Why Jim Cramer Thinks Rivian Isn’t the Next Tesla

Rivian IPO stock is scheduled to start trading under the “RIVN” ticker symbol on Nov. 10, 2021 but the exact timing hasn’t been disclosed.

Nov. 10 2021, Published 5:59 a.m. ET

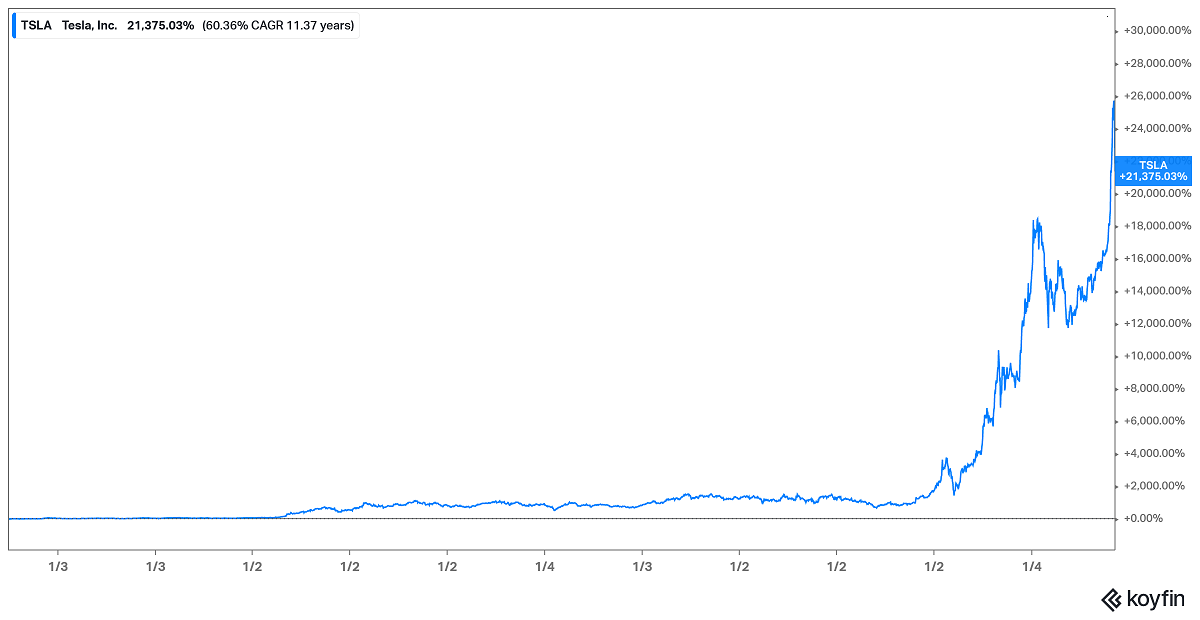

The Rivian IPO has attracted significant investor interest, with some hoping it will be the next Tesla. If you invested $1,000 in Tesla's IPO, you would have more than $210,000 now. At what time will Rivian start trading, and will it rise or fall?

Rivian, which makes electric vehicles, has started producing and delivering its flagship R1T pickup truck. In America, pickups are among the bestselling vehicles, and Ford has long dominated this space. Ford owns a stake in Rivian stock. Tesla is also getting into the pickup business with its Cybertruck.

Rivian also has an SUV, the R1S, in its pipeline. The company also has a contract to make and supply Amazon with 100,000 electric delivery vans.

Rivian's IPO price and ticker symbol

Rivian priced its IPO stock at $78 per share, above the already boosted range of $72–$74. It previously suggested a range of $57–$62. The company also raised the deal size to offer 153 million shares instead of 135 million shares. A company can increase its IPO size and hike the price if there's strong demand and the IPO is oversubscribed. That can allow the company to raise more money than expected. Rivian will start trading on the Nasdaq under the “RIVN” ticker symbol.

At what time does Rivian start trading?

Rivian stock will start trading on Nov. 10, but the exact time hasn’t been revealed yet. It could hit the exchange in the morning or afternoon. The company reserved 7 percent of its IPO shares for customers who have preordered its R1T pickup or R1S SUV. Rivian has received more than 55,000 preorders. It also reserved 0.4 percent of the IPO shares for retail investors through online broker SoFi.

Will Rivian (RIVN) stock rise or fall?

Tesla’s IPO stock soared more than 40 percent on its first day of trading. How Rivian stock performs will depend on several factors.

Investors may rush to buy the IPO stock if they believe the stock is undervalued, but there may be a rush to sell if the market perceives the stock is overvalued. Rivian is going public at a valuation of almost $70 billion. That figure rivals Ford’s $80 billion and GM’s $85 billion, but they're more established automakers with profitable operations. Any announcement regarding Rivian’s production plans or relationship with major customers like Amazon could also influence the stock’s debut.

Is Rivian a good-long term investment?

Rivian is targeting a lucrative market with its R1T pickup, and the truck's impressive features could speed up sales. Additionally, the R1T has a headstart, considering that Ford’s F-150 Lightning and Tesla’s Cybertruck aren't expected to hit the market until next year. The global market for pickup trucks is on course to surpass $207 billion by 2026 from $166 billion in 2019.

Climate change concerns are also fueling the shift to vehicles that run on clean energy, which bodes well for electric vehicle makers such as Rivian. The IPO will generate more money for the company to invest in expanding its business.

However, Jim Cramer has cautioned that investors expecting Rivian to be the next Tesla may be disappointed. The CNBC Mad Money host and former hedge fund manager argues that Rivian is coming into a more competitive market than Tesla. He also has valuation concerns, and thinks investors may be better off getting exposure to Rivian through Ford instead of owning Rivian stock directly.