Semiconductor Stocks to Buy Now as Senate Passes CHIPS Act

The U.S. Senate has passed the CHIPS and Science Act and it will now head to the House. What are the best semiconductor stocks to buy now?

July 28 2022, Published 8:18 a.m. ET

The U.S. Senate has passed the CHIPS and Science Act and it will now head to the House where it's widely expected to pass. The CHIPS Act proposes $52 billion for incentivizing semiconductor manufacturing and research in the country. What are the best semiconductor stocks to buy now?

The CHIPS and Science Act, also known as CHIPS-Plus Act, is a toned-down version of the original CHIPS Act, which proposed even higher spending. Amid soaring inflation and a high fiscal deficit, several lawmakers, including Joe Manchin, have been against excessive spending.

The U.S. needs the CHIPS-Plus Act.

There's little denying that the U.S. needs the CHIPS-Plus Act. The country’s share in global chip manufacturing has fallen over the years as semiconductor manufacturing moved to Asia, especially China and Taiwan.

The COVID-19 pandemic and the resultant supply chain woes exposed vulnerabilities in the U.S. manufacturing supply chain and the overreliance on imports of critical components. U.S. automotive production still hasn’t recovered from the chip shortage situation and General Motors wasn't able to ship thousands of cars in the first half of the year due to the chip shortage.

Th semiconductor shortage is adding to inflation.

Semiconductor prices also increased amid the shortage, which led to cost-push inflation for many companies and eventually higher prices for U.S. consumers. Since the production of new cars has fallen, the demand and prices of used cars have spiked. Higher car prices have also played a part in multi-decade high U.S. inflation.

These are the best semiconductor stocks to buy in 2022.

Semiconductor stocks have fallen in 2022. Along with the macro sell-off, concerns about a short-term oversupply of chips that go in smartphones and PCs are hurting sentiments. There are also concerns about a structural chip oversupply because other countries are also looking to encourage domestic semiconductor manufacturing. The following chip stocks look good buys for long-term investors.

- Intel (NYSE: INTC)

- Micron (NYSE: MU)

- Nvidia (NYSE: NVDA)

Intel is expected to be among the major beneficiaries of the CHIPS-Plus Act.

Intel is expected to be among the biggest beneficiaries of the CHIPS-Plus Act. The company has also entered into contract manufacturing and recently entered into an agreement to supply chips for Taiwan’s MediaTek.

The entry into contract manufacturing is part of its IDM 2.0 strategy under its CEO Pat Gelsinger. Intel stock has lost over a fifth of its market cap in 2022 and now trades at an NTM (next-12 month) PE multiple of 12.4x. It also has an attractive dividend yield of 3.6 percent.

Micron is among the cheapest semiconductor stocks.

With an NTM PE multiple of around 10x, Micron is among the cheapest semiconductor stocks. The stock has lost over a third of its market cap in 2022 and is underperforming the markets by a wide margin.

During its fiscal third quarter 2022 earnings, Micron provided tepid guidance for the fiscal fourth quarter and also forecast a fall in global PC and smartphone sales. The company also said that it's adjusting production amid slowing demand. However, given its relative undervaluation, Micron is one of the best semiconductor stocks to buy in 2022.

Nvidia is an attractive semiconductor stock for growth investors.

Nvidia stock is down almost 40 percent in 2022 and is underperforming other semiconductor stocks. Nvidia is a growth company and has been under pressure amid pessimism toward growth stocks. However, for long-term investors, Nvidia is an attractive semiconductor stock after the crash.

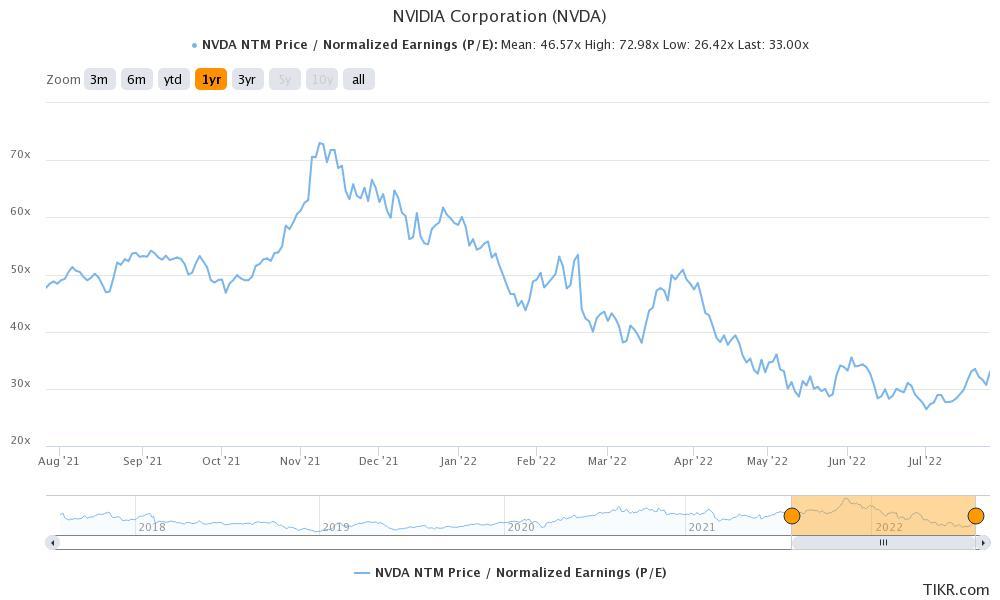

Nvidia’s valuations look reasonable and it trades at an NTM PE multiple of 33x. While the multiple might look high given the valuations of other semiconductor stocks, it's lower than what the stock has traded over the last three years.

Overall, Nvidia isn't just a semiconductor company but a play on multiple growth themes including gaming and metaverse. The stock has created tremendous investor wealth over the last decade and could turn out to be a winner again once market sentiments improve.