IRNT Stock Should Recover and Go Back Up, Good Long-Term Buy

IronNet stock is down sharply from the peaks. Will IRNT recover and go back up after the crash and is it a good stock to buy?

Sept. 30 2021, Published 8:19 a.m. ET

IronNet (IRNT), which went public through a reverse merger with LGL Systems Acquisition (DFNS), has had a volatile ride amid Reddit-driven short squeezes. The stock tumbled by almost a quarter on Sept. 29 and is now down 58 percent from its all-time highs. Will IRNT recover and go back up after the crash and is it a good stock to buy?

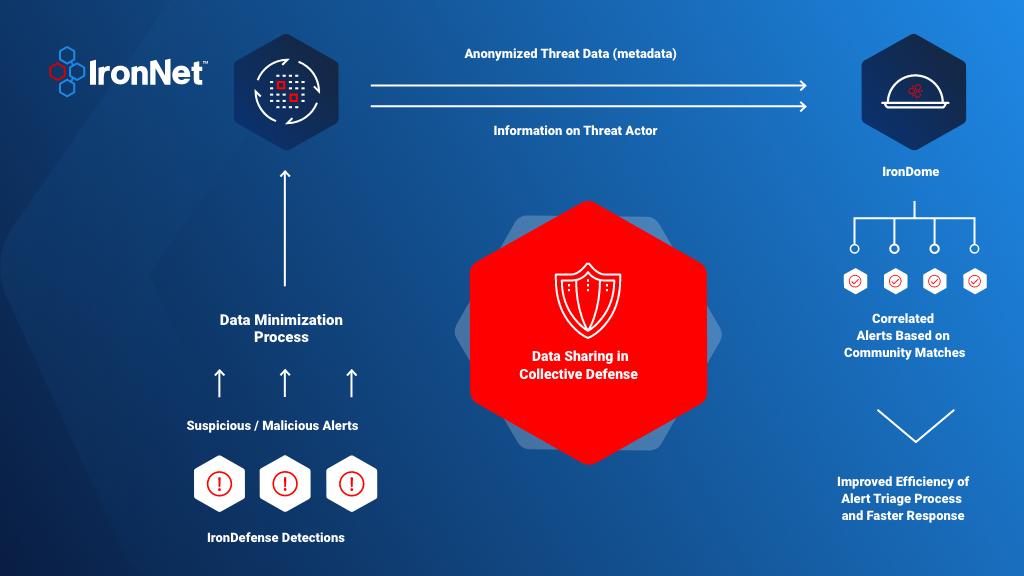

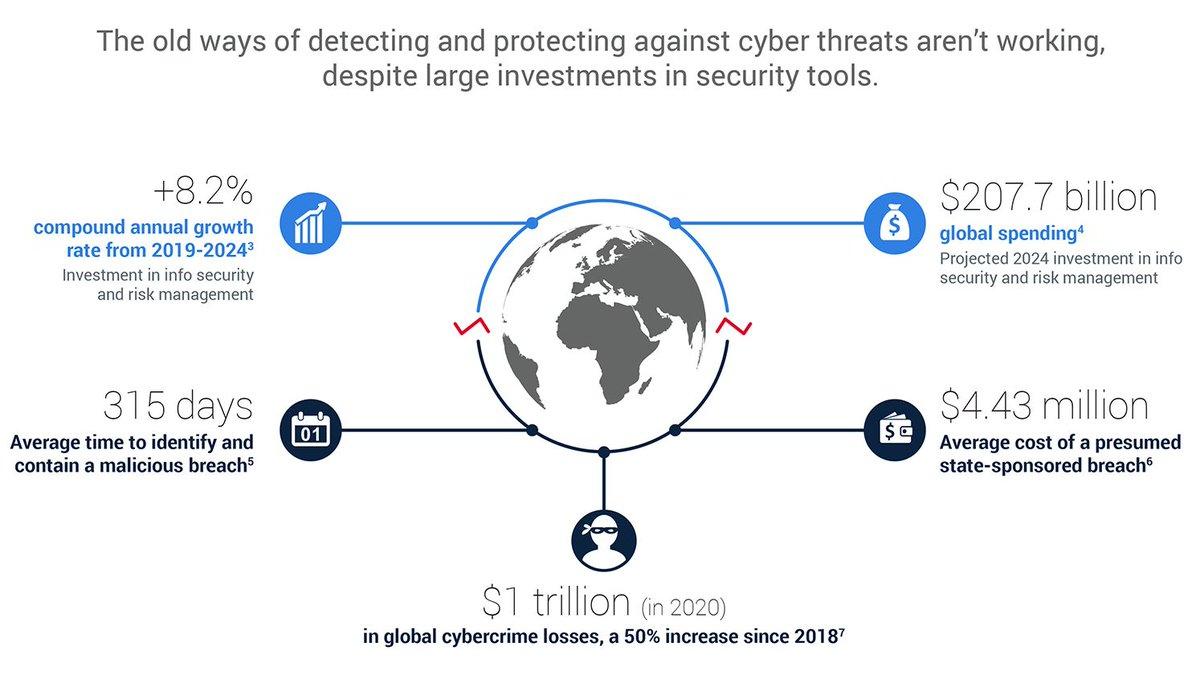

IronNet is a cybersecurity company that works on the Collective Defense Platform that uses AI-driven behavioral analytics to detect cyber anomalies. According to IronNet’s estimates, its total addressable market opportunity is expected to grow to $41.1 billion in 2024. The cybersecurity industry’s outlook looks positive amid the ever-increasing threat of cyberattacks.

Why has IronNet stock been dropping?

At the peak, IronNet’s valuations started to appear stretched. As is the case with other short squeezes that Reddit traders have managed to trigger, IRNT stock soon tumbled from the highs. The company’s second-quarter earnings, after which the stock rallied sharply, weren't as spectacular as the price action suggested.

Now, IRNT stock is simply reverting towards more normalized valuations after the crash. While short squeezes can impact the price action for the short term, they can’t keep prices elevated for long. Also, the fears of dilution have made IRNT investors uneasy.

IRNT stock on Reddit group WallStreetBets

Currently, IRNT stock is among the most popular stocks on Reddit group WallStreetBets. Although most Reddit traders saw the stock as an incredible investment opportunity earlier in September, most of them have a bearish view of the company now. Reddit traders point to the company’s current poor financials and the overhang of the massive dilution that would come after the exercise of warrants.

IronNet’s current financials might appear poor. However, the finances were poor even when some WallStreetBets members were touting the stock as the greatest investment opportunity for retail investors. Growth companies like IRNT aren't a play on current earnings but explosive future growth.

Is IronNet a good stock to buy?

A lot of IronNet’s revenues are in the form of recurring revenues and the gross margins are also impressive. IRNT stock looks like a good buy for the long term considering the cybersecurity industry's growth outlook.

Arbitrage between IRNT stock and warrants

The upcoming dilution is certainly a concern. One way to play that would be to buy the warrants instead of the stock. There's still some merger arbitrage between IronNet stock and the warrants. Investors can buy the warrants and get them converted into common stock later.

Will IronNet stock recover and go back up?

Investors should brace for more volatility over the short term. Reddit traders are pessimistic amid the impending dilution. However, the company would also receive some cash as the warrants get exercised, which would help it fund organic and inorganic growth.

However, if you're willing to be patient, IRNT stock should recover and go back up in the medium to long term. Cybersecurity is one of the industries that should benefit from digital transformation. The increased pace of digitization also means more cyberattacks, which in turn would mean more business for cybersecurity companies like IRNT.