Warrants in SPACs — Are They Better Than Common Stocks?

SPAC warrants have become a hot investment. What are warrants in a SPAC and should you buy them or the common stock?

March 1 2021, Published 9:03 a.m. ET

SPACs are giving traditional IPOs tough competition. In the first two months of 2021, the total money raised through SPACs exceeded the money raised through traditional IPOs. Usually, SPAC IPOs also come up with warrants. What are warrants in SPACs and should you buy them?

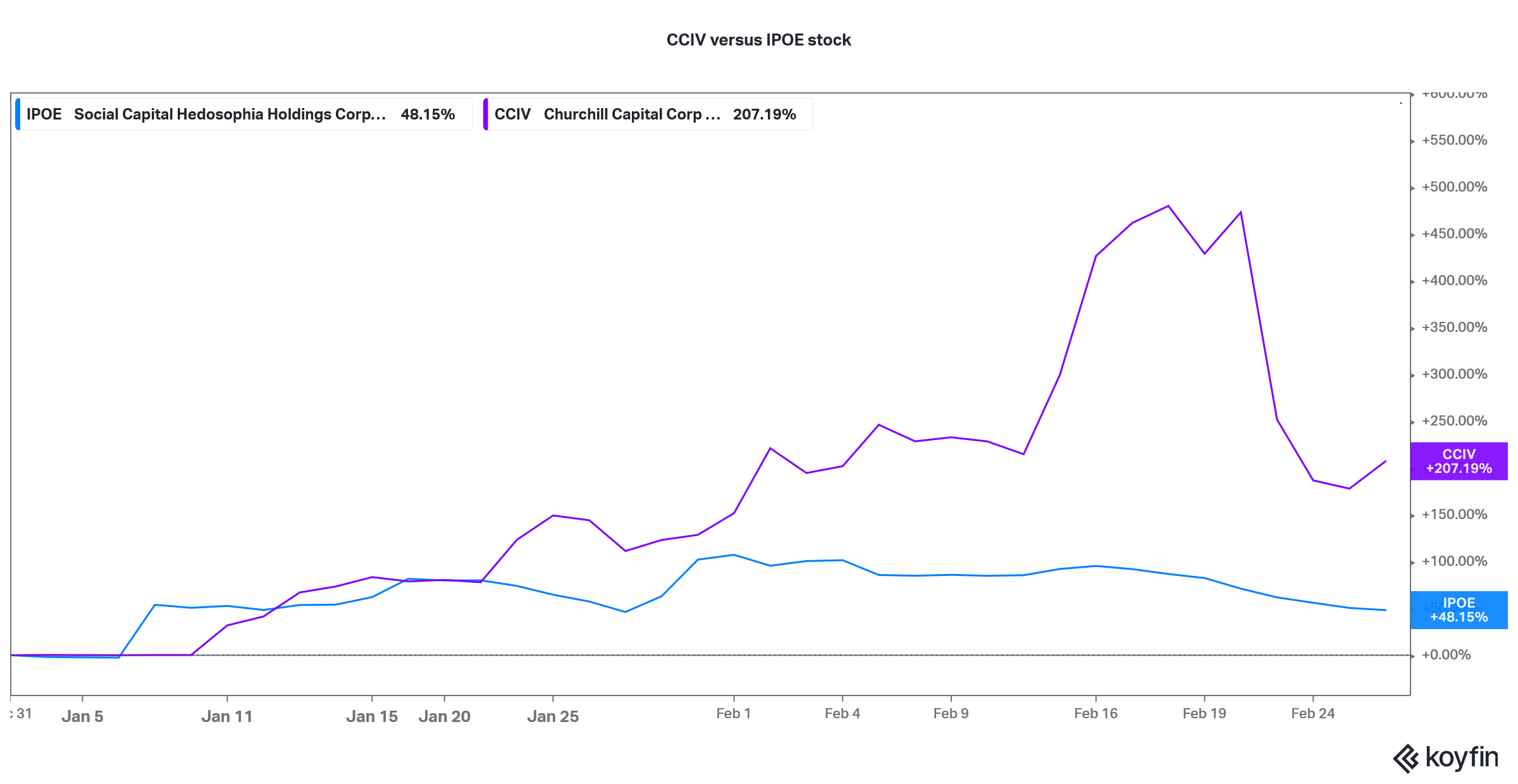

The SPAC mania has continued despite the sharp fall in Churchill Capital IV (CCIV) SPAC stock after it announced a merger with Lucid Motors. Looking at the upcoming IPOs in March 2021, there are mainly SPACs and only a few traditional IPOs.

What are warrants?

Before we analyze warrants in a SPAC, let’s familiarize ourselves with warrants in general. A stock warrant is a derivative contract that gives the holder the right to buy the company’s stock at a specified price in the stipulated period. They are very similar to a call option.

However, there are some differences. For example, warrants are issued directly by a company and the issuing company raises capital when the warrants are exercised. However, a call option is a contract between two entities on the stock market. Exercising an option wouldn't impact the company’s capital structure.

Warrants in a SPAC

A SPAC is a blank-check company that’s created to take a private company public. The target company gets the IPO proceeds that the SPAC raised and any PIPE (private investment in public equity). Most SPAC IPOs come up with warrants that when converted provide the merged entity with capital.

For some period after the SPAC IPO, the common stock and warrants trade together but eventually become two different instruments and start trading separately. The warrants are usually exercisable at a premium to the IPO price and the general convention is to keep the exercise price at $11.5.

The warrants are exercisable based on the terms mentioned in the SPAC IPO filing. Also, they are cash-settled and the warrant holder has to pay the cash to the company to receive the shares in lieu of the warrants.

Usually, SPAC IPOs come with partial warrants. For example, CCIV, which announced a merger with Lucid Motors, had one-fifth of a redeemable warrant attached to each common stock. Social Capital Hedosophia Holdings (IPOE), which is set to merge with SoFi, had one-fourth of one redeemable warrant attached to each common stock.

How SPAC warrant compared to SPAC stocks

After the SPAC warrant and the stock start trading independently, they can buy any of these. However, the risk-return trade-offs are different. Like stock options, the warrant is a leveraged play on the SPAC merger. If the SPAC common stock surges after the merger, you would make a high return on your investment.

However, if the stock price is below the strike price when the warrants become exercisable, you would end up losing all of your capital just like an out-of-the-money option. The biggest downside in SPAC warrants is that if the SPAC fails to merge, you would end up losing all of your capital in a warrant. In the SPAC common stock, you would at least get back your capital plus accrued interest.

Buying SPAC common stock or warrants

Berkshire Hathaway chairman Warren Buffett uses warrants effectively to enhance the returns while limiting the downside. However, he uses warrants with debt instruments that help him participate in the stock’s upside while protecting the portfolio from any fall in the underlying stock.

Looking at a SPAC, the warrants are largely similar to those on debt instruments or other common stock. If you are comfortable taking the leveraged bet on the SPAC merger, you can opt for a warrant. Many times, we see an arbitrage opportunity between the warrant and the common stock.

SPAC warrant arbitrage

However, in most cases, the arbitrage is because the market expects the SPAC common stock to fall before the merger happens. The outstanding stock count would increase for the SPAC after the warrants are exercised, which would have a negative impact on the valuation.

Something similar happened in the CCIV-Lucid Motors merger as the massive PIPE investment, which led to higher outstanding shares for the SPAC, triggered a sell-off in CCIV common stock.