Latest Tech Software IPOs — Which Companies Are Going Public in 2020?

Many tech companies and other companies have been filing IPOs. Right now, the tech IPO market looks strong in the second half of 2020.

Aug. 26 2020, Updated 11:54 a.m. ET

Tech billionaire Peter Thiel is behind two buzzworthy IPOs this quarter.

So far, 2020 has been a rollercoaster for the markets and the economy. Despite the turmoil amid the COVID-19 pandemic, many tech companies and other companies have been filing IPOs. Right now, the tech IPO market looks strong in the second half of 2020. Investors want stocks with solid business models. The tech sector is in high demand amid the shift to remote work.

According to CNBC, Jackie Kelley, the Americas IPO and strategic transitions leader at Ernst & Young said, “We could find ourselves in a very strong second half here as we go into the elections. We’re already seeing increased IPO activity over the last couple weeks. As long as markets stay stable, I think we have a good runway to get a significant amount of this backlog out into the markets.”

Latest round of tech software IPOs

According to Forbes, a series of tech software companies filed to go public on Aug. 24. Many tech companies have been racing to go public before the U.S. presidential election. The market value is really high right now and companies want to take advantage of the continued market rally.

The following tech companies filed their IPO paperwork with the SEC on Aug. 24.

Snowflake's IPO looks promising

Snowflake is a cloud software startup company that was founded in San Mateo, Calif. in 2012. The company focuses on analytics and big data. Snowflake filed paperwork for an IPO with the SEC. The company plans to trade on the NYSE under the ticker “SNOW.” Snowflake hasn't yet disclosed an IPO date or the number of shares that will be available.

To date, Snowflake has raised $1.4 billion in venture capital funding from investors. In February 2020, the company raised $479 million at a post-money valuation of $12.4 billion. Snowflake’s sales rose 174 percent in 2019 to $246.7 million. The company’s net loss nearly doubled to $348.5 million.

JFrog works to narrow its losses amid IPO

JFrog makes tools for software developers. The Israel-based company was founded in 2008. JFrog’s tools allow organizations to continuously deliver software updates across any system. The company filed IPO paperwork with the SEC and applied to list on Nasdaq under the ticker “FROG.”

JFrog has been working to narrow its losses over the past few years. Although the company isn’t profitable yet, it’s making steady progress. JFrog had losses of $26 million in 2018, $5.4 million in 2019, and $400,000 in the first half of 2020. In 2019, the company’s sales rose 65 percent to $104.7 million. For the 12 months ending June 30, 2020, JFrog booked $128 million in sales.

The company hasn’t released information yet regarding its IPO date.

Unity Technologies could go public in a few weeks

Unity Technologies is a tech company that produces a 3D gaming engine that creates video games and other programs. The company was founded in San Francisco in 2004. Unity Technologies filed IPO paperwork with the SEC to list on the NYSE under the ticker “U.” Although the IPO date hasn’t been released yet, the company could go public in a few weeks.

Unity Technologies has invested more than $450 million in research and development in the past two fiscal years. As of June 30, 2020, the company has $453.2 million in cash and total assets of $1.29 billion. In 2019, the company’s revenue rose 42 percent to $541.8 million, while the net loss increased 24 percent to $163.2 million. Unity’s revenue has risen 39 percent in the first half of 2020 to $351.3 million.

The company had 1.5 million active users in 2019. The software built with Unity runs on more than 1.5 billion devices. As a result, Unity is one of the most important technologies in gaming.

According to a report from Real Money, “Unity has a story to sell on its IPO roadshow that's almost tailor-made for the current environment. It's a mobile, PC and console gaming play with a blue-chip customer base; it's a SaaS play with an impressive net expansion rate; and it can also claim exposure to fields such as mobile ads, 3D animation and AR/VR content.”

Sumo Logic is the first cybersecurity IPO in 2020

Sumo Logic is a cloud-based machine data analytics company that was founded in Redwood City, Calif. in 2010. The company provides on-demand cloud log management solutions. Sumo Logic filed IPO paperwork with the SEC to trade on Nasdaq under the ticker “SUMO.” Details about the IPO date and other specifics haven’t been released yet.

