What U.S. States Are Tax Havens? You May Be Surprised

Following the release of the Pandora Papers, journalists have highlighted a plethora of U.S. states as global tax havens.

Oct. 8 2021, Published 11:49 a.m. ET

On the surface, the Pandora Papers report comes across as stuff we already knew: the ultra-rich are hiding money in various tax havens around the world. However, international officials have already launched new investigations, and even the U.S. has committed to tightening financial regulations. "Billions of dollars of dirty money belonging to adversarial actors are flooding the United States," U.S. representatives Tom Malinowski and John Curtis wrote.

A trove of U.S. states act as tax havens in their own right. While Americans have known about some of them for a long time, others are more surprising.

Corporate tax haven Delaware, President Biden's hometown

Hometown of Joe Biden, Delaware has been a known corporate tax haven for years. At 1209 N. Orange Street, in the state's capital of Wilmington, lies an unassuming building that serves as a P.O. box headquarters for hundreds of thousands of corporations. There are at least 1.8 million businesses incorporated in the state, which is nearly double the entire state's population of 973,764.

According to DelawareInc., "More than 65 percent of all Fortune 500 companies and more than half of all U.S. publicly traded companies are incorporated in the state of Delaware."

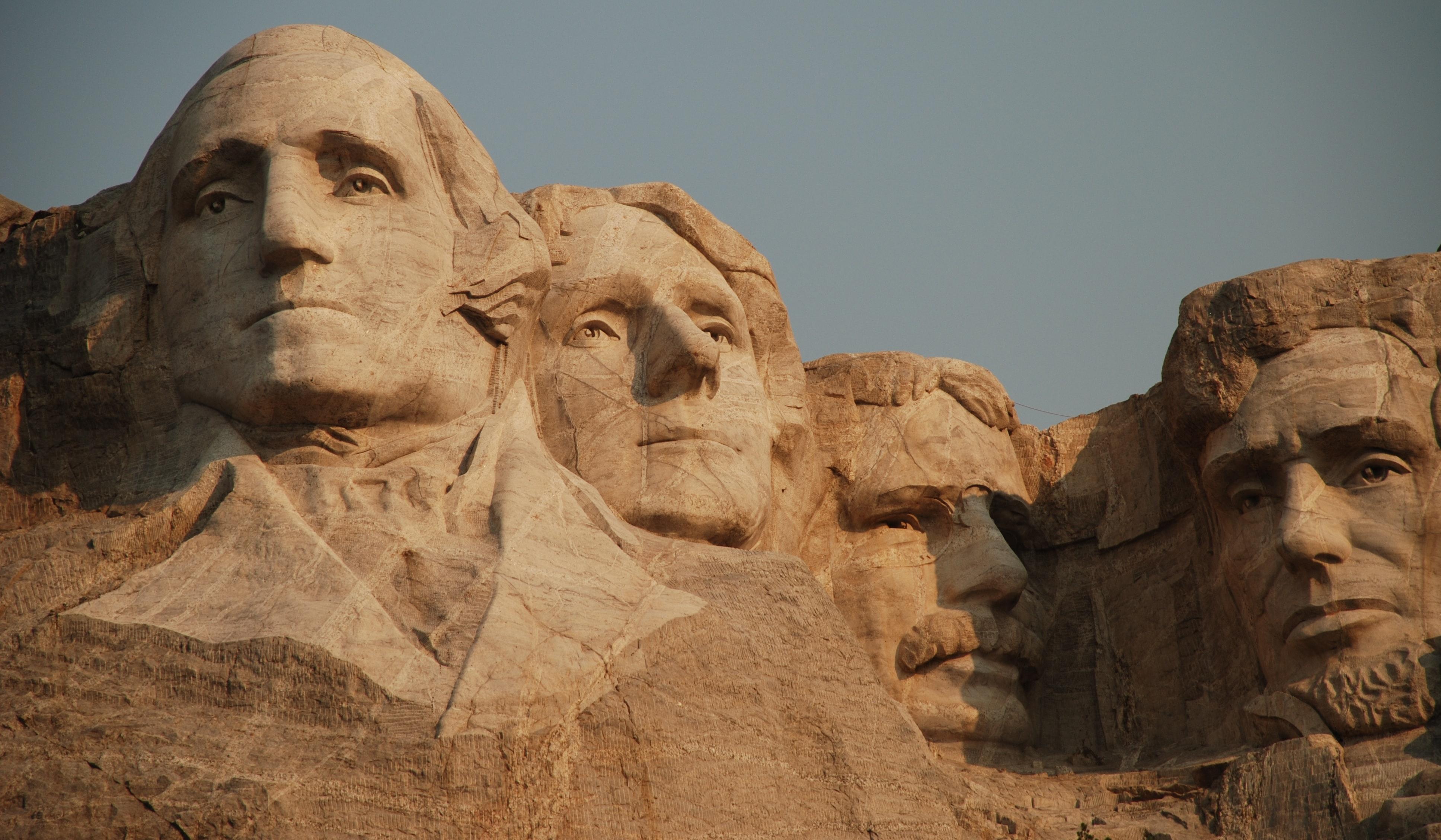

South Dakota unveiled as a tax haven for the ultra-rich

The state of South Dakota has loosened tax laws over the past few decades, pitting it against international tax havens such as the Cayman Islands and Switzerland. The Pandora Papers, a journalistic investigation of around 12 million documents from the world's wealthiest leaders, sheds light on what's really going on in South Dakota.

For example, trusts can live for generations in South Dakota, eliminating the need to pay estate taxes in inheritance. Additionally, people have been able to get loans authorized at any interest rate since the state began allowing it in 1981.

According to the Pandora Papers, "Customer assets in South Dakota trusts have more than quadrupled over the past decade to $360 billion."

Trust-friendly legislation is perhaps the biggest reason South Dakota has been deemed a domestic tax haven. Eighty-one of the 206 U.S.-based trusts identified in the Pandora Papers are located in South Dakota.

Other states serving as tax havens in the U.S.

The Pandora Papers states, "By 2020, 17 of the world's 20 least-restrictive jurisdictions for trusts were American states, according to a study by Israeli academic Adam Hofri-Winogradow."

Outside of Delaware and South Dakota, those states include Alaska, Wyoming, Nevada, Florida, and Texas. Nevada ranks fifth for the most trusts, according to the report. States with lower population levels are more likely to serve as tax havens.

Unlike the Bahamas, which now requires transparency in who owns a trust or company, people can hide behind forms and institutions in certain U.S. states through financial secrecy laws.

While the rich from the Pandora Papers may not be doing anything outright illegal, the report shows how tax and financial laws cater to the upper echelon, only enhancing their wealth and power over time.