Why SoFi Stock’s Forecast Looks Bullish After the Bank Charter

SoFi is trading higher amid optimism about the bank charter. What's SoFi stock's forecast as it becomes a bank holding company? Here's what to expect.

Jan. 19 2022, Published 9:18 a.m. ET

Fintech company Social Finance, popularly known as SoFi, was trading higher in premarket on Jan. 19 amid optimism about the bank charter. What's SoFi's stock forecast and what are the pros and cons of SoFi turning into a bank holding company? Why does the forecast look bullish after the bank charter?

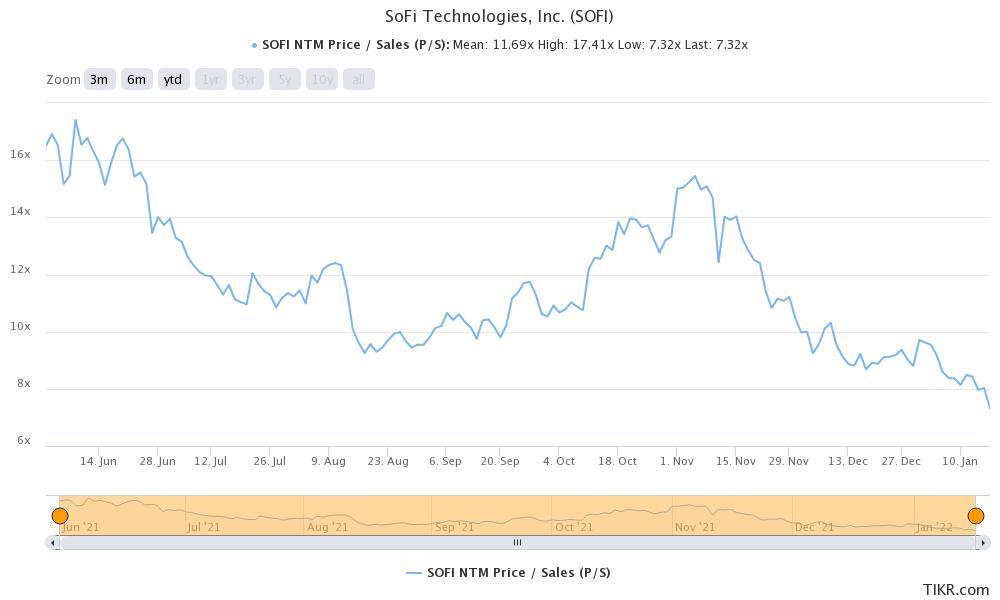

SoFi went public in 2021 through a reverse merger with Social Capital Hedosophia Holdings, a SPAC sponsored by Chamath Palihapitiya. The stock has had a turbulent ride. It fell to its 52-week low on Jan. 18 and trades at less than half of its 52-week highs. However, it's still the best-performing stock from the companies that went public through a merger with SPACs sponsored by Palihapitiya.

SoFi got regulatory clearance to become a bank holding company.

The U.S. Federal Reserve and the OCC (Office of the Comptroller of the Currency) have approved SoFi’s application to become a bank holding company. The regulators have approved SoFi’s proposed merger with Golden Pacific Bancorp and will allow it to operate the company’s bank subsidy as SoFi Bank, National Association.

SoFi stock forecast: Analysts were bullish ahead of the bank charter.

Most Wall Street analysts were bullish on SoFi stock ahead of the expected bank charter. Citi had a "buy" rating on the stock and among others, the brokerage was optimistic about the company’s prospects after it receives the bank charter. After regulators approved SoFi’s request to become a bank holding company, Wedbush Securities initiated coverage with an “outperform” rating and a $20 target price.

Why is the bank charter important for SoFi?

Like fellow fintech companies, SoFi had to tie up with FDIC-insured banks to offer products to its customers. There was a middleman between SoFi and its customers, which meant lower margins.

SoFi's management is upbeat about getting permission for a bank holding company. Anthony Noto, SoFi’s CEO said, “With a national bank charter, not only will we be able to lend at even more competitive interest rates and provide our members with high-yielding interest in checking and savings, it will also enhance our financial products and services.”

Most importantly, it will help the company gain access to low-cost funds like FDIC-insured banks. Mizuho analyst Dan Dolev, who's bullish on SoFi, expects that access to low-cost funds will add almost $300 million to SoFi’s adjusted EBITDA. Rosenblatt also raised its target price on the stock to $30 after the decision.

Is there any disadvantage to becoming a bank holding company?

In its release, the OCC said that SoFi Bank has agreed not to engage in any crypto-related activities. Also, the company has agreed to pre-decided capital contributions and agreed to adhere to an operating agreement.

SoFi also has crypto offerings. However, Dolev isn't too perturbed and thinks that with additional disclosures, SoFi can continue to offer crypto-related services. Bank holding companies are allowed to offer crypto-related services and the regulator has only restricted the bank and not SoFi per se.

SoFi stock looks like a good buy for long-term investors.

SoFi stock has tumbled from its peaks. However, more than anything particular about the stock, the crash should be seen in the context of the sell-off in growth names. Fintech companies have been hit especially hard and even the well-known fintech names like PayPal and Block (formerly Square) have fallen hard.

If you're willing to take a long-term view, SoFi looks like a good buy. The company’s growth has stayed intact even though several growth companies are witnessing a growth slowdown.

SoFi has a diversified product offering and there are multiple cross-sell opportunities on the platform. With approval to become a bank holding company, SoFi will have the agility and innovation of a fintech company while offering the security of a bank.

SoFi’s valuations look reasonable at these levels and it's a good fintech stock to buy amid the turmoil in growth stocks due to rate hike fears.