Humbl Stock Forecast: Will HMBL Stock Recover or Fall More?

Crypto startup company Humbl (HMBL) is down sharply from its highs. What’s the forecast for HMBL stock in 2021? Will it recover or fall more?

April 13 2021, Published 8:46 a.m. ET

Crypto startup company Humbl (HMBL) has been very volatile in 2021. The stock rose to a high of $7.72 but since then it has looked weak. The stock is down 64 percent from its 52-week highs. What’s the forecast for HMBL stock in 2021? Will it recover or fall more?

HMBL stock went public through a reverse merger with Tesoro (TNSP), which was primarily a home-renovation retailer. While the transaction was similar to the reverse mergers that we see in SPAC transactions, Tesoro wasn't a blank-check company but had business operations.

Why HMBL stock has soared in 2021

The sharp rise in HMBL stock is largely due to the exciting end industries that it's operating in. Currently, Humbl operates under three verticals —Financial, Marketplace, and Humbl Pay.

The Financial vertical offers a BLOCK Exchange Traded Index (ETX), which would enable a buyer to invest in a basket of cryptocurrencies. Humbl Pay is a fintech vertical, which would offer payment solutions. The Marketplace is Humbl’s e-commerce vertical.

There has been a lot of investor interest towards all three of the verticals where Humbl is present, especially the cryptocurrency business. As bitcoin prices have surged, all of the companies in the cryptocurrency vertical have surged. Digital currencies are getting recognized more as an alternate asset class.

Is HMBL a good crypto stock?

The faith shown by mainstream companies like Tesla and Square, which have invested money in bitcoins, has helped increase the adoption and mainstreaming of digital assets. Payment companies are also allowing payments in bitcoins, which is another bullish driver for digital currency.

Through its ETXs, Humbl would let users invest in a basket of cryptocurrencies, which would lead to higher risk-adjusted returns for investors.

Humbl’s marketplace is also a long-term value driver looking at the pivot from brick-and-mortar stores to online shopping. The company has Humbl Studios, which features products from third-party sellers and Humbl x Shop, which has merchandise from Humbl.

Through Humbl Studios, the company intends to bring small businesses from across the world on its platform and help them reach a global audience. It also features some of the well-known artisans.

The Mobile Pay vertical is a payment solution business. However, it is yet to go live and merchants can pre-register. The company claims that with its Humbl Pay merchants can go digital in one day. It intends to launch the product in multiple countries globally and would target freelancers, merchants, and consumers.

HMBL and TNSP stock forecast

Usually, in SPAC mergers, the target company provides the business and earnings outlook, which helps value the business. However, there isn't much information about Humbl in the merger announcement. TNSP was primarily a home-renovation retailer that posted little revenues before it merged with HMBL.

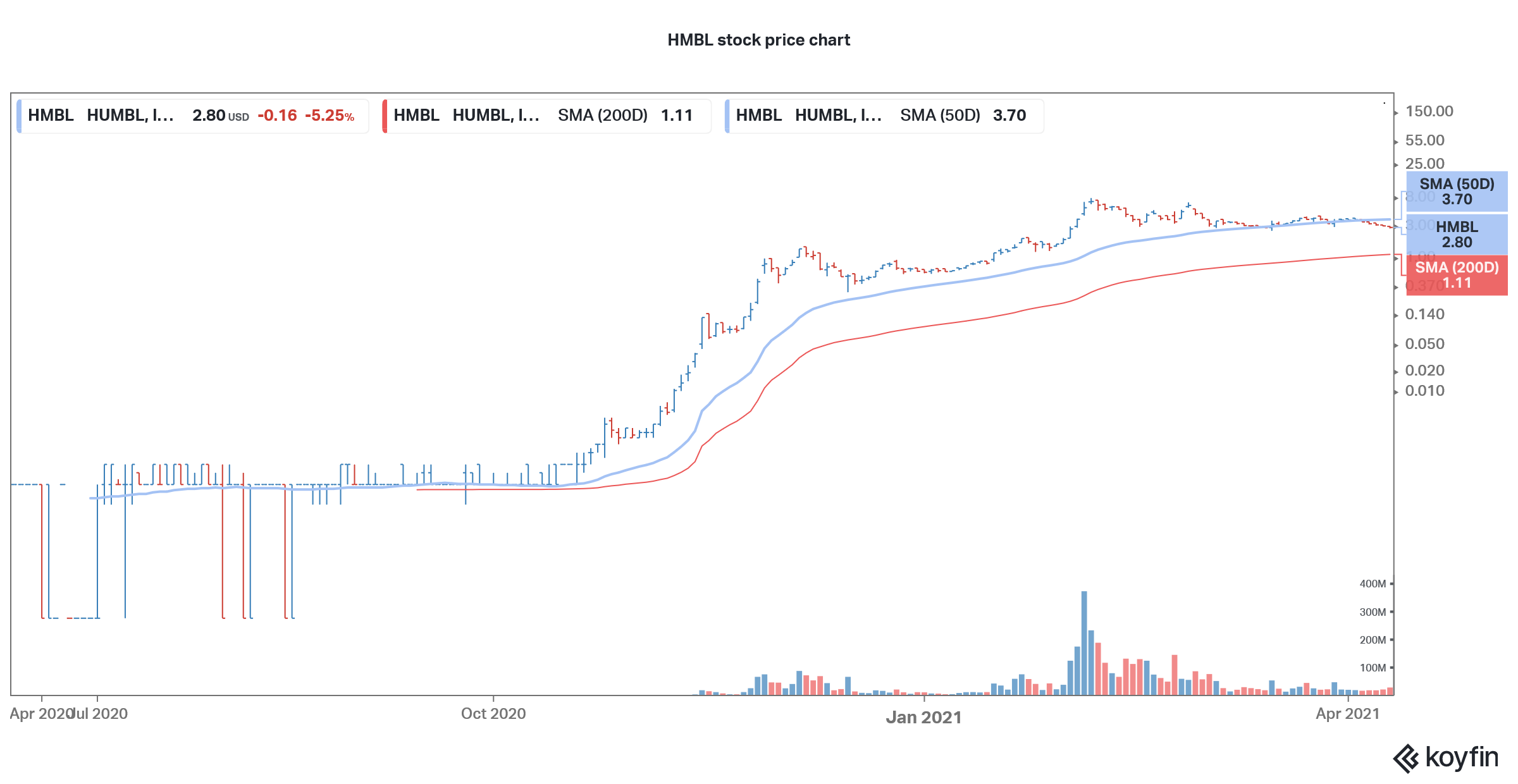

HMBL stock has fallen below 50-day SMA

HMBL stock is a speculative play.

Humbl will release its earnings later this year. Since we don’t have a lot of data points to value the company, none of the Wall Street analysts are covering the stock. For now, HMBL is a speculative play. The biggest risk the company would face is on the execution part.

After the initial hype, Humbl needs to show progress on its business plans for its stock price to recover. Looking at the technical indicators, the stock has dipped below the 50-day SMA, which indicates short-term weakness. However, the 14-day RSI stands at 41.32, which is nearing the oversold territory. RSI values below 30 are seen as oversold.