How Long Will the Greater Fool Theory in AMC Entertainment Stock Last?

AMC Entertainment stock has fallen sharply from the highs. Why is AMC stock falling and how low will it go? Here's what investors can expect.

July 8 2021, Published 11:25 a.m. ET

AMC Entertainment (AMC) stock was trading sharply lower in the early price action on July 8. The stock extended its slide from the last few trading sessions. The stock is now down over 40 percent from the 52-week highs. Why is AMC stock falling and how low will it go?

AMC and GameStop (GME) are the two poster boys of meme stocks. Both of them trade at levels that Wall Street analysts can't justify with traditional valuation models. For analysts, GameStop is a gaming retailer and the industry is fighting for relevance as gaming moves online. AMC is a cinema chain company trying to fend off streaming companies from its turf while also negotiating the twists and turns of the COVID-19 pandemic.

AMC stock on Reddit group WallStreetBets

Apart from the pumping from Reddit traders there didn't seem to be a reason why AMC stock should have risen to its all-time highs. Even now, AMC stock trades at over 7x of what it did before the COVID-19 pandemic.

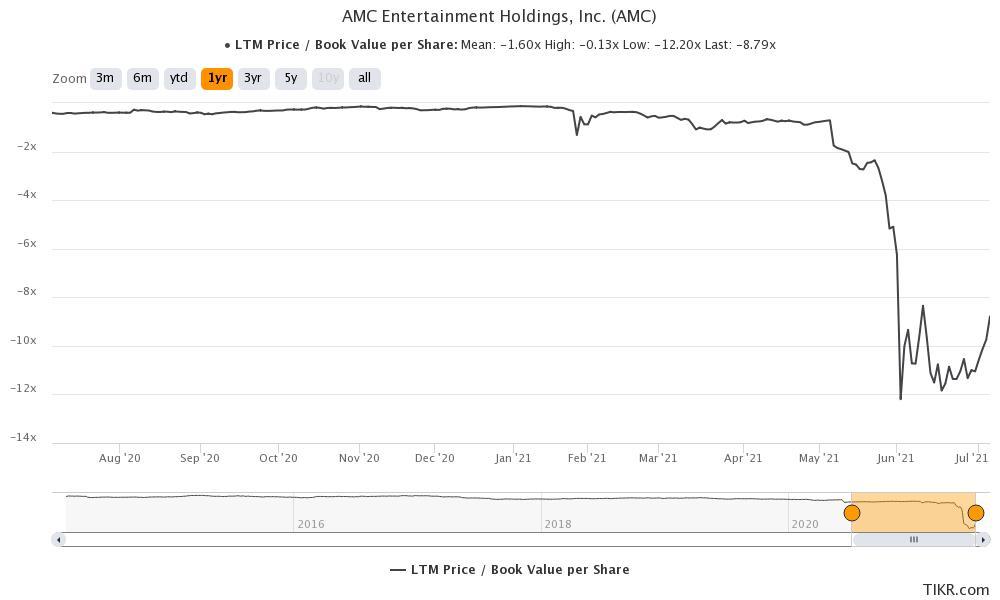

While the company managed to survive the pandemic, it came with a series of costs. The company’s book value per share is negative and the price-to-book value ratio is negative 8.8x.

The company has over $11 billion in total liabilities which include debt, lease obligations, and deferent rent obligations. AMC had to resort to debt issuance and equity issuance to keep afloat.

At times, it has been difficult to keep track of stock issuance by AMC, which has almost been a flash sale. However, this time, stockholders blocked the proposal to issue another 25 million shares.

AMC has negative book value per share

AMC is now majority-owned by retail investors, unlike most other U.S. companies where institutional investors are the biggest investors. However, at the current price levels, not many institutions will want to hold AMC stock.

Dalian Wanda Group, which is owned by Chinese billionaire Wang Jianlin, was previously a major investor but cashed out amid the frenzied rally. Even Mudrick Capital sold the shares that it bought from AMC shortly after the acquisition.

Why AMC stock is falling

AMC stock has fallen because Reddit traders shifted their attention to other stocks. Given its bloated valuations, AMC would need a dose of regular pumping to keep the stock high. From a valuation perspective, the stock looks way too overvalued with a market cap of over $20 billion.

The company will need to post profits way above what it did before the pandemic to justify the valuations. Not only has the stock price ballooned, but the number of outstanding shares has also increased, which would mean a lower EPS when the company actually starts generating profits.

How low will AMC stock go?

AMC has a median target price of $3.70, which would mean a downside of over 91 percent over the next 12 months. The stock’s lowest target price is $1, while the highest target price of $16 also implies a downside of almost 62 percent. Looking at the fundamentals, AMC will need to fall to at least $20 before it could even be considered as an investment.

Will AMC stock rise of fall more?

Looking at the fundamentals, AMC stock should fall more from these levels. However, there's a wide army of Reddit traders who are trying to take the stock up. Several hedge funds are apprehensive about taking short positions in AMC considering what happened with Melvin Capital on its GME short position.

In the short term, Reddit traders might be able to support AMC stock. However, in the medium to long term, the stock will face a reality check. It could turn out to be a greater fool theory at play unless the “game” eventually ends.