How To Track Upcoming IPOs to Get in on the Ground Floor

An IPO usually takes about four to six months to start trading. Here’s how to track upcoming IPOs so you can get in early on the hottest new public companies.

Dec. 11 2020, Published 12:55 p.m. ET

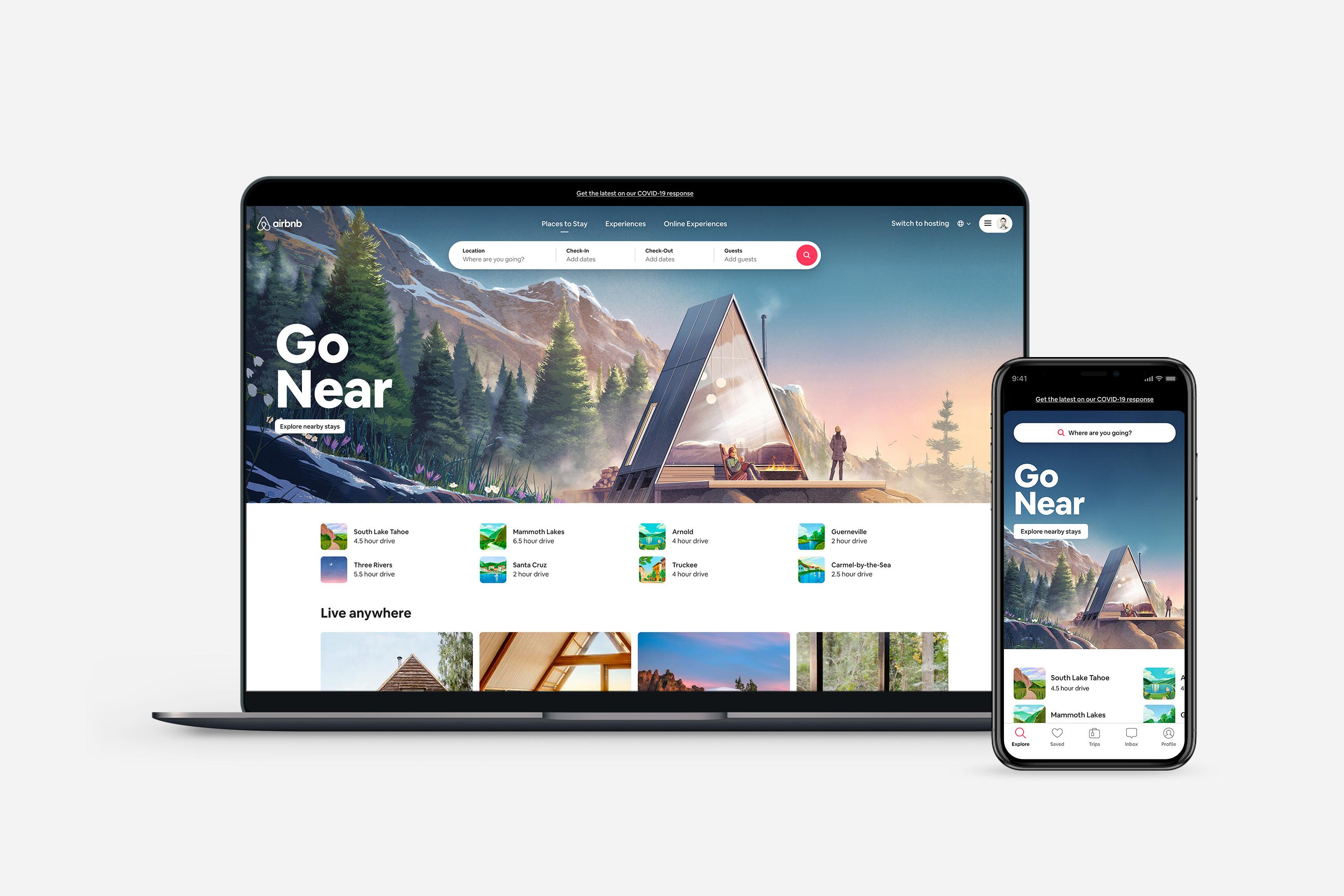

Some high-profile, privately held companies — including Airbnb, DoorDash, and Palantir — went public this year by launching an initial public offering. So, what exactly is an IPO, and how long does it take to start trading?

IPO occurs when a privately held company comes to the public markets to raise funds by selling its stock. It is also known as “going public.” Beyond structuring a company’s shares for sale, the method involves identifying stakeholders and creating regulatory compliance for financial disclosures and transparency. As a result, this process protects investors from buying shares of fraudulent companies.

What is an IPO?

An IPO refers to the process of offering shares of a company to the investor public in a new stock issuance. Big U.S. IPOs usually occur on the NYSE or NASDAQ to great anticipation. IPO can be an opportunity for companies to raise huge funds, which can be used for general corporate purposes or acquire other firms. An IPO can also be seen as an exit strategy for the company’s original investors, realizing the full profit from their private investments.

It takes several months for an IPO to start trading after it files.

An IPO usually takes about four to six months to start trading. It’s a very grueling process for the company’s directors. First, the company has to decide on an investment bank, also known as book running manager, to lead them through the IPO process. The company then usually files a confidential document, often called an IPO prospectus, with the U.S. SEC.

An IPO prospectus is likely to contain everything investors should know about the firm, including its financial statements and risk factors. After various rounds with the SEC, that document will be finally made available to the public.

The company then goes on an investor roadshow where top executives share a presentation about the company with institutional investors to determine its demand. The night before the exchange listing, the company executives and the investment bank determine the price of their stock. They will also decide whom they’ll allocate how many shares. Usually, 85 percent of a company’s shares are sold to institutional investors, and retail investors aren’t involved in the process.

A company can also go public through a direct listing process. In this method, the company sells shares directly to the general public without getting any help from an investment bank. Notably, no new shares are created in a direct listing process, and only existing outstanding shares are sold to the investors.

Here’s how you can track upcoming initial public offerings:

The best go-to site for all IPO related information is the NYSE or NASDAQ website. It is the most official and reliable source of information. You can also visit a number of websites that track equities such as Yahoo’s finance section. Additionally, you can perform a Google News search with the keyword “upcoming IPO,” which can result in upcoming IPO offerings. Google News can provide information for all global IPOs irrespective of which country or exchange an IPO is going to list.