IRNT Stock Is a Good Bet Amid Digital Shift and Cybersecurity Threats

IronNet went public through a reverse merger with DFNS. What’s the forecast for IRNT stock and is it a good investment?

Sept. 15 2021, Published 12:52 p.m. ET

IronNet Cybersecurity (IRNT) stock was trading sharply higher on Sept. 15. The company went public through a reverse merger with LGL Systems Acquisition (DFNS). What’s the forecast for IRNT stock and is it a good investment?

IronNet provides cybersecurity solutions. The medium to long-term forecast for the industry looks positive due to growing cybersecurity threats. There has been a spate of cyberattacks recently that have highlighted the importance of cybersecurity solutions.

IronNet stock surges after earnings

IronNet released its fiscal second-quarter 2022 earnings on Sept. 14. It reported revenues of $6.1 million in the quarter compared to $7.9 million in the same quarter last year. The company had an ARR (annual recurring revenues) of $24.1 million compared to $19.5 million in the second quarter of fiscal 2021.

IronNet’s customer count more than doubled from 22 to 51 during the period. However, its dollar-based average contract length fell from 3.2 to 2.8.

IRNT reported an operating loss of $17 million compared to $14.2 million during the same period last year. The company maintained the fiscal 2022 revenue guidance of $43 million–$45 million and expects the ARR at $75 million by the end of the year.

Cybersecurity company Darktrace, whose primary listing is in London, also reported better-than-expected results on Sept. 15. The company raised its guidance, which led to a spike in the stock.

IRNT stock forecast

Currently, no Wall Street analysts are covering IRNT stock since it has been listed for less than a month. The forecast for the stock looks positive based on the outlook for cybersecurity. The company has also been making new partnerships.

IronNet has been certified as an integration partner in the MISA (Microsoft Intelligent Security Association), which is a platform for independent software vendors. The company has been expanding its revenue base and has also entered into a partnership with Mandiant, which is a part of FireEye.

James Gerber, the IronNet CFO, said, “Our cloud-based subscription revenue -- which grew to 60% of product revenue in the first half of the year, a 65% year-over-year growth rate -- is a strong proof point for the business and underscores the fully recurring aspect of our financial model.”

Is IronNet stock a good investment?

IronNet looks like a good investment based on the growth outlook. The company expects its revenues to more than double to $110.8 million in fiscal 2023. IronNet expects its revenues to rise to $287.5 million by fiscal 2025. Currently, IronNet has a market cap of $2.24 billion.

This gives us a fiscal 2024 price-to-sales multiple of 7.8x. The valuations don’t seem unreasonable considering the strong top-line growth. Also, given the business model, which has a high percentage of recurring revenues, the valuations look justified.

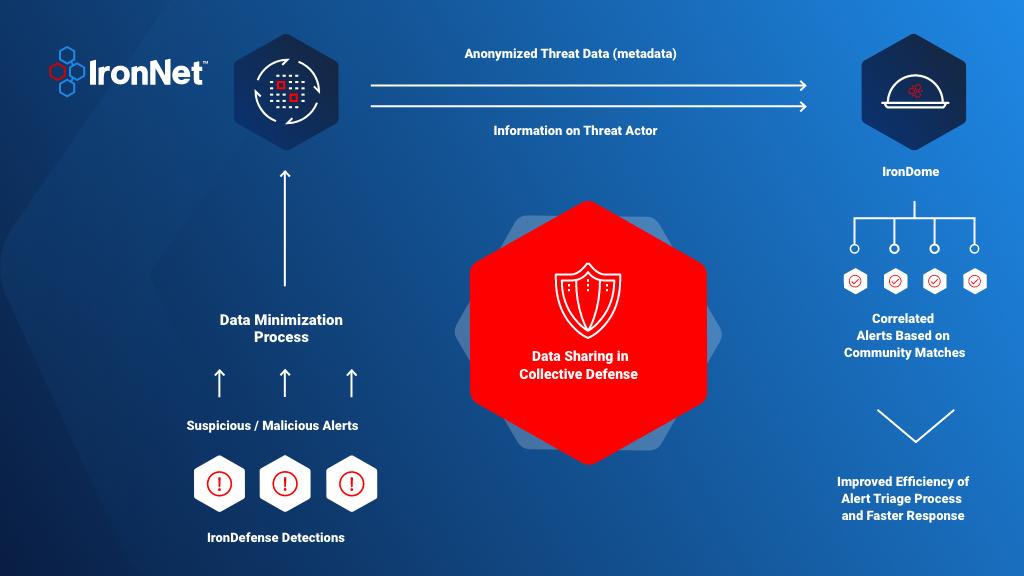

IronNet’s Collective Defense platform uses AI-driven behavioral analytics to detect cyber anomalies. According to the company’s estimates, its total addressable market opportunity is expected to grow to $41.1 billion in 2024.

While the digital transformation has been a boon for several companies, it has also led to more cybersecurity threats. IronNet looks like a good stock to buy and play increasing cyber risks as the world goes digital.