Paysafe Has Attractive Valuations, Looks Like a Good Stock to Buy

Paysafe completed the reverse merger with BFT. The stock is trading higher on April 15. Why is PSFE stock rising and is it a good stock to buy now?

April 15 2021, Published 9:01 a.m. ET

Paysafe (PSFE) completed the reverse merger with William P. Foley’s Foley Trasimene Acquisition Corp II (BFT) in March. PSFE stock gained 2.5 percent on April 14 and was trading higher in pre-market trading on April 15. Why is PSFE stock rising and is it a good stock to buy now?

After the Paysafe-BFT merger, the warrants started to trade under the new ticker symbol “PSFE-WT.” The warrants are exercisable at $11.5 per share.

PSFE stock warrants

Most SPACs attach the warrants along with the common stock. These warrants are a leveraged play on the SPAC stock. Looking at PSFE warrants, they are currently in the money and the holders would exercise the warrants.

While this would lead to a higher share count for PSFE, the company would also get cash, which would strengthen its balance sheet and help it invest in growth.

Why PSFE stock is rising

There hasn’t been any company-specific news for Paysafe stock recently. However, there has been a recovery in some of the beaten-down quality stocks like PSFE. Fintech stocks sold off in March as the U.S. stock markets, especially the growth stocks, had fallen amid the spike in bond yields.

Also, PSFE’s valuations got attractive after the fall and investors seem to find value in this fintech play, which helped aid the rise in its stock.

PayPal trades at a premium to Paysafe

PSFE stock valuation

PSFE has a market capitalization of just around $10 billion. In its investor presentation, the company talked about a pro forma net debt of $1.8 billion after the merger. This would mean an EV of around $11.8 billion.

Now, Paysafe expects to post revenues between $1.52 and $1.55 billion in 2021 and an EBITDA of $500 million. I haven't adjusted the EBITDA for merger-related costs since it's a one-time expense.

PSFE stock looks undervalued.

Looking at the metrics and forecasts provided by Paysafe, the stock is valued at a 2021 EV-to-sales multiple of 11.6x and an EV-EBITDA multiple of 23.6x. I have taken the higher end of the estimates for the calculation.

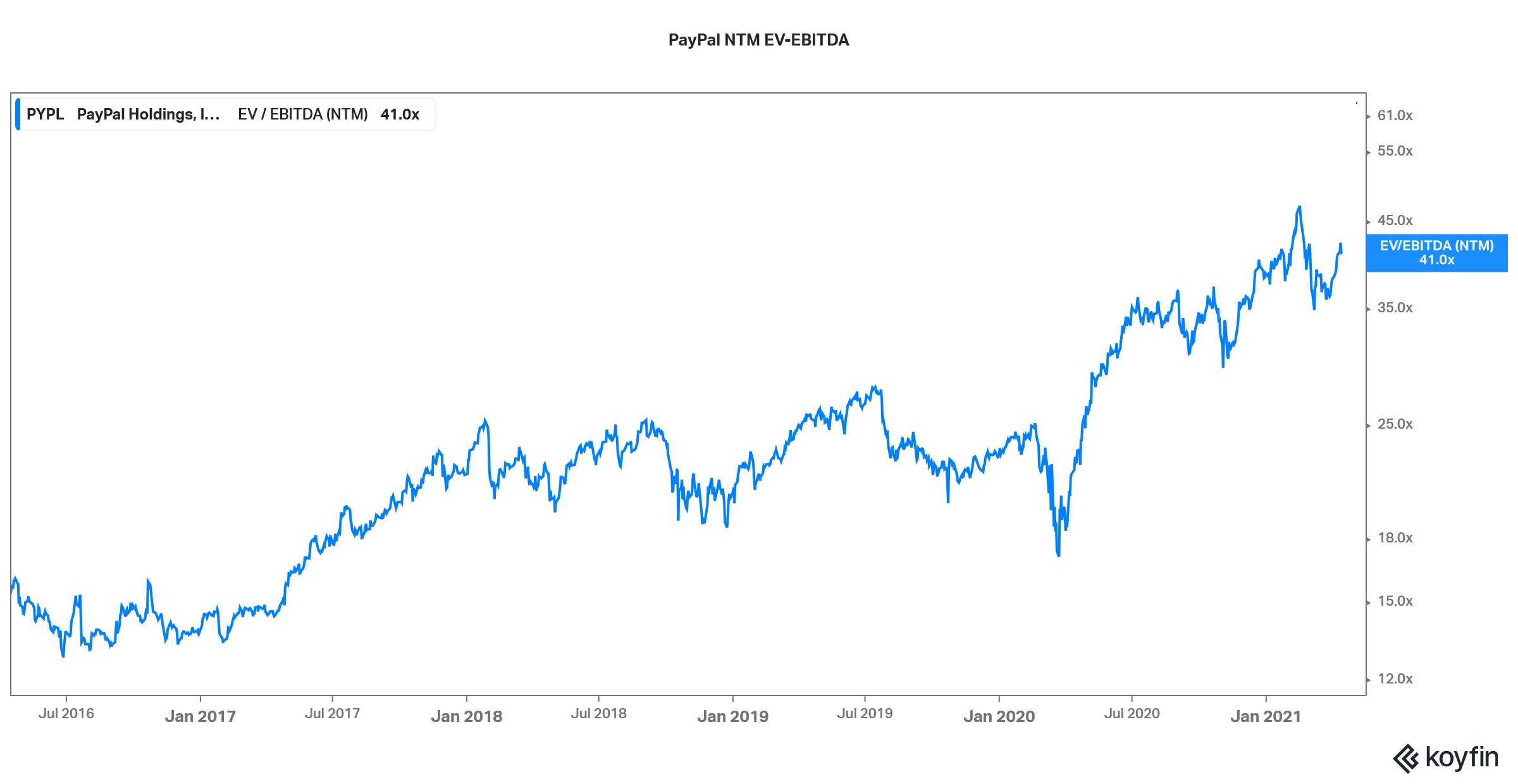

Looking at peer companies, PayPal is valued at an NTM EV-to-sales multiple of 12.1x and an EV-to-EBITDA multiple of 41.0x. The multiples are much higher than what PSFE trades at. PSFE stock looks undervalued at the current prices.

Paysafe is a good stock to buy now.

PSFE has EBITDA margins above 30 percent, which is higher than PayPal. Also, Paysafe has an asset-light business model and higher cash flow conversion, which makes the stock attractive.

Paysafe is the leader in the iGaming market and it offers digital wallets. Cathie Wood of ARK Investment, who is known for identifying disruptive technologies, sees digital wallets as an exciting investment theme along with genomics.

Paysafe’s Skrill digital wallet has partnered with Coinbase to expand its cryptocurrency offering. This would enable customers in 37 U.S. states and territories to trade in multiple cryptocurrencies. Coinbase listed on April 14 and the stock soared above the reference price in its direct listing.

Overall, Paysafe has a scalable and asset-light business model that generated good margins and cash flows. The business is growing fast and Paysafe expects its revenues and EBITDA to rise 10 percent and 16 percent, respectively, between 2020 and 2023. Finally, PSFE is available at attractive valuations and looks like a good stock to buy now.

PSFE target price

Currently, PSFE is covered by only two analysts and both of them have a buy rating on the stock. PSFE’s median target price is $19, which is a premium of over 38 percent over the current prices. We could see more analysts initiate coverage on PSFE stock in the near to medium term, which might help improve the sentiments.