SPARC Versus SPAC: Different Financial Instruments With a Similar Goal

You might have heard of the SPAC bubble, but what about the ecosystem for a different financial instrument—SPARCs? What's the difference between a SPARC and a SPAC?

Nov. 29 2021, Published 9:55 a.m. ET

You might have heard of SPACs, especially with reports of a SPAC bubble forming in a heavily saturated arena. But what about the ecosystem for a different financial instrument—SPARCs?

A SPARC (special purpose acquisition rights company) gives investors a different type of asset than a traditional blank-check firm. Here are the details, plus how one billionaire is using the SPARC structure to push his long-awaited listing through the regulatory gates.

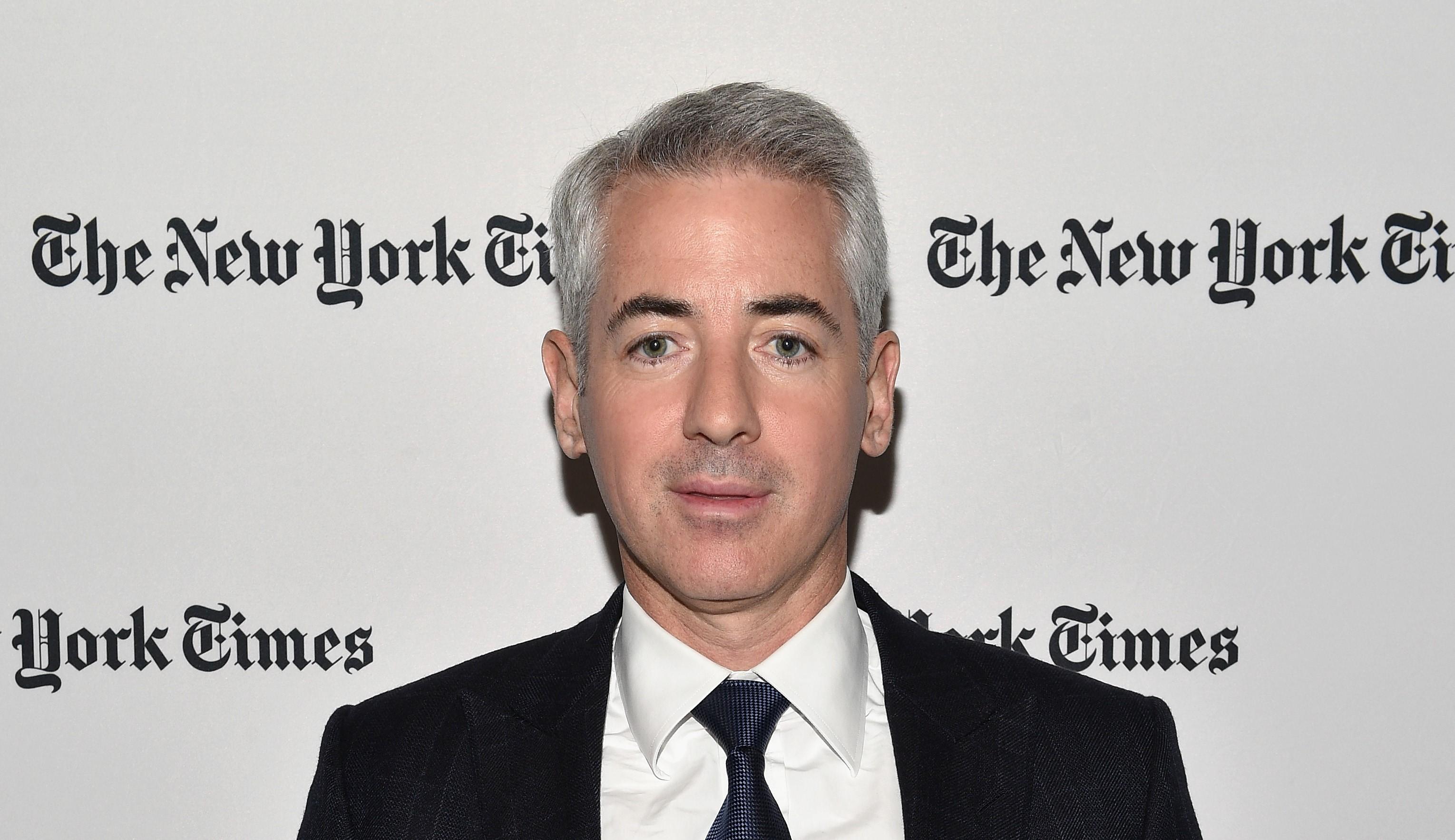

Bill Ackman tries a special listing again with a SPARC.

Earlier this year, billionaire Bill Ackman's SPAC failed to make it through the SEC gates, which ultimately caused early investors to lose millions. Pershing Square Tontine Holdings attempted to go public with partial 10-percent ownership of Universal Music Group (which was simultaneously going public in the Netherlands). However, SPACs are usually reserved for firms to take a full company public.

As Pershing Square faces a lawsuit from investors, Ackman is trying again—this time with a different structure called a SPARC.

The special purpose acquisition rights company, Pershing Square SPARC Holdings Ltd., is the first of its kind to face Wall Street regulators. It's an affiliate of the originally attempted SPAC and will offer 244.4 million subscription warrants to investors.

These warrants give traders the right to purchase common stock starting at a price of $10 per share.

What's the difference between a SPARC and a SPAC?

A SPAC (or blank-check firm) is a holding company that goes public with the sole intent of taking another company public through a merger. Once a SPAC sets a merger target, it signs a definitive agreement and eventually changes its ticker symbol to reflect the newly merged company. SPAC investors can directly buy shares in the holding company before the merger or wait until the merger is complete and buy shares of the new ticker.

Some of the most successful SPACs in recent years include Sir Richard Branson's Virgin Galactic (NYSE:SPCE) and luxury EV company Lucid Motors (NASDAQ:LCID).

In contrast, a SPARC allows investors to acquire a stock warrant, or the right to purchase a company's stock once it lists. Stock warrants usually stem from employers who want to give workers the right to buy corporate shares at a set price prior to the warrant's expiration. The warrant becomes effective after the holding company sets a merger target.

The biggest difference between a SPAC and a SPARC is that a SPAC requires investors to put in money up front, while a SPARC doesn't. For Ackman, this differentiation is crucial since his $4 billion SPAC failure resulted in young and enthusiastic investors losing loads of upfront capital.

Will Ackman's SPARC get past the SEC?

The SEC blocked Ackman's SPAC, Pershing Square Tontine Holdings, from taking a partial company public. The multi-billion-dollar failure put Ackman in the limelight for all the wrong reasons. He continues to test the limits of the U.S. stock market regulatory environment with his SPARC.

The untested structure requires SEC approval before being listed on the NYSE. For now, it's a waiting game.