How to Calculate Your Personal Inflation Rate — and Use It to Budget Better

If you feel like broad inflation metrics don’t line up with your specific life, consider calculating a personal inflation rate to help you budget.

Oct. 18 2022, Published 12:18 p.m. ET

The cost of living across the United States is up 8.2 percent in the 12 months ending in September according to the Bureau of Labor Statistics (BLS).

As individual consumers, knowing the broad inflation rate helps us paint a picture of the economy as it stands, but it doesn’t cater to everyone.

This inflation rate focuses mostly on folks living in major cities and doesn’t account for regional inflation differences or disparities in personal expenses. That’s where the personal inflation rate comes into play.

A personal inflation rate helps you understand the trajectory of your own cost of living and better budget for your personal finance (emphasis on personal). Here’s how to calculate it.

How a personal inflation rate differs from broad inflation:

The Consumer Price Index (CPI) tells us where inflation stands in the context of the broad economy. It focuses primarily on urban areas throughout the U.S. and does not target rural areas. To calculate it, BLS considers the following factors:

Food and beverages

Apparel

Transportation

Medical care

Recreation

Education

Communication

Other goods and services

On the contrary, a personal inflation rate is specific to you. What categories do you spend the most in? Are there any categories you spend in that the CPI doesn’t even consider?

Does the area where you live make one or more of these categories more expensive than the national average? All of this contributes to personalization in an inflation rate.

Here's how you can calculate your personal inflation rate:

Pro tip: A personal inflation rate works best for someone with fairly consistent spending habits. If you tend to spend erratically, consider labeling (but not eliminating) expensive outliers to get a fuller picture.

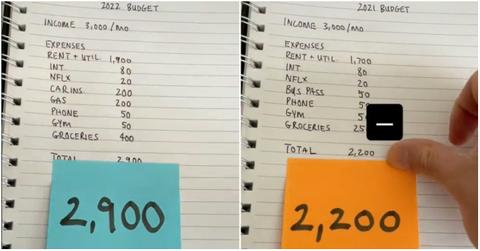

Create a spreadsheet and plug in your expenses. If you already have a detailed budget, you can refer to this.

Start by categorizing your expenses as BLS does (see the bulleted list above). Then, you can break down categories further or add new categories to include the rest of your expenses.

Add up costs across categories, including semi-regular or annual costs. If the costs are not monthly, calculate them to get a monthly rate (such as dividing by 12 for annual subscriptions).

- Go back a year and do the same for your expenses from 12 months prior.

- Compare your total monthly spending on a month-to-month or year-over-year basis. You can do this by subtracting the old total from the new total, then taking the difference and dividing it by the old total. This gives you your monthly or yearly personal inflation rate.

- Since you’ve already done the leg work, you can continue using this formula to see how your personal inflation rate trends over time.

How to put your personal inflation rate to use

If you keep any sort of budget—whether you track every expense or use something as simple as the 80/20 rule—you may want to factor in inflation.

With costs for many of life’s necessities increasing monthly, calculating inflation helps you keep an accurate budget over time. It avoids underestimating costs so you don’t find yourself in a financial bind.

When budgeting, you can insert your personal inflation rate to get a more accurate picture than CPI might give you of how your expenses could change over time.