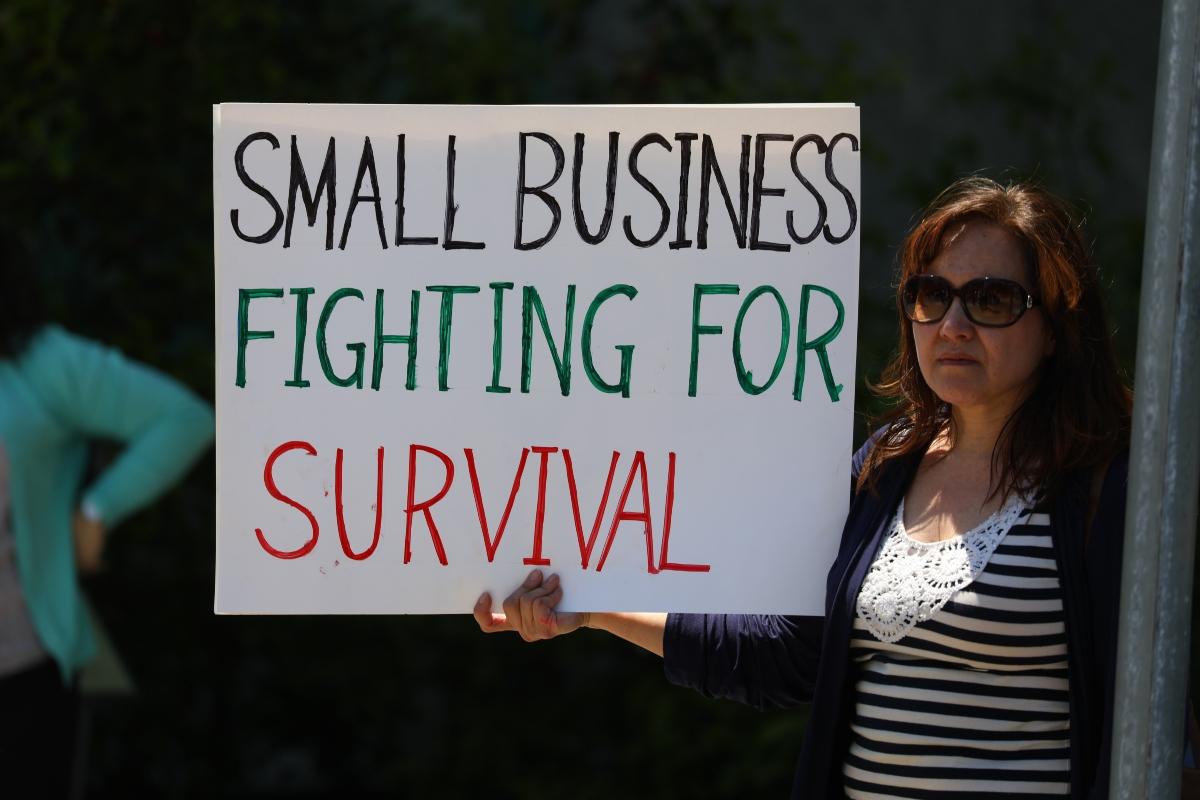

Will the PPP Be Extended Again to Offer More Small-Business Loans?

The PPP (Paycheck Protection Program) offered loans to keep small businesses afloat despite restrictions amid the COVID-19 pandemic. The program isn't expected to get extended more.

June 28 2021, Published 9:10 a.m. ET

It has been 15 months since Congress initially passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Some people wonder whether certain types of financial assistance might continue or get extended again. The PPP (Paycheck Protection Program) was the CARES Act’s strategy for helping small businesses survive the COVID-19 pandemic.

The PPP has been vital to many small-business owners and their employees. Even after the initial month or two of COVID-19-related lockdowns ended, thousands of U.S. businesses continued to struggle. The PPP provided First Draw and Second Draw loans to help businesses continue to make payroll and pay other essential operational expenses.

The PPP has been extended until June 30, 2021, but applications closed by May 31, 2021. There haven't been any indications from Congress about plans to extend the PPP further.

Who are PPP loans for?

PPP loans are intended to support small businesses, which include sole proprietors and independent contractors without employees on the payroll. Under SBA (Small Business Administration) guidelines, a business should have fewer than 500 employees to qualify for First Draw or meet the industry size standard if above 500.

There was some outrage around the country when it was revealed that many large corporations like Shake Shack accepted massive PPP funding. This upset people because some of these companies have thousands of employees and more resources to survive pandemic-related closures.

Thanks to a lawsuit brought by media companies in 2020, you can look up which businesses received PPP loans and how much money they received.

Another measure taken to help curb larger corporations taking too much of the PPP funding was a 14-day application period in February 2021 exclusively for businesses with fewer than 20 employees. This was to help ensure that the smallest businesses had a chance to receive a loan before the funds ran out.

PPP loans are low-interest, with a 1 percent interest rate, but many loan recipients are eligible for full PPP loan forgiveness. You must provide the SBA with certain documentation to prove proper allocation of your loan funds, which includes at least 60 percent of the loan going to cover payroll expenses for employees.

How many times has the PPP loan program been extended?

There have been two segments of the PPP loans that small businesses were eligible to apply for. Business owners could apply for either First Draw or Second Draw loans through the PPP. In March 2021, the PPP was extended from March 31 to June 30, 2021. However, the application deadline was only extended until May 31, 2021.

At this time, there isn't a Congressional plan to extend the PPP past June. However, since many businesses continue to struggle to recover, there are some other programs available to provide small-business assistance.

The Shuttered Venue Operators Grant and Restaurant Revitalization Fund are two programs that might help your business if you’ve been impacted negatively by COVID-19. Also, the Economic Injury Disaster Loans and Employee Retention Credit might be beneficial as businesses get back on their feet.