How to Take Advantage of a Recession by Planning Ahead

With many economists calling for a U.S. recession in 2022, can you take advantage of the next recession? Here's how to plan ahead.

Aug. 5 2022, Published 8:37 a.m. ET

An increasing number of Americans have been getting worried about a recession. While the U.S. economy isn't in a recession, going by the country’s official definition, it did contract in the first two quarters of 2022. The U.S. Federal Reserve has been downplaying recession risks despite ample signs to the contrary. With many economists calling for a U.S. recession in 2022, can you take advantage of a recession?

First, we should understand that while recessions have negative connotations for a lot of people, they are normal. The most recent U.S. recession was in 2020, which ended the historic 11-year expansion.

What happens in a recession?

To understand how to take advantage of a recession, you need to understand what happens in a recession. Usually, we see job losses, a lot of small businesses shut down, and prices for many discretionary products and services come down. Also, housing prices tend to be lower in a recession, even though in the past there have been cases where housing prices rose in a recession.

You can prepare for a recession — here's how.

You can take advantage of a recession if you're prepared for one. It isn't rocket science and you only need to follow some simple personal finance principles. First, you should save a minimum of six months’ worth of expenses in a liquid low-risk instrument. This would provide you with a cushion in case of a sudden recession or job loss.

Second, you should have a diversified portfolio spread across different asset classes. The proportion can be decided based on your risk appetite. Also, it's important to not let your credit card outstanding bloat and maintain a good credit score. The simple rule of finance is to spend less than what you earn and save the remaining.

Individuals can take advantage of a recession.

If you are prepared for a recession then you will be able to take advantage of it. As stocks fall during a recession, you can either invest fresh funds into quality stocks or shift some of the money from other asset classes into debt.

Asset allocation, both tactical and strategic, is the most important but often overlooked part of investment management. A lot of quality stocks plunge during a recession but eventually bounce back. If you have idle funds, you can buy some of the quality stocks at a bargain during a recession.

Since housing prices can come down in a recession, you can buy the house that you always wanted during a recession. Given the overheated U.S. housing market, the possibility of home prices coming down during the next recession looks high.

You might also be able to buy clothes as well as gadgets and cars at a discount during the recession. It would be prudent to look out for fire sales around you during a recession.

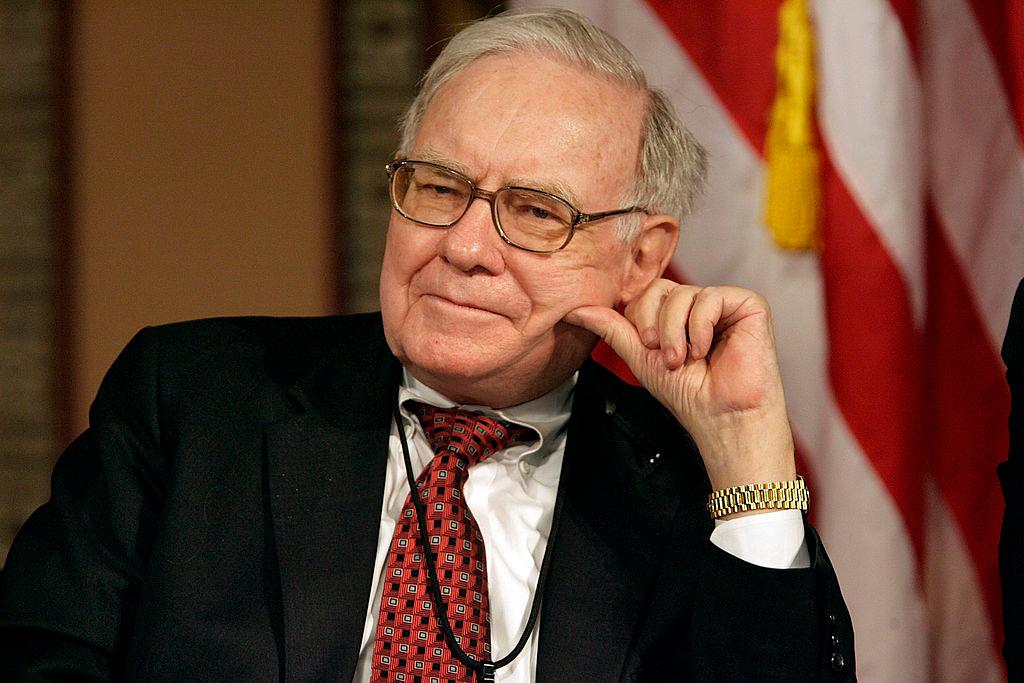

Since a lot of small businesses fail to survive a recession, you might even be able to buy some of the small businesses below their real worth. Warren Buffett follows the same ideology but on a much bigger scale where “small” might mean a few billion dollars.