Why Is My FICO Score Lower Than My Credit Score?

If you’re wondering why your FICO score is lower than your credit score, the answer depends on what credit scoring model is being used.

June 17 2021, Published 5:24 a.m. ET

Your credit score can impact many things in life. Besides affecting your ability to get a loan, buy a house, or buy a vehicle, your credit score can affect what you pay for insurance and if you can get a cell phone.

If you’re wondering why your FICO score is lower than your credit score, the answer depends on what credit scoring model is being used and what factors that scoring model looks at.

Credit scores are used to give lenders an idea of your creditworthiness, or, in other words, how likely you are to pay your bills on time. Credit scores range from 300 to 850, with 300 being the lowest and 850 the highest.

You’ll have better luck getting a loan with a credit score of 850 than 500. If you're able to get a loan with a low score, that loan will probably come with a higher interest rate.

How are credit scores determined?

A few factors determine your credit score. Three major credit bureaus—TransUnion, Experian, and Equifax—create credit reports and designate your credit score based on your borrowing habits and payment history. FICO (Fair Isaac Corporation) scores are calculated using a proprietary algorithm.

Today, many people use websites, like Credit Karma or Credit Sesame, to keep track of their credit score. Credit card companies, such as Discover and Capital One, can also give you updates on your FICO score.

Tracking your credit score can be confusing because it can differ depending on the credit monitoring system. For example, you may have a credit score of 702 with TransUnion, 720 with Equifax, and 707 with FICO.

Why does my credit score differ?

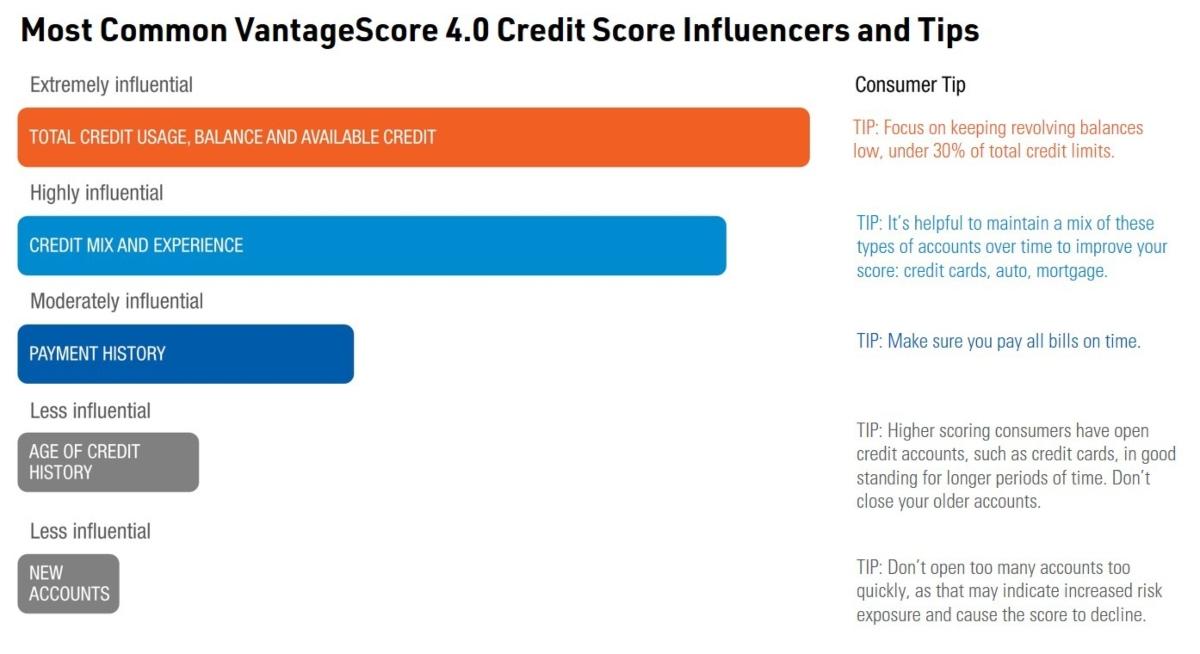

Scores vary between systems because they look at different factors to determine your creditworthiness. TransUnion, Equifax, and Experian all use the VantageScore 3.0 credit scoring model. VantageScore looks at data compiled by the three credit bureaus, with a primary focus on your total credit usage, credit card balances, credit mix, and payment history. Less influential factors in determining your VantageScore are the age of your credit history and new accounts.

On the other hand, FICO scores primarily look at your payment history and how on time you are with payments on your loans and credit cards. Your total debt is also an important factor, especially when it's compared with your credit limit. For example, if the balance on your credit card is $3,000 and the credit limit is $4,000, that will impact your FICO score.

Financial experts typically recommend that your credit usage is below 30 percent of your credit availability. So, if you have a $4,000 credit limit, your balance should remain below $1,200.

FICO scores also give more importance to the duration of your credit history. Therefore, if you have old credit cards that you don’t often use, closing them could hurt your FICO score. As most banks and lenders will look at your FICO score when deciding whether to give you a loan, you may want to pay closer attention to it than other scores.