While the company’s revenue increased 50 percent in 2019 to $155.1 million, its net loss increased 95 percent to $92.1 million. The company booked $170 million in revenue for the 12 months ending April 30, 2020. Sumo Logic has raised $340 million in six rounds of outside funding.

As the first cybersecurity IPO in 2020, Sumo Logic stands out from the crowd.

Asana files for IPO through direct listing

Asana is a San Francisco-based project management software company that was founded in 2008. The company’s software helps teams organize and track their work. Asana applied to list on the NYSE and didn’t provide a ticker symbol. Since the company has filed to go public through a direct listing, it won’t raise new capital.

Asana’s revenue increased 86 percent in 2019 to $142.6 million, while the net loss increased 133 percent to $118.6 million. The company raised nearly $215 million in venture capital funding from investors.

According to Business Insider India, Asana is valued at $1.5 billion. As of January 31, 2020, the company had more than 75,000 paying customers and 1.2 million paid users.

The company hasn’t provided specific details about the IPO date or figures yet.

What are the other upcoming IPOs in 2020?

In addition to the recent boom in tech software IPOs, there are other pending and upcoming IPOs in the second half of 2020 spanning various sectors.

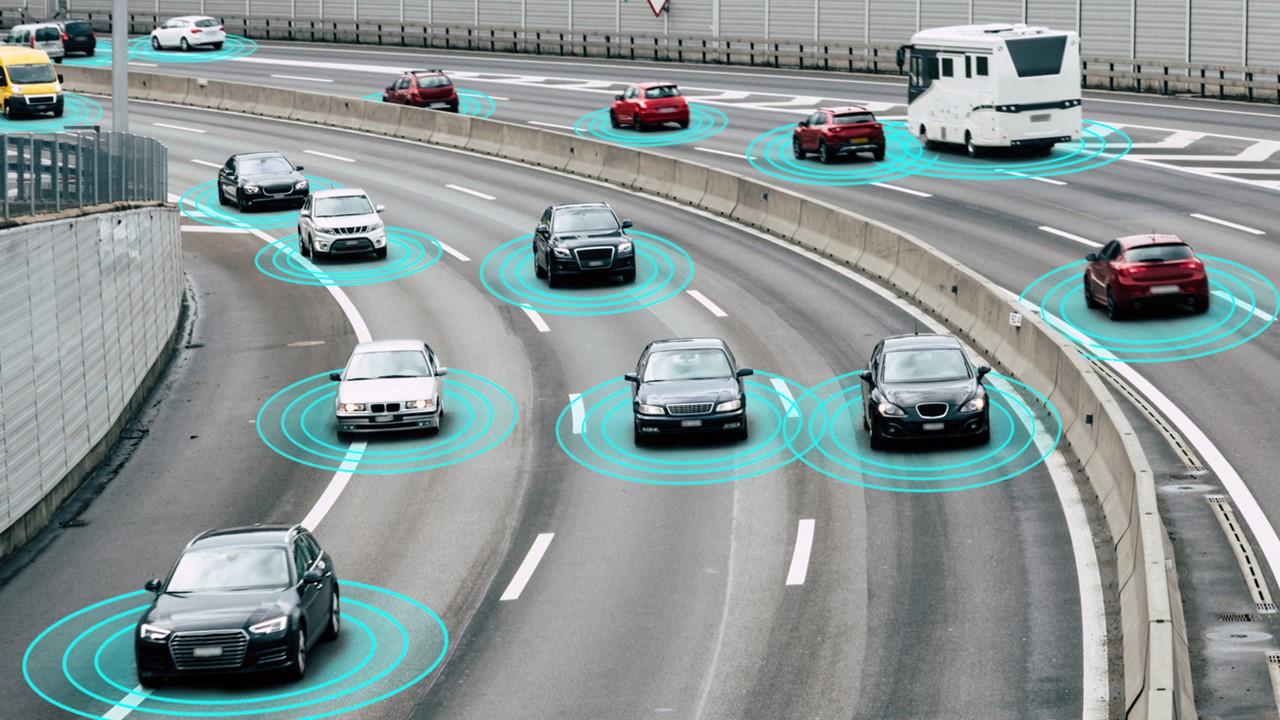

Luminar Technologies should go public in Q4

On Aug. 24, Luminar Technologies announced that it plans to go public through a $3.4 billion merger with Gores Metropoulos. The company applied to list on Nasdaq under the ticker “LAZR.”

