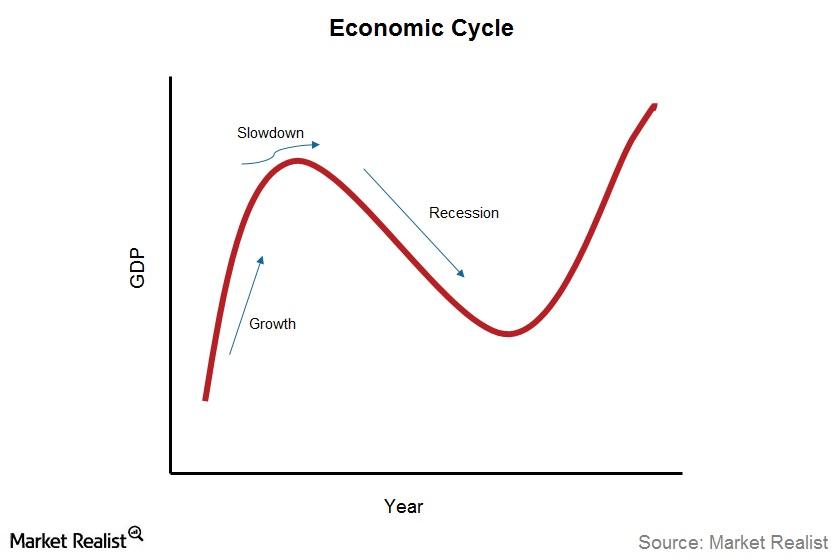

How an Economic Cycle Can Impact Mutual Funds

All that goes up must come down. And this applies to economic cycles as well. No boom lasts forever, and all economies experience a slowdown.