Humbl Stock Wants to Be Everything, Might End Up Being Nothing

Humbl stock is trading sharply lower on April 20. Why is Humbl stock dropping and should you buy or sell the stock now?

April 27 2021, Updated 10:30 a.m. ET

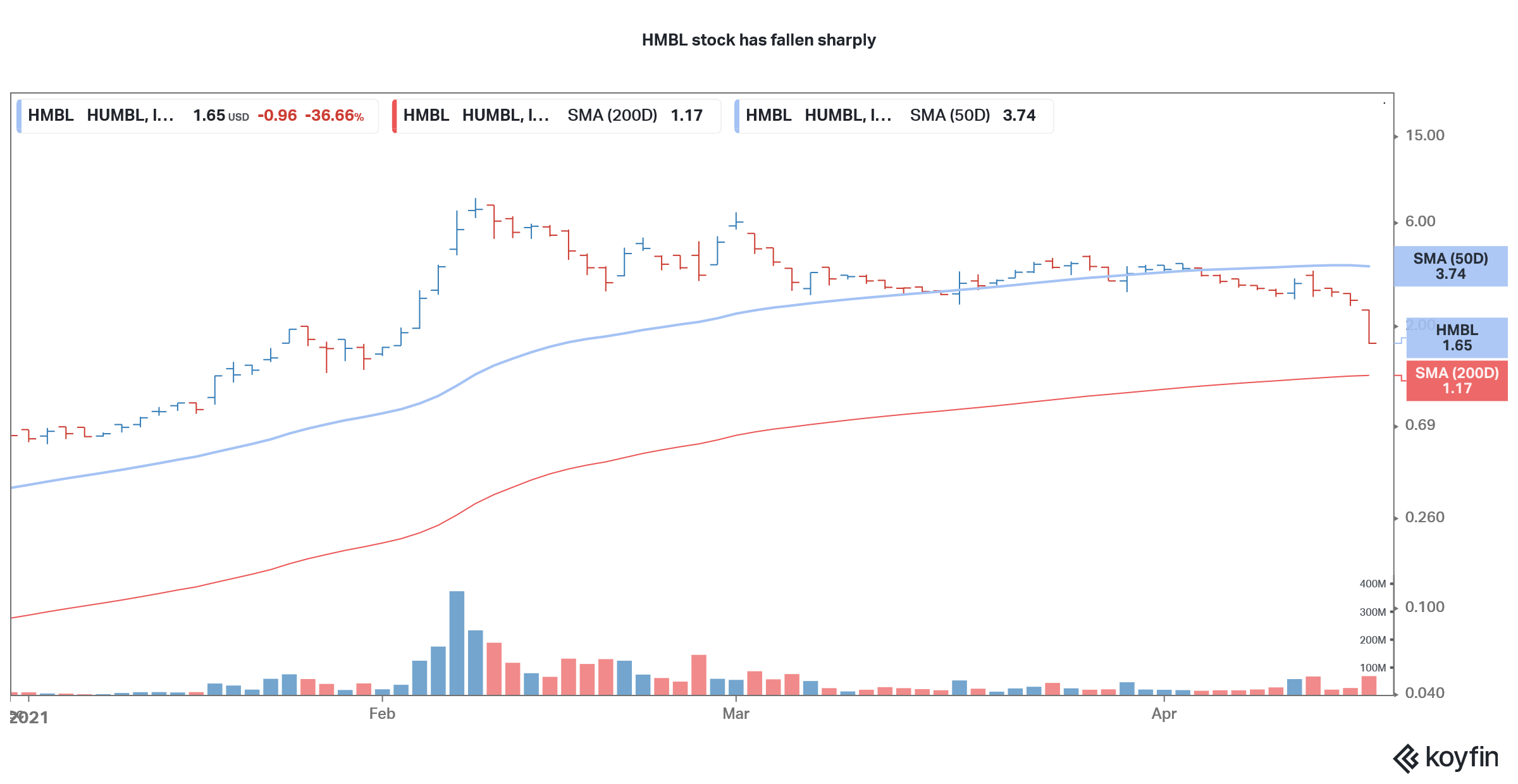

Humbl stock fell over 36 percent on April 19 and has now lost almost 79 percent from its 52-week highs. CEO Brian Foote was on CNBC last week. It's a rarity for a penny stock to get showcased on the channel. The company has also filed its 2020 annual report. Why is Humbl stock dropping and should you buy or sell the stock now?

Humbl’s business plans are very elaborate. It has three main business verticals focusing on different industries. It's launching Humbl Pay, which would compete with the likes of PayPal.

Humbl wants to be everything.

Humbl Financial has launched the BLOCK Exchange Traded Index (ETX), which will enable a buyer to invest in a basket of cryptocurrencies. The company is also partnering with athletes for NFTs (non-fungible tokens). The Financial vertical would compete with several financial and NFT companies.

Finally, the e-commerce vertical called Marketplace has Humbl Studios, which features products from third-party sellers, and Humbl x Shop, which has merchandise from Humbl.

Through Humbl Studios, HMBL intends to bring small businesses from across the world on its platform and help them reach a global audience. It also features some well-known artisans. The business would compete with companies like Etsy.

HMBL stock is dropping

Why is HMBL stock dropping?

While HMBL has massive plans for its business, investors are questioning the execution. In the interview with CNBC, while Foote said that the company is making revenues and is adding customers for its ETX platform, the 2020 annual report didn't show any revenues. However, the company launched the ETX product in 2021 and we will see the revenue contribution in upcoming earnings.

Humbl's 2020 annual report also showed the massive impending dilution. It had 974,218,599 outstanding shares as of April 14. However, the annual report talked about 552,522 Series B preferred shares that can be converted into 10,000 HMBL common shares each. This would mean an additional 5,525,220,000 HMBL shares on conversion.

HMBL stock warrants

At the end of 2020, HMBL issued 262,725,000 warrants with a weighted average exercise price of $0.23875. All of the warrants are in the money and would be exercised over the next two years. This would mean HMBL’s outstanding shares rising by 5,787,945,000, which would lead to a massive dilution. The outstanding share count would rise to almost 6.8 billion after the conversion.

HMBL plans to list on Nasdaq.

HMBL has filed its audited 2020 annual report, which is a precondition for listing on the Nasdaq. The company plans to up list from the OTC exchange to Nasdaq, which might lead to higher volumes.

Trading volumes aren't really a concern for HMBL stock even now. There are two main issues that investors should be concerned about. The first is of course on the execution part. Announcing plans to become the next Amazon, PayPal, and Square is one thing, but the execution is questionable.

Secondly, based on the almost 1.8 billion outstanding shares assuming conversion of all warrants and preferred shares, HMBL has a pro forma market capitalization of over $11.3 billion. Since we don’t have the most recent financials and credible forecasts, we would have to look at alternate valuation mechanisms.

If the company can succeed in even one of the three businesses that it's targeting, it can be a multi-bagger stock. However, given the recent crash in speculative growth names, investors don’t seem to have much appetite for these “future earnings plays.”

HMBL continues to be a speculative play. Investors can take a small speculative bet in the company but it risks being nothing in a bid to become everything.