Luminar, which is backed by tech billionaire Peter Thiel, produces lidar laser sensors for autonomous vehicles. The combined company aims to get the sensors onto automakers’ production lines globally.

Gores Metropoulos raised $400 million in cash in November 2019. The other $170 million will come from investors.

The merger should close in the fourth quarter of 2020. At the closing, Luminar shareholders will get 271.8 million shares of Gores Metropoulos common stock. The combined company should have an implied pro forma enterprise value of $2.9 billion with an equity value of $3.4 billion.

Corsair Gaming files for IPO again

Corsair Gaming is a billion dollar gaming company that has benefited amid the COVID-19 pandemic. The company filed for an IPO with an initial target price of $100 million on June 25, 2020. According to Forbes, Corsair Gaming will be treated as an emerging growth company. The company applied to list on Nasdaq under the ticker “CRSR.” Corsair Gaming hasn’t released an IPO date yet.

Founded in Fremont, Calif. in 1994, the company has sold 190 million gaming and streaming products since 1998—85 million of the products have been sold since 2005. Corsair Gaming filed to go public in 2010 and postponed the plans in 2012.

Currently, Corsair Gaming is in solid financial shape. The company has seen double-digit revenue growth amid the COVID-19 pandemic. Between January and June of 2020, the company generated a profit of $23.8 million. Corsair has a net income of $31.3 million in 2020 compared to a $26.7 million loss in the same period in 2019.

Palantir plans to go public in late September

Palantir is a CIA-backed big data company that sells data analysis software. Founded in Palo Alto, Calif. in 2003 and co-founded by tech billionaire Peter Thiel, the company was valued at $20 billion. Palantir filed a public listing proposal with the SEC in July 2020. On Aug. 25, Palantir filed for an IPO. The company also announced that it plans to move its headquarters from the Silicon Valley to Denver. The company plans to go public later in September and hasn’t provided a specific date yet. Palantir applied to list on the NYSE under the ticker “PLTR.”

Palantir favors a direct listing instead of the regular IPO process. With a direct public listing, current investors will be able to sell shares the first day. There won’t be a lockup period like with a traditional IPO.

So far, Palantir has raised $500 million from Sompo Holdings and Fujitsu. The company aims to raise an additional $411 million for a total of $961 million before its public debut.

Palantir worked with the U.S. military to track down Osama bin Laden. Recently, the company has been working with governments around the world to track the COVID-19 pandemic.

Airbnb plans to go public later in 2020

Airbnb is a well-known home-sharing and vacation rental company that was founded in San Francisco in 2008. On Aug. 19, the company filed a public listing proposal with the SEC. In September 2019, the company said that it would go public in 2020. The company is expected to go public by the end of 2020 although no date has been set. Airbnb plans to list on Nasdaq but may switch to the NYSE.

The COVID-19 pandemic brought the travel and tourism industry to a halt, which impacted Airbnb’s business. The company was valued at $18 billion after a funding round in April 2020. Airbnb’s sales fell 67 percent to $335 million in the second quarter of 2020. The company posted a loss before interest, taxes, depreciation, and amortization of $400 million.

Airbnb’s bookings improved in the second quarter of 2020. However, the company laid off 25 percent of its workforce or 1,900 employees.

An Ant Group IPO in October?

Ant Group is a Chinese technology giant. The company was founded by Jack Ma in 2014 with its headquarters in Hangzhou. Ant Group filed a dual IPO in Hong Kong and Shanghai on Aug. 25. With a market valuation of more than $200 million, the company chose China over the U.S. amid uncertainty and increased tension between the two countries.

Although Ant Group hasn’t provided a specific date, the IPO could be as soon as October 2020. The company hasn’t provided any details yet about share pricing.

Ant Group is an affiliate of Alibaba. The company also owns Alipay, which is a popular payment and lifestyle app. Alipay has over 1 billion annual active users.

Ant Group’s net profit for the first six months of 2020 was $21.2 billion yuan ($3 billion) on revenue of $72.5 billion yuan ($10.5 billion) with a net profit margin of 30 percent. The company reported a 1,000 percent jump in its profits in the first half of 2020 compared to the first half of 2019.