These Credit Cards Use to Experian and Other Credit Bureaus for Card Approval

Credit card usage is reported to credit bureaus, while card issuers also rely on bureaus for card approval. Which cards use Experian for approval?

March 24 2022, Published 2:16 p.m. ET

The average American has or will have to take on some type of debt, whether big or small. The borrowed funds could be in the form of a loan, line of credit, or a credit card line. Regardless, it’s best to make smart decisions with your debt, as credit bureaus are always monitoring your credit activity. Along with Equifax and TransUnion, Experian is one the three major credit bureaus that help compose your credit scores. Which credit card lenders use Experian for approval?

Experian and the other credit reporting agencies recently announced that they will remove most medical debts from credit reports. This can help many Americans in the U.S. because many people deal with paying back hefty medical expenses that they aren’t able to pay off quickly. And of course having medical debt that’s not being paid off can negatively affect a person's credit score. With medical debt being wiped out, this will give Americans more flexibility when it comes to their lending power.

Why are credit bureaus like Experian important?

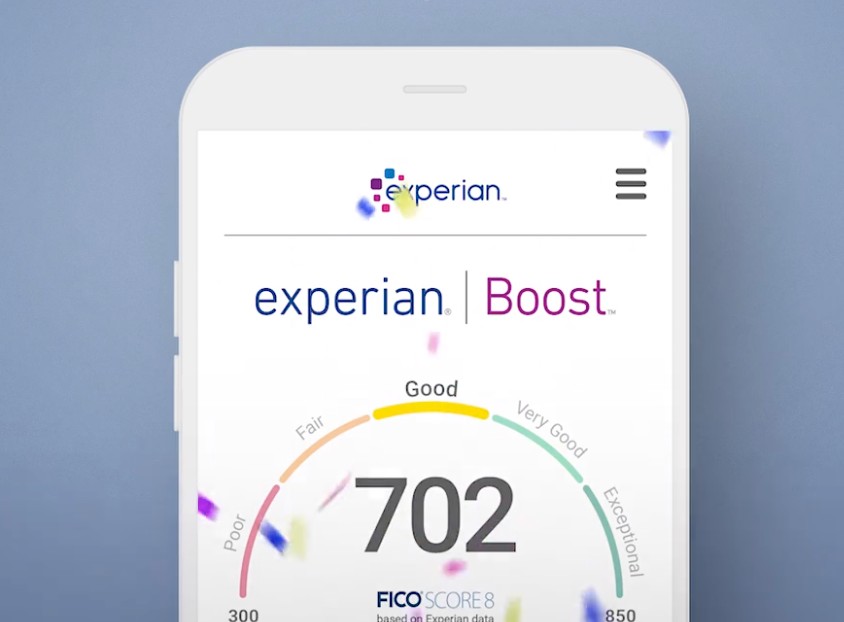

These credit bureaus are largely responsible for providing data to lenders, banks, creditors, collection agencies, and credit card companies. The data these agencies can monitor include credit limits, soft and hard inquiries, types of accounts, account balances, payment history, and how long you’ve kept an account open for. All of those types of information compose a credit report, and all three bureaus use their credit reports to build FICO and VantageScores.

FICO and VantageScores are essentially two important types of credit scores. Payment history plays a more important role in FICO scores, while total credit usage and account balances hold more weight in VantageScores. Both scores are important, but as long as you practice good credit habits, you can have both scores be high. But along with credit cards reporting your credit activity to bureaus, they also use bureaus to get a credit score when you're applying for a card.

Which credit cards use Experian to approve card applicants?

There are no credit card issuers that exclusively use Experian to obtain a credit score to approve applicants. While an issuer may only use one of the three bureaus for an applicant's approval, the bureau used can vary for each applicant. And in many cases, lenders will use multiple agencies, if not all three, when looking to approve an applicant. Chase, Bank of America, and Wells Fargo are some of the many card issuers who use Experian and the other two agencies for approval.

Which credit cards report to Experian?

If a credit card lender reports your activity to Experian, then it’s likely that it reports it to all three credit bureaus. And most credit cards nowadays report to these bureaus, so fortunately you don’t have to search too far. When searching for a credit card, it’s best to find a card that suits your personal preferences and needs.

Credit cards can specialize in certain areas such as low-fee balance transfers, low interest rates, student benefits, easy approval, extra security, cash back, and other rewards.

One credit card that reports to all agencies is the Chase Freedom Unlimited card. It has a zero-percent intro APR bonus on all purchases and balance transfers for 15 months, allowing you to pay zero interest on your purchase for over a year. The card also offers five percent cash back on certain travel purchases, three percent on dining and drug stores, and 1.5 percent cash back on every other purchase.

For those who want a secure credit card and low interest rates, the Merrick Bank Double Your Line Secured Visa Card is another option. It currently has a variable APR of 17.45 percent, and also offers fraud coverage if the card is lost or stolen. There are many cards to choose from and Experian provides a list on its website of all the credit cards that report to it.