Will China Bail Out Evergrande and Lift Global Stock Markets?

The Evergrande crisis has been rattling Chinese as well as the global stock markets. Will China eventually bail out Evergrande?

Sept. 21 2021, Published 8:21 a.m. ET

Global stock markets plummeted in September 2020 in response to the Evergrande debt crisis in China. U.S. stock markets, which had fallen in three of the previous weeks, also tumbled. Globally, investors wonder if China will bail out Evergrande and lift the stock markets.

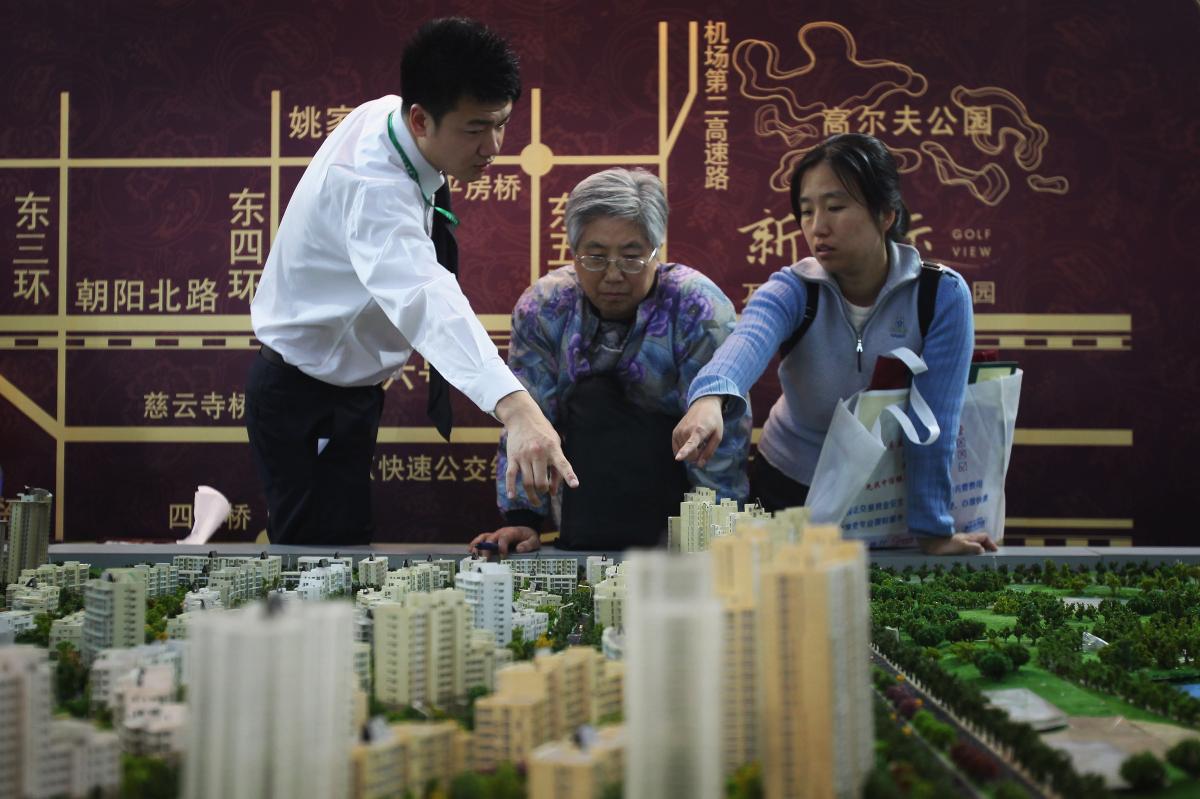

First, we should understand that the Evergrande crisis has been brewing considering the company’s over $300 billion liability pile. The Chinese housing market has been quite leveraged and the country has been concerned about financial stability. Especially under the leadership of President Xi Jinping, the government has been taking several measures for financial and social stability.

What the Evergrande crisis is all about

Evergrande’s crisis intensified after China placed limits on the debt that real estate companies can take. The company's cash engine stopped, which led to a problem in servicing debt.

Is Evergrande too big to fail?

The term “too big to fail” is generally used for financial institutions whose collapse can trigger systemic instability. The term was used widely during the 2008 financial crisis. After the Lehman collapse, the U.S. government stepped in and bailed out several institutions.

While Evergrande isn't a financial institution per se, it owes money to a lot of banks and financial institutions. Evergrande's failure would impact several Chinese financial institutions.

To gauge the size of Evergrande’s debt problem, consider that the company’s total liabilities are almost 3 percent of China’s GDP. According to the Chinese think tank Evergrande Research Institute, the real estate sector accounted for 7 percent of the Chinese GDP in 2019 and ancillary industries accounted for another 17.2 percent.

The housing market's contribution to the total GDP is much larger in China than in many other countries.

Will China bail out Evergrande?

There are arguments both for and against whether China will bail out Evergrande. Some analysts think that the country will eventually bail out Evergrande and let state-owned banks lend to the cash-starved company. Meanwhile, other people don't think that China will bail out Evergrande because it would run contrary to the objective of deleveraging the economy.

China would also be mindful of the millions of homebuyers whose money is struck with Evergrande. These buyers would risk losing money if Evergrande collapsed. This could lead to social unrest, which is something that China might want to avoid. In all likelihood, China will bail out the company in one way or another.

What the Evergrande crisis means for Chinese stock markets

Chinese stock markets have been under pressure amid the Evergrande crisis. Even companies like Alibaba have fallen amid the crisis. Given the importance of the housing market for China’s economy and by its extension its stock markets, the Evergrande crisis has been making investors jittery.

Evergrande letter

Evergrande chairman Xu Jiayin sent a letter to employees saying that the company will soon “walk out of the darkness.” Users on Chinese social media platforms have been critical of Jiayin and think that he's “delusional.”

While the domino effect from the Evergrande crisis might not be as widespread as the 2008 Lehman Brothers crisis, it's bound to impact global stock markets. Metal and mining companies are especially at a risk. China’s burgeoning housing sector is the single biggest consumer of many metals, especially steel.

Coming back to whether China will bail out Evergrande, we’ll know soon. The troubled company is scheduled to make some interest payments this week. If China wants to bail out Evergrande, as it has done for many companies including NIO in the past, the time is right now.