A Voyager Digital Stock Update After the Company's Bankruptcy

The crypto crash has impacted several companies, including Voyager Digital. What's happened to its stock after its Chapter 11 bankruptcy?

July 19 2022, Updated 4:39 a.m. ET

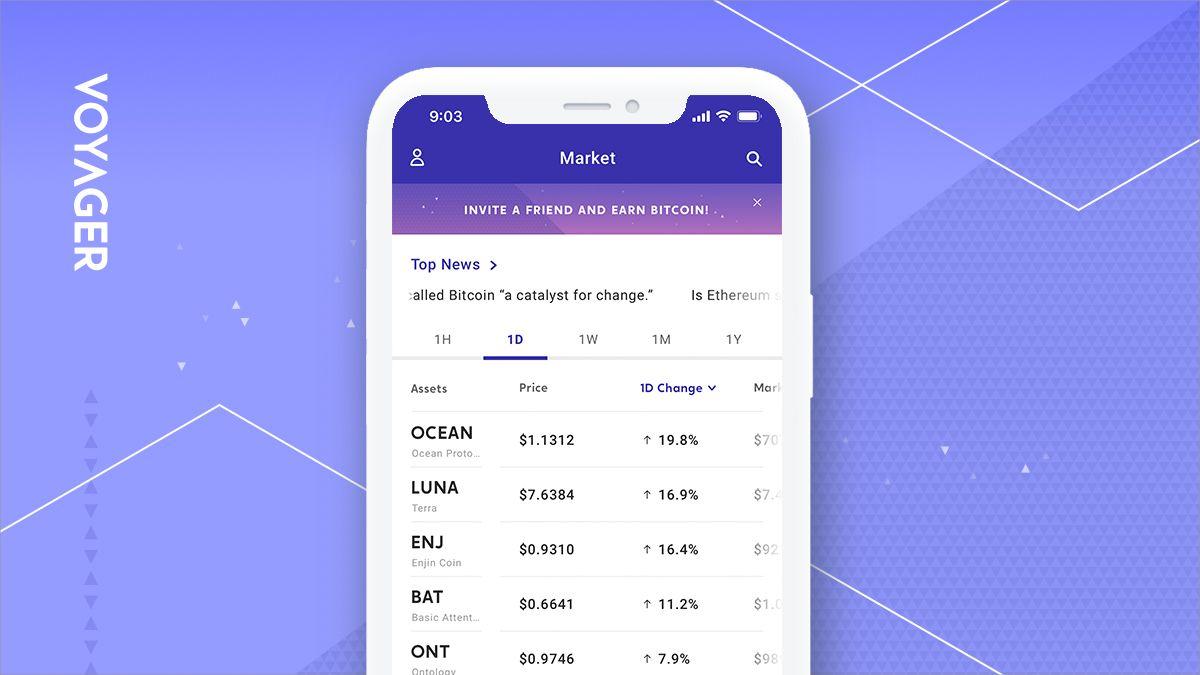

The crypto crash has impacted several companies, including Voyager Digital. The online brokerage, which focuses on cryptocurrencies and digital assets, filed for Chapter 11 bankruptcy on July 5. What happened to Voyager Digital stock?

Almost all assets have been hit in 2022 amid high inflation. The Fed was forced to hike rates aggressively, spooking investors and steering them away from risk assets, especially crypto.

Crypto fund Three Arrows Capital collapses

Three Arrows Capital (3AC) was among the first ones to fall. 3AC, a crypto fund, suffered huge losses as it was caught in the crosshairs of the Luna crash and a sell-off in other digital assets. The company went bust and it was ordered to liquidate by a British Virgin Islands court after creditors sued it for failing to repay debts. Voyager Digital was one of its creditors and 3AC owed the company $650 million. Due to 3AC going bust and the crypto crash, Voyager had to file for bankruptcy.

What happened to Voyager Digital stock?

Voyager Digital stock has fallen more than 99 percent from its peak in March 2021. Even before the crash related to 3AC, Voyager stock was 94 percent below its high in Nov. 2021.

Voyager halted withdrawals, deposits, and trading activity on July 1, 2022. And following Voyager's bankruptcy filing, the Toronto Stock Exchange (TSE), where the company’s stock was listed, suspended it from trading as of July 6. It did so to give Canadian regulators time to review the company’s listing requirements. In the five days leading up to the delisting, the stock fell by 27 percent.

Will Voyager survive the bankruptcy?

Investors’ confidence in crypto has been shaken, especially after the collapse of stablecoins in May. As a result of that crash, they withdrew even more, compounding the problem for companies in the sector. Of companies that file for bankruptcy, about 25 percent survive. Voyager might survive, but it will depend on the condition of the cryptocurrency market.

Crypto-related companies might need a bailout

Crypto-related companies have been facing financial difficulty following this year's plunge. In these difficult times, billionaire crypto exchange boss Sam Bankman-Fried has come to the rescue for some, including Voyager. He has also extended a revolving credit facility of $250 million to BlockFi. Similarly, in 2008, the banking sector was struggling and the federal government bailed it